Engineering

Engineering

Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3.6 Consolidated financial statements Notes to the consolidated financial statements<br />

The fair value hierarchy reflects the significance of the inputs used to<br />

determine fair values. Financial instruments with fair value<br />

measurement based on quoted prices in active markets are disclosed<br />

in Level 1. In Level 2 determination of fair values is based on<br />

observable inputs, e.g. foreign exchange rates. Level 3 comprises<br />

financial instruments for which the fair value measurement is based on<br />

unobservable inputs.<br />

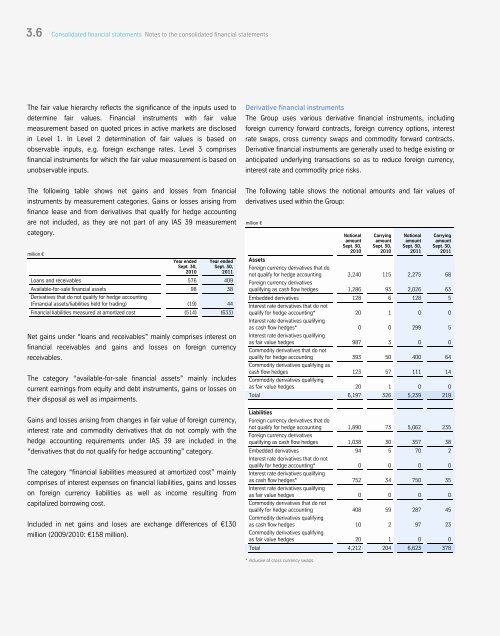

The following table shows net gains and losses from financial<br />

instruments by measurement categories. Gains or losses arising from<br />

finance lease and from derivatives that qualify for hedge accounting<br />

are not included, as they are not part of any IAS 39 measurement<br />

category.<br />

million €<br />

Year ended<br />

Sept. 30,<br />

2010<br />

Year ended<br />

Sept. 30,<br />

2011<br />

Loans and receivables 576 409<br />

Available-for-sale financial assets<br />

Derivatives that do not qualify for hedge accounting<br />

98 38<br />

(Financial assets/liabilities held for trading) (19) 44<br />

Financial liabilities measured at amortized cost (514) (633)<br />

Net gains under “loans and receivables” mainly comprises interest on<br />

financial receivables and gains and losses on foreign currency<br />

receivables.<br />

The category “available-for-sale financial assets” mainly includes<br />

current earnings from equity and debt instruments, gains or losses on<br />

their disposal as well as impairments.<br />

Gains and losses arising from changes in fair value of foreign currency,<br />

interest rate and commodity derivatives that do not comply with the<br />

hedge accounting requirements under IAS 39 are included in the<br />

“derivatives that do not qualify for hedge accounting” category.<br />

The category “financial liabilities measured at amortized cost” mainly<br />

comprises of interest expenses on financial liabilities, gains and losses<br />

on foreign currency liabilities as well as income resulting from<br />

capitalized borrowing cost.<br />

Included in net gains and loses are exchange differences of €130<br />

million (2009/2010: €158 million).<br />

Derivative financial instruments<br />

The Group uses various derivative financial instruments, including<br />

foreign currency forward contracts, foreign currency options, interest<br />

rate swaps, cross currency swaps and commodity forward contracts.<br />

Derivative financial instruments are generally used to hedge existing or<br />

anticipated underlying transactions so as to reduce foreign currency,<br />

interest rate and commodity price risks.<br />

The following table shows the notional amounts and fair values of<br />

derivatives used within the Group:<br />

million €<br />

Notional<br />

amount<br />

Sept. 30,<br />

2010<br />

Carrying<br />

amount<br />

Sept. 30,<br />

2010<br />

Notional<br />

amount<br />

Sept. 30,<br />

2011<br />

Carrying<br />

amount<br />

Sept. 30,<br />

2011<br />

Assets<br />

Foreign currency derivatives that do<br />

not qualify for hedge accounting<br />

Foreign currency derivatives<br />

3,240 115 2,275 68<br />

qualifying as cash flow hedges 1,286 93 2,026 63<br />

Embedded derivatives<br />

Interest rate derivatives that do not<br />

128 6 128 5<br />

qualify for hedge accounting*<br />

Interest rate derivatives qualifying<br />

20 1 0 0<br />

as cash flow hedges*<br />

Interest rate derivatives qualifying<br />

0 0 299 5<br />

as fair value hedges<br />

Commodity derivatives that do not<br />

987 3 0 0<br />

qualify for hedge accounting<br />

Commodity derivatives qualifying as<br />

393 50 400 64<br />

cash flow hedges<br />

Commodity derivatives qualifying<br />

123 57 111 14<br />

as fair value hedges 20 1 0 0<br />

Total 6,197 326 5,239 219<br />

Liabilities<br />

Foreign currency derivatives that do<br />

not qualify for hedge accounting<br />

Foreign currency derivatives<br />

1,890 73 5,062 235<br />

qualifying as cash flow hedges 1,038 30 357 38<br />

Embedded derivatives<br />

Interest rate derivatives that do not<br />

94 5 70 2<br />

qualify for hedge accounting*<br />

Interest rate derivatives qualifying<br />

0 0 0 0<br />

as cash flow hedges*<br />

Interest rate derivatives qualifying<br />

752 34 750 35<br />

as fair value hedges<br />

Commodity derivatives that do not<br />

0 0 0 0<br />

qualify for hedge accounting<br />

Commodity derivatives qualifying<br />

408 59 287 45<br />

as cash flow hedges<br />

Commodity derivatives qualifying<br />

10 2 97 23<br />

as fair value hedges 20 1 0 0<br />

Total 4,212 204 6,623 378<br />

* inclusive of cross currency swaps