Engineering

Engineering

Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

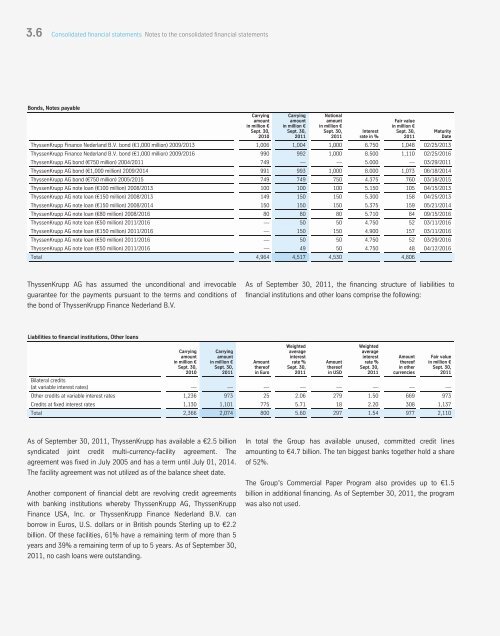

3.6 Consolidated financial statements Notes to the consolidated financial statements<br />

Bonds, Notes payable<br />

Carrying<br />

amount<br />

in million €<br />

Sept. 30,<br />

2010<br />

Carrying<br />

amount<br />

in million €<br />

Sept. 30,<br />

2011<br />

Notional<br />

amount<br />

in million €<br />

Sept. 30,<br />

2011<br />

Interest<br />

rate in %<br />

Fair value<br />

in million €<br />

Sept. 30,<br />

2011<br />

ThyssenKrupp Finance Nederland B.V. bond (€1,000 million) 2009/2013 1,006 1,004 1,000 6.750 1,048 02/25/2013<br />

ThyssenKrupp Finance Nederland B.V. bond (€1,000 million) 2009/2016 990 992 1,000 8.500 1,110 02/25/2016<br />

ThyssenKrupp AG bond (€750 million) 2004/2011 749 — — 5.000 — 03/29/2011<br />

ThyssenKrupp AG bond (€1,000 million) 2009/2014 991 993 1,000 8.000 1,073 06/18/2014<br />

ThyssenKrupp AG bond (€750 million) 2005/2015 749 749 750 4.375 760 03/18/2015<br />

ThyssenKrupp AG note loan (€100 million) 2008/2013 100 100 100 5.150 105 04/15/2013<br />

ThyssenKrupp AG note loan (€150 million) 2008/2013 149 150 150 5.300 158 04/25/2013<br />

ThyssenKrupp AG note loan (€150 million) 2008/2014 150 150 150 5.375 159 05/21/2014<br />

ThyssenKrupp AG note loan (€80 million) 2008/2016 80 80 80 5.710 84 09/15/2016<br />

ThyssenKrupp AG note loan (€50 million) 2011/2016 — 50 50 4.750 52 03/11/2016<br />

ThyssenKrupp AG note loan (€150 million) 2011/2016 — 150 150 4.900 157 03/11/2016<br />

ThyssenKrupp AG note loan (€50 million) 2011/2016 — 50 50 4.750 52 03/29/2016<br />

ThyssenKrupp AG note loan (€50 million) 2011/2016 — 49 50 4.750 48 04/12/2016<br />

Total 4,964 4,517 4,530 4,806<br />

ThyssenKrupp AG has assumed the unconditional and irrevocable<br />

guarantee for the payments pursuant to the terms and conditions of<br />

the bond of ThyssenKrupp Finance Nederland B.V.<br />

Liabilities to financial institutions, Other loans<br />

Carrying<br />

amount<br />

in million €<br />

Sept. 30,<br />

2010<br />

Carrying<br />

amount<br />

in million €<br />

Sept. 30,<br />

2011<br />

Maturity<br />

Date<br />

As of September 30, 2011, the financing structure of liabilities to<br />

financial institutions and other loans comprise the following:<br />

Amount<br />

thereof<br />

in Euro<br />

Weighted<br />

average<br />

interest<br />

rate %<br />

Sept. 30,<br />

2011<br />

Amount<br />

thereof<br />

in USD<br />

Weighted<br />

average<br />

interest<br />

rate %<br />

Sept. 30,<br />

2011<br />

Amount<br />

thereof<br />

in other<br />

currencies<br />

Fair value<br />

in million €<br />

Sept. 30,<br />

2011<br />

Bilateral credits<br />

(at variable interest rates) — — — — — — — —<br />

Other credits at variable interest rates 1,236 973 25 2.06 279 1.50 669 973<br />

Credits at fixed interest rates 1,130 1,101 775 5.71 18 2.20 308 1,137<br />

Total 2,366 2,074 800 5.60 297 1.54 977 2,110<br />

As of September 30, 2011, ThyssenKrupp has available a €2.5 billion<br />

syndicated joint credit multi-currency-facility agreement. The<br />

agreement was fixed in July 2005 and has a term until July 01, 2014.<br />

The facility agreement was not utilized as of the balance sheet date.<br />

Another component of financial debt are revolving credit agreements<br />

with banking institutions whereby ThyssenKrupp AG, ThyssenKrupp<br />

Finance USA, Inc. or ThyssenKrupp Finance Nederland B.V. can<br />

borrow in Euros, U.S. dollars or in British pounds Sterling up to €2.2<br />

billion. Of these facilities, 61% have a remaining term of more than 5<br />

years and 39% a remaining term of up to 5 years. As of September 30,<br />

2011, no cash loans were outstanding.<br />

In total the Group has available unused, committed credit lines<br />

amounting to €4.7 billion. The ten biggest banks together hold a share<br />

of 52%.<br />

The Group’s Commercial Paper Program also provides up to €1.5<br />

billion in additional financing. As of September 30, 2011, the program<br />

was also not used.