Engineering

Engineering

Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

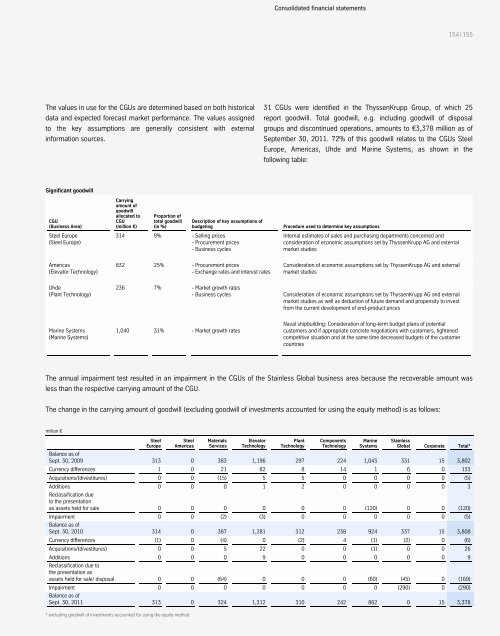

3.6 Consolidated financial statements Notes to the consolidated financial statements<br />

The values in use for the CGUs are determined based on both historical<br />

data and expected forecast market performance. The values assigned<br />

to the key assumptions are generally consistent with external<br />

information sources.<br />

Significant goodwill<br />

CGU<br />

(Business Area)<br />

Steel Europe<br />

(Steel Europe)<br />

Americas<br />

(Elevator Technology)<br />

Uhde<br />

(Plant Technology)<br />

Marine Systems<br />

(Marine Systems)<br />

Carrying<br />

amount of<br />

goodwill<br />

allocated to<br />

CGU<br />

(million €)<br />

314<br />

832<br />

236<br />

1,040<br />

Proportion of<br />

total goodwill<br />

(in %)<br />

9%<br />

25%<br />

7%<br />

31%<br />

Consolidated financial statements<br />

154 | 155<br />

31 CGUs were identified in the ThyssenKrupp Group, of which 25<br />

report goodwill. Total goodwill, e.g. including goodwill of disposal<br />

groups and discontinued operations, amounts to €3,378 million as of<br />

September 30, 2011. 72% of this goodwill relates to the CGUs Steel<br />

Europe, Americas, Uhde and Marine Systems, as shown in the<br />

following table:<br />

Description of key assumptions of<br />

budgeting Procedure used to determine key assumptions<br />

- Selling prices<br />

- Procurement prices<br />

- Business cycles<br />

- Procurement prices<br />

- Exchange rates and interest rates<br />

- Market growth rates<br />

- Business cycles<br />

- Market growth rates<br />

Internal estimates of sales and purchasing departments concerned and<br />

consideration of economic assumptions set by ThyssenKrupp AG and external<br />

market studies<br />

Consideration of economic assumptions set by ThyssenKrupp AG and external<br />

market studies<br />

Consideration of economic assumptions set by ThyssenKrupp AG and external<br />

market studies as well as deduction of future demand and propensity to invest<br />

from the current development of end-product prices<br />

Naval shipbuilding: Consideration of long-term budget plans of potential<br />

customers and if appropriate concrete negotiations with customers, tightened<br />

competitive situation and at the same time decreased budgets of the customer<br />

countries<br />

The annual impairment test resulted in an impairment in the CGUs of the Stainless Global business area because the recoverable amount was<br />

less than the respective carrying amount of the CGU.<br />

The change in the carrying amount of goodwill (excluding goodwill of investments accounted for using the equity method) is as follows:<br />

million €<br />

Steel<br />

Europe<br />

Steel<br />

Americas<br />

Materials<br />

Services<br />

Elevator<br />

Technology<br />

Plant<br />

Technology<br />

Components<br />

Technology<br />

Marine<br />

Systems<br />

Stainless<br />

Global Corporate Total*<br />

Balance as of<br />

Sept. 30, 2009 313 0 383 1,196 297 224 1,043 331 15 3,802<br />

Currency differences 1 0 21 82 8 14 1 6 0 133<br />

Acquisitions/(divestitures) 0 0 (15) 5 5 0 0 0 0 (5)<br />

Additions<br />

Reclassification due<br />

to the presentation<br />

0 0 0 1 2 0 0 0 0 3<br />

as assets held for sale 0 0 0 0 0 0 (120) 0 0 (120)<br />

Impairment<br />

Balance as of<br />

0 0 (2) (3) 0 0 0 0 0 (5)<br />

Sept. 30, 2010 314 0 387 1,281 312 238 924 337 15 3,808<br />

Currency differences (1) 0 (4) 0 (2) 4 (1) (2) 0 (6)<br />

Acquisitions/(divestitures) 0 0 5 22 0 0 (1) 0 0 26<br />

Additions<br />

Reclassification due to<br />

the presentation as<br />

0 0 0 9 0 0 0 0 0 9<br />

assets held for sale/ disposal 0 0 (64) 0 0 0 (60) (45) 0 (169)<br />

Impairment<br />

Balance as of<br />

0 0 0 0 0 0 0 (290) 0 (290)<br />

Sept. 30, 2011 313 0 324 1,312 310 242 862 0 15 3,378<br />

* excluding goodwill of investments accounted for using the equity method