Engineering

Engineering

Engineering

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3.6 Consolidated financial statements Notes to the consolidated financial statements<br />

Consolidated financial statements<br />

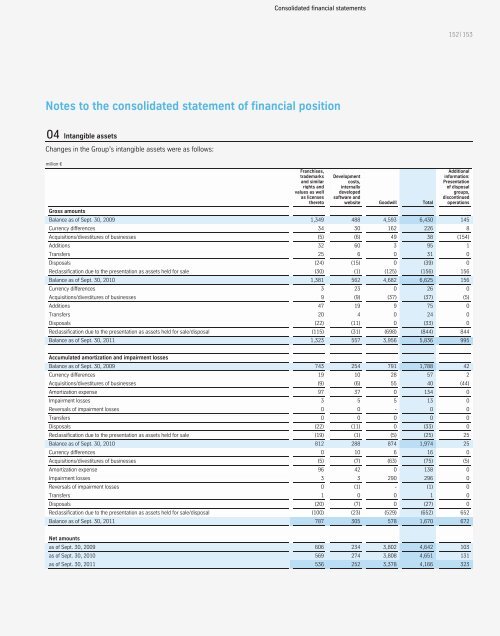

Notes to the consolidated statement of financial position<br />

04 Intangible assets<br />

Changes in the Group’s intangible assets were as follows:<br />

million €<br />

Gross amounts<br />

Franchises,<br />

trademarks<br />

and similar<br />

rights and<br />

values as well<br />

as licenses<br />

thereto<br />

Development<br />

costs,<br />

internally<br />

developed<br />

software and<br />

website Goodwill Total<br />

152 | 153<br />

Additional<br />

information:<br />

Presentation<br />

of disposal<br />

groups,<br />

discontinued<br />

operations<br />

Balance as of Sept. 30, 2009 1,349 488 4,593 6,430 145<br />

Currency differences 34 30 162 226 8<br />

Acquisitions/divestitures of businesses (5) (6) 49 38 (154)<br />

Additions 32 60 3 95 1<br />

Transfers 25 6 0 31 0<br />

Disposals (24) (15) 0 (39) 0<br />

Reclassification due to the presentation as assets held for sale (30) (1) (125) (156) 156<br />

Balance as of Sept. 30, 2010 1,381 562 4,682 6,625 156<br />

Currency differences 3 23 0 26 0<br />

Acquisitions/divestitures of businesses 9 (9) (37) (37) (5)<br />

Additions 47 19 9 75 0<br />

Transfers 20 4 0 24 0<br />

Disposals (22) (11) 0 (33) 0<br />

Reclassification due to the presentation as assets held for sale/disposal (115) (31) (698) (844) 844<br />

Balance as of Sept. 30, 2011 1,323 557 3,956 5,836 995<br />

Accumulated amortization and impairment losses<br />

Balance as of Sept. 30, 2009 743 254 791 1,788 42<br />

Currency differences 19 10 28 57 2<br />

Acquisitions/divestitures of businesses (9) (6) 55 40 (44)<br />

Amortization expense 97 37 0 134 0<br />

Impairment losses 3 5 5 13 0<br />

Reversals of impairment losses 0 0 - 0 0<br />

Transfers 0 0 0 0 0<br />

Disposals (22) (11) 0 (33) 0<br />

Reclassification due to the presentation as assets held for sale (19) (1) (5) (25) 25<br />

Balance as of Sept. 30, 2010 812 288 874 1,974 25<br />

Currency differences 0 10 6 16 0<br />

Acquisitions/divestitures of businesses (5) (7) (63) (75) (5)<br />

Amortization expense 96 42 0 138 0<br />

Impairment losses 3 3 290 296 0<br />

Reversals of impairment losses 0 (1) - (1) 0<br />

Transfers 1 0 0 1 0<br />

Disposals (20) (7) 0 (27) 0<br />

Reclassification due to the presentation as assets held for sale/disposal (100) (23) (529) (652) 652<br />

Balance as of Sept. 30, 2011 787 305 578 1,670 672<br />

Net amounts<br />

as of Sept. 30, 2009 606 234 3,802 4,642 103<br />

as of Sept. 30, 2010 569 274 3,808 4,651 131<br />

as of Sept. 30, 2011 536 252 3,378 4,166 323