Engineering

Engineering

Engineering

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

To our shareholders<br />

1.4 To our shareholders ThyssenKrupp stock<br />

Page 52<br />

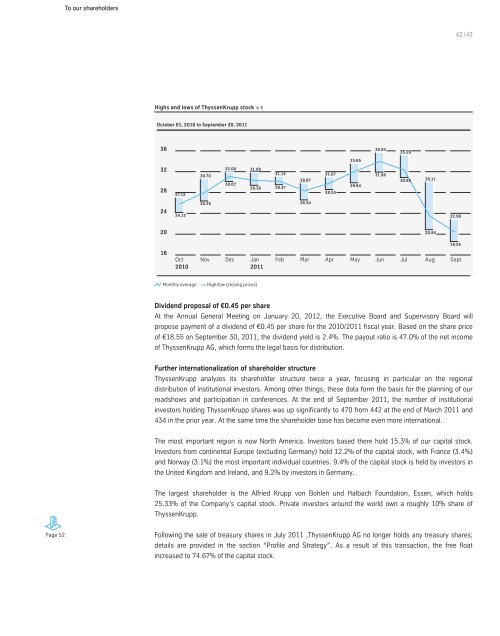

Highs and lows of ThyssenKrupp stock in €<br />

October 01, 2010 to September 30, 2011<br />

36<br />

32<br />

28<br />

24<br />

20<br />

16<br />

27.12<br />

24.13<br />

Oct<br />

2010<br />

30.70<br />

26.35<br />

32.00 31.99<br />

30.07<br />

29.39<br />

Nov Dec Jan<br />

2011<br />

Monthly average High/low (closing prices)<br />

31.13<br />

29.47<br />

29.87<br />

26.54<br />

Feb Mar Apr May Jun Jul Aug Sept<br />

42 | 43<br />

Dividend proposal of €0.45 per share<br />

At the Annual General Meeting on January 20, 2012, the Executive Board and Supervisory Board will<br />

propose payment of a dividend of €0.45 per share for the 2010/2011 fiscal year. Based on the share price<br />

of €18.55 on September 30, 2011, the dividend yield is 2.4%. The payout ratio is 47.0% of the net income<br />

of ThyssenKrupp AG, which forms the legal basis for distribution.<br />

Further internationalization of shareholder structure<br />

ThyssenKrupp analyzes its shareholder structure twice a year, focusing in particular on the regional<br />

distribution of institutional investors. Among other things, these data form the basis for the planning of our<br />

roadshows and participation in conferences. At the end of September 2011, the number of institutional<br />

investors holding ThyssenKrupp shares was up significantly to 470 from 442 at the end of March 2011 and<br />

434 in the prior year. At the same time the shareholder base has become even more international.<br />

The most important region is now North America. Investors based there hold 15.3% of our capital stock.<br />

Investors from continental Europe (excluding Germany) hold 12.2% of the capital stock, with France (3.4%)<br />

and Norway (3.1%) the most important individual countries. 9.4% of the capital stock is held by investors in<br />

the United Kingdom and Ireland, and 9.2% by investors in Germany.<br />

The largest shareholder is the Alfried Krupp von Bohlen und Halbach Foundation, Essen, which holds<br />

25.33% of the Company’s capital stock. Private investors around the world own a roughly 10% share of<br />

ThyssenKrupp.<br />

Following the sale of treasury shares in July 2011 ,ThyssenKrupp AG no longer holds any treasury shares;<br />

details are provided in the section “Profile and Strategy”. As a result of this transaction, the free float<br />

increased to 74.67% of the capital stock.<br />

31.07<br />

28.55<br />

33.65<br />

29.84<br />

35.84<br />

31.96<br />

35.28<br />

30.85<br />

30.11<br />

20.84<br />

22.96<br />

18.55