Engineering

Engineering

Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management report on the Group<br />

2.2 Management report on the Group Consolidated results of operations<br />

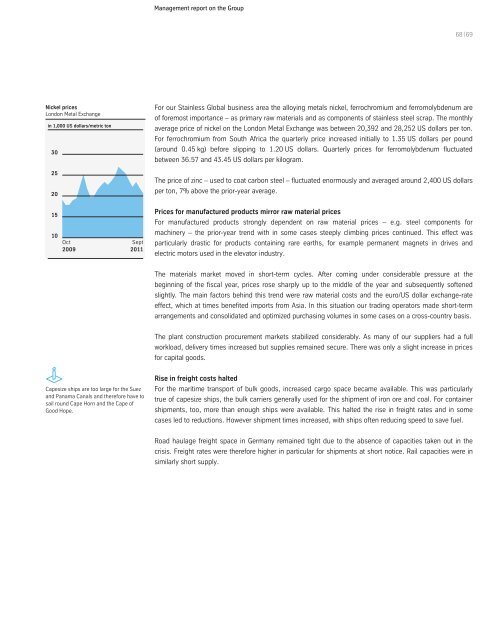

Nickel prices<br />

London Metal Exchange<br />

in 1,000 US dollars/metric ton<br />

30<br />

25<br />

20<br />

15<br />

10<br />

Oct<br />

2009<br />

Sept<br />

2011<br />

Capesize ships are too large for for the the Suez<br />

and Panama Canals and therefore have to to<br />

sail round Cape Horn and the the Cape of of Good<br />

Hope. Good Hope.<br />

68 | 69<br />

For our Stainless Global business area the alloying metals nickel, ferrochromium and ferromolybdenum are<br />

of foremost importance – as primary raw materials and as components of stainless steel scrap. The monthly<br />

average price of nickel on the London Metal Exchange was between 20,392 and 28,252 US dollars per ton.<br />

For ferrochromium from South Africa the quarterly price increased initially to 1.35 US dollars per pound<br />

(around 0.45 kg) before slipping to 1.20 US dollars. Quarterly prices for ferromolybdenum fluctuated<br />

between 36.57 and 43.45 US dollars per kilogram.<br />

The price of zinc – used to coat carbon steel – fluctuated enormously and averaged around 2,400 US dollars<br />

per ton, 7% above the prior-year average.<br />

Prices for manufactured products mirror raw material prices<br />

For manufactured products strongly dependent on raw material prices – e.g. steel components for<br />

machinery – the prior-year trend with in some cases steeply climbing prices continued. This effect was<br />

particularly drastic for products containing rare earths, for example permanent magnets in drives and<br />

electric motors used in the elevator industry.<br />

The materials market moved in short-term cycles. After coming under considerable pressure at the<br />

beginning of the fiscal year, prices rose sharply up to the middle of the year and subsequently softened<br />

slightly. The main factors behind this trend were raw material costs and the euro/US dollar exchange-rate<br />

effect, which at times benefited imports from Asia. In this situation our trading operators made short-term<br />

arrangements and consolidated and optimized purchasing volumes in some cases on a cross-country basis.<br />

The plant construction procurement markets stabilized considerably. As many of our suppliers had a full<br />

workload, delivery times increased but supplies remained secure. There was only a slight increase in prices<br />

for capital goods.<br />

Rise in freight costs halted<br />

For the maritime transport of bulk goods, increased cargo space became available. This was particularly<br />

true of capesize ships, the bulk carriers generally used for the shipment of iron ore and coal. For container<br />

shipments, too, more than enough ships were available. This halted the rise in freight rates and in some<br />

cases led to reductions. However shipment times increased, with ships often reducing speed to save fuel.<br />

Road haulage freight space in Germany remained tight due to the absence of capacities taken out in the<br />

crisis. Freight rates were therefore higher in particular for shipments at short notice. Rail capacities were in<br />

similarly short supply.