Engineering

Engineering

Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management report on the Group<br />

2.4 Management report on the Group Financial position<br />

Pages 171-173 171–173<br />

At the end of September 2011<br />

ThyssenKrupp had total a available cash and liquidity cash<br />

equivalents of €8.3 billion. of €8.3 billion.<br />

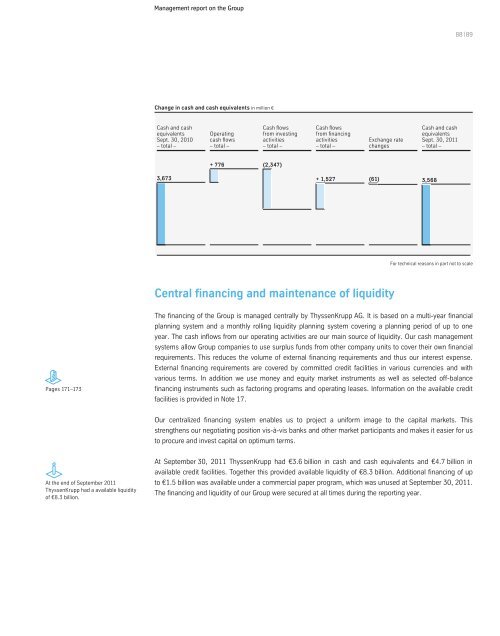

Change in cash and cash equivalents in million €<br />

Cash and cash<br />

equivalents<br />

Sept. 30, 2010<br />

– total –<br />

3,673<br />

Operating<br />

cash flows<br />

– total –<br />

Cash flows<br />

from investing<br />

activities<br />

– total –<br />

+ 776 (2,347)<br />

Cash flows<br />

from financing<br />

activities<br />

– total –<br />

Exchange rate<br />

changes<br />

+ 1,527 (61) 3,568<br />

Central financing and maintenance of liquidity<br />

Cash and cash<br />

equivalents<br />

Sept. 30, 2011<br />

– total –<br />

88 | 89<br />

For technical reasons in part not to scale<br />

The financing of the Group is managed centrally by ThyssenKrupp AG. It is based on a multi-year financial<br />

planning system and a monthly rolling liquidity planning system covering a planning period of up to one<br />

year. The cash inflows from our operating activities are our main source of liquidity. Our cash management<br />

systems allow Group companies to use surplus funds from other company units to cover their own financial<br />

requirements. This reduces the volume of external financing requirements and thus our interest expense.<br />

External financing requirements are covered by committed credit facilities in various currencies and with<br />

various terms. In addition we use money and equity market instruments as well as selected off-balance<br />

financing instruments such as factoring programs and operating leases. Information on the available credit<br />

facilities is provided in Note 17.<br />

Our centralized financing system enables us to project a uniform image to the capital markets. This<br />

strengthens our negotiating position vis-à-vis banks and other market participants and makes it easier for us<br />

to procure and invest capital on optimum terms.<br />

At September 30, 2011 ThyssenKrupp had €3.6 billion in cash and cash equivalents and €4.7 billion in<br />

available credit facilities. Together this provided available liquidity of €8.3 billion. Additional financing of up<br />

to €1.5 billion was available under a commercial paper program, which was unused at September 30, 2011.<br />

The financing and liquidity of our Group were secured at all times during the reporting year.