Engineering

Engineering

Engineering

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3.6 Consolidated financial statements Notes to the consolidated financial statements<br />

Accrued postretirement obligations other than pensions<br />

The Group provides certain postretirement health care and life<br />

insurance benefits to retired employees in the USA who meet certain<br />

minimum requirements regarding age and length of service. The plans<br />

primarily relate to the retained assets and liabilities of ThyssenKrupp<br />

Budd. The plans existing in Canada were settled in cash in fiscal year<br />

2010/2011.<br />

In December 2003, the US government signed into law the Medicare<br />

Prescription Drug, Improvement and Modernization Act. This law<br />

provides for a federal subsidy to sponsors of retiree health care benefit<br />

plans that provide benefit that is at least actuarially equivalent to the<br />

benefit established by the law. The Group accounts for these federal<br />

subsidies as reimbursement rights in accordance with IAS 19.<br />

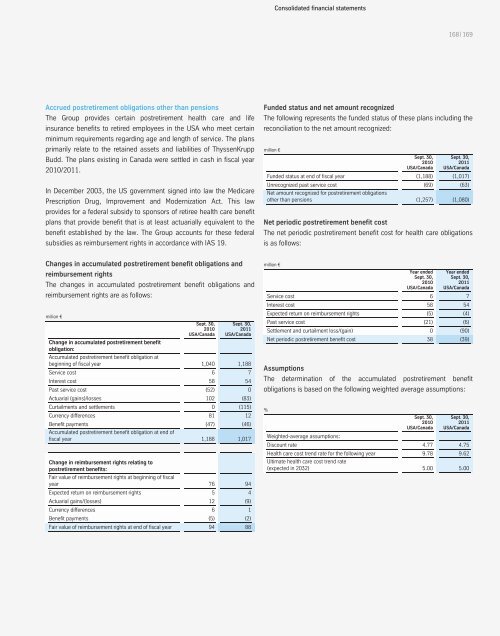

Changes in accumulated postretirement benefit obligations and<br />

reimbursement rights<br />

The changes in accumulated postretirement benefit obligations and<br />

reimbursement rights are as follows:<br />

million €<br />

Sept. 30,<br />

2010<br />

USA/Canada<br />

Sept. 30,<br />

2011<br />

USA/Canada<br />

Change in accumulated postretirement benefit<br />

obligation:<br />

Accumulated postretirement benefit obligation at<br />

beginning of fiscal year 1,040 1,188<br />

Service cost 6 7<br />

Interest cost 58 54<br />

Past service cost (52) 0<br />

Actuarial (gains)/losses 102 (83)<br />

Curtailments and settlements 0 (115)<br />

Currency differences 81 12<br />

Benefit payments<br />

Accumulated postretirement benefit obligation at end of<br />

(47) (46)<br />

fiscal year 1,188 1,017<br />

Change in reimbursement rights relating to<br />

postretirement benefits:<br />

Fair value of reimbursement rights at beginning of fiscal<br />

year 76 94<br />

Expected return on reimbursement rights 5 4<br />

Actuarial gains/(losses) 12 (9)<br />

Currency differences 6 1<br />

Benefit payments (5) (2)<br />

Fair value of reimbursement rights at end of fiscal year 94 88<br />

Consolidated financial statements<br />

168 | 169<br />

Funded status and net amount recognized<br />

The following represents the funded status of these plans including the<br />

reconciliation to the net amount recognized:<br />

million €<br />

Sept. 30,<br />

2010<br />

USA/Canada<br />

Sept. 30,<br />

2011<br />

USA/Canada<br />

Funded status at end of fiscal year (1,188) (1,017)<br />

Unrecognized past service cost<br />

Net amount recognized for postretirement obligations<br />

(69) (63)<br />

other than pensions (1,257) (1,080)<br />

Net periodic postretirement benefit cost<br />

The net periodic postretirement benefit cost for health care obligations<br />

is as follows:<br />

million €<br />

Year ended<br />

Sept. 30,<br />

2010<br />

USA/Canada<br />

Year ended<br />

Sept. 30,<br />

2011<br />

USA/Canada<br />

Service cost 6 7<br />

Interest cost 58 54<br />

Expected return on reimbursement rights (5) (4)<br />

Past service cost (21) (6)<br />

Settlement and curtailment loss/(gain) 0 (90)<br />

Net periodic postretirement benefit cost 38 (39)<br />

Assumptions<br />

The determination of the accumulated postretirement benefit<br />

obligations is based on the following weighted average assumptions:<br />

%<br />

Sept. 30,<br />

2010<br />

USA/Canada<br />

Sept. 30,<br />

2011<br />

USA/Canada<br />

Weighted-average assumptions:<br />

Discount rate 4.77 4.75<br />

Health care cost trend rate for the following year<br />

Ultimate health care cost trend rate<br />

9.78 9.62<br />

(expected in 2032) 5.00 5.00