Engineering

Engineering

Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3.6 Consolidated financial statements Notes Notes to to the the consolidated financial financial statements<br />

The Group uses professional investment managers to invest plan<br />

assets based on specific investment guidelines developed by the<br />

plans’ Investment Committees. The Investment Committees consist of<br />

senior financial management especially from treasury and other<br />

appropriate executives. The Investment Committees meet regularly to<br />

approve the target asset allocations, and review the risks and<br />

performance of the major pension funds and approve the selection and<br />

retention of external managers.<br />

The Group’s target portfolio structure has been developed based on<br />

asset-liability studies that were performed for the major pension funds<br />

within the Group.<br />

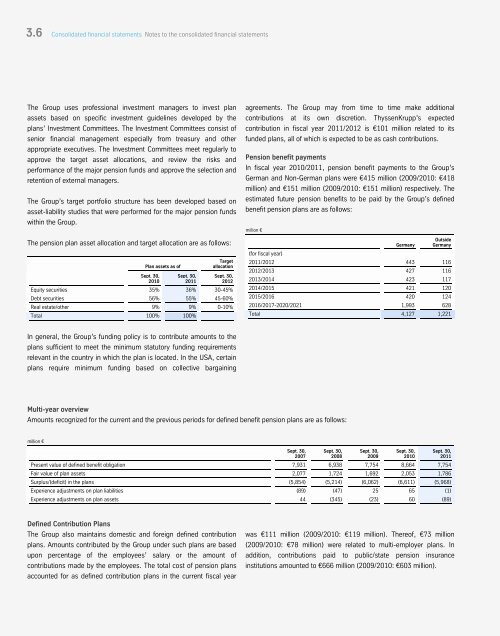

The pension plan asset allocation and target allocation are as follows:<br />

Plan assets as of<br />

Sept. 30,<br />

2010<br />

Sept. 30,<br />

2011<br />

Target<br />

allocation<br />

Sept. 30,<br />

2012<br />

Equity securities 35% 36% 30-45%<br />

Debt securities 56% 55% 45-60%<br />

Real estate/other 9% 9% 0-10%<br />

Total 100% 100%<br />

In general, the Group’s funding policy is to contribute amounts to the<br />

plans sufficient to meet the minimum statutory funding requirements<br />

relevant in the country in which the plan is located. In the USA, certain<br />

plans require minimum funding based on collective bargaining<br />

agreements. The Group may from time to time make additional<br />

contributions at its own discretion. ThyssenKrupp’s expected<br />

contribution in fiscal year 2011/2012 is €101 million related to its<br />

funded plans, all of which is expected to be as cash contributions.<br />

Pension benefit payments<br />

In fiscal year 2010/2011, pension benefit payments to the Group’s<br />

German and Non-German plans were €415 million (2009/2010: €418<br />

million) and €151 million (2009/2010: €151 million) respectively. The<br />

estimated future pension benefits to be paid by the Group’s defined<br />

benefit pension plans are as follows:<br />

million €<br />

Multi-year overview<br />

Amounts recognized for the current and the previous periods for defined benefit pension plans are as follows:<br />

million €<br />

Germany<br />

Outside<br />

Germany<br />

(for fiscal year)<br />

2011/2012 443 116<br />

2012/2013 427 116<br />

2013/2014 423 117<br />

2014/2015 421 120<br />

2015/2016 420 124<br />

2016/2017-2020/2021 1,993 628<br />

Total 4,127 1,221<br />

Present value of defined benefit obligation 7,931 6,938 7,754 8,664 7,754<br />

Fair value of plan assets 2,077 1,724 1,692 2,053 1,786<br />

Surplus/(deficit) in the plans (5,854) (5,214) (6,062) (6,611) (5,968)<br />

Experience adjustments on plan liabilities (89) (47) 25 65 (1)<br />

Experience adjustments on plan assets 44 (345) (23) 60 (89)<br />

Defined Contribution Plans<br />

The Group also maintains domestic and foreign defined contribution<br />

plans. Amounts contributed by the Group under such plans are based<br />

upon percentage of the employees’ salary or the amount of<br />

contributions made by the employees. The total cost of pension plans<br />

accounted for as defined contribution plans in the current fiscal year<br />

Sept. 30,<br />

2007<br />

Sept. 30,<br />

2008<br />

Sept. 30,<br />

2009<br />

Sept. 30,<br />

2010<br />

168<br />

Sept. 30,<br />

2011<br />

was €111 million (2009/2010: €119 million). Thereof, €73 million<br />

(2009/2010: €78 million) were related to multi-employer plans. In<br />

addition, contributions paid to public/state pension insurance<br />

institutions amounted to €666 million (2009/2010: €603 million).