Engineering

Engineering

Engineering

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3.6 Consolidated financial statements Notes Notes to to the the consolidated financial financial statements<br />

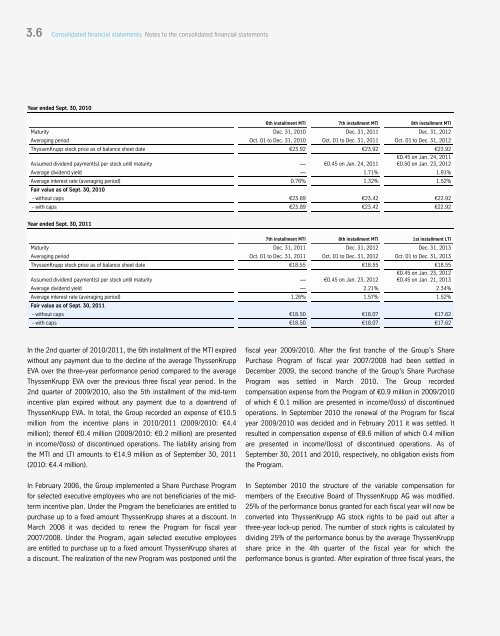

Year ended Sept. 30, 2010<br />

6th installment MTI 7th installment MTI 8th installment MTI<br />

Maturity Dec. 31, 2010 Dec. 31, 2011 Dec. 31, 2012<br />

Averaging period Oct. 01 to Dec. 31, 2010 Oct. 01 to Dec. 31, 2011 Oct. 01 to Dec. 31, 2012<br />

ThyssenKrupp stock price as of balance sheet date €23.92 €23.92 €23.92<br />

€0.45 on Jan. 24, 2011<br />

Assumed dividend payment(s) per stock until maturity — €0.45 on Jan. 24, 2011 €0.50 on Jan. 23, 2012<br />

Average dividend yield — 1.71% 1.91%<br />

Average interest rate (averaging period) 0.76% 1.32% 1.52%<br />

Fair value as of Sept. 30, 2010<br />

- without caps €23.89 €23.42 €22.92<br />

- with caps €23.89 €23.42 €22.92<br />

Year ended Sept. 30, 2011<br />

7th installment MTI 8th installment MTI 1st installment LTI<br />

Maturity Dec. 31, 2011 Dec. 31, 2012 Dec. 31, 2013<br />

Averaging period Oct. 01 to Dec. 31, 2011 Oct. 01 to Dec. 31, 2012 Oct. 01 to Dec. 31, 2013<br />

ThyssenKrupp stock price as of balance sheet date €18.55 €18.55 €18.55<br />

€0.45 on Jan. 23, 2012<br />

Assumed dividend payment(s) per stock until maturity — €0.45 on Jan. 23, 2012 €0.45 on Jan. 21, 2013<br />

Average dividend yield — 2.21% 2.34%<br />

Average interest rate (averaging period) 1.26% 1.57% 1.52%<br />

Fair value as of Sept. 30, 2011<br />

- without caps €18.50 €18.07 €17.62<br />

- with caps €18.50 €18.07 €17.62<br />

In the 2nd quarter of 2010/2011, the 6th installment of the MTI expired<br />

without any payment due to the decline of the average ThyssenKrupp<br />

EVA over the three-year performance period compared to the average<br />

ThyssenKrupp EVA over the previous three fiscal year period. In the<br />

2nd quarter of 2009/2010, also the 5th installment of the mid-term<br />

incentive plan expired without any payment due to a downtrend of<br />

ThyssenKrupp EVA. In total, the Group recorded an expense of €10.5<br />

million from the incentive plans in 2010/2011 (2009/2010: €4.4<br />

million); thereof €0.4 million (2009/2010: €0.2 million) are presented<br />

in income/(loss) of discontinued operations. The liability arising from<br />

the MTI and LTI amounts to €14.9 million as of September 30, 2011<br />

(2010: €4.4 million).<br />

In February 2006, the Group implemented a Share Purchase Program<br />

for selected executive employees who are not beneficiaries of the midterm<br />

incentive plan. Under the Program the beneficiaries are entitled to<br />

purchase up to a fixed amount ThyssenKrupp shares at a discount. In<br />

March 2008 it was decided to renew the Program for fiscal year<br />

2007/2008. Under the Program, again selected executive employees<br />

are entitled to purchase up to a fixed amount ThyssenKrupp shares at<br />

a discount. The realization of the new Program was postponed until the<br />

fiscal year 2009/2010. After the first tranche of the Group’s Share<br />

Purchase Program of fiscal year 2007/2008 had been settled in<br />

December 2009, the second tranche of the Group’s Share Purchase<br />

Program was settled in March 2010. The Group recorded<br />

compensation expense from the Program of €0.9 million in 2009/2010<br />

of which € 0.1 million are presented in income/(loss) of discontinued<br />

operations. In September 2010 the renewal of the Program for fiscal<br />

year 2009/2010 was decided and in February 2011 it was settled. It<br />

resulted in compensation expense of €8.6 million of which 0.4 million<br />

are presented in income/(loss) of discontinued operations. As of<br />

September 30, 2011 and 2010, respectively, no obligation exists from<br />

the Program.<br />

In September 2010 the structure of the variable compensation for<br />

members of the Executive Board of ThyssenKrupp AG was modified.<br />

25% of the performance bonus granted for each fiscal year will now be<br />

converted into ThyssenKrupp AG stock rights to be paid out after a<br />

three-year lock-up period. The number of stock rights is calculated by<br />

dividing 25% of the performance bonus by the average ThyssenKrupp<br />

share price in the 4th quarter of the fiscal year for which the<br />

performance bonus is granted. After expiration of three fiscal years, the<br />

164