Engineering

Engineering

Engineering

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3.6 Consolidated financial statements Notes to the consolidated financial statements<br />

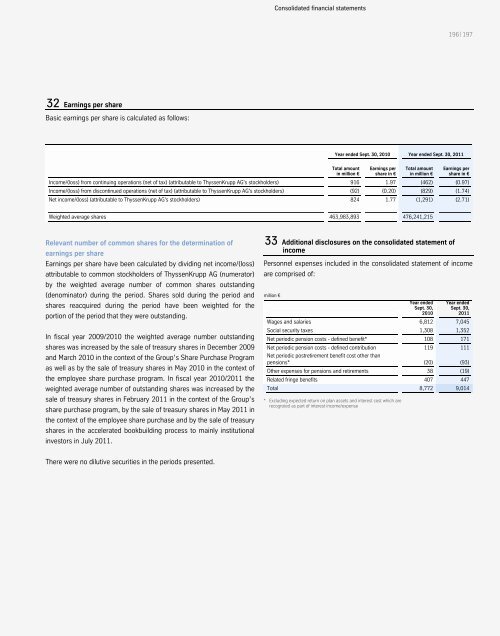

32 Earnings per share<br />

Basic earnings per share is calculated as follows:<br />

Consolidated financial statements<br />

196 | 197<br />

Year ended Sept. 30, 2010 Year ended Sept. 30, 2011<br />

Total amount<br />

in million €<br />

Earnings per<br />

share in €<br />

Total amount<br />

in million €<br />

Earnings per<br />

share in €<br />

Income/(loss) from continuing operations (net of tax) (attributable to ThyssenKrupp AG's stockholders) 916 1.97 (462) (0.97)<br />

Income/(loss) from discontinued operations (net of tax) (attributable to ThyssenKrupp AG's stockholders) (92) (0.20) (829) (1.74)<br />

Net income/(loss) (attributable to ThyssenKrupp AG's stockholders) 824 1.77 (1,291) (2.71)<br />

Weighted average shares 463,983,893 476,241,215<br />

Relevant number of common shares for the determination of<br />

earnings per share<br />

Earnings per share have been calculated by dividing net income/(loss)<br />

attributable to common stockholders of ThyssenKrupp AG (numerator)<br />

by the weighted average number of common shares outstanding<br />

(denominator) during the period. Shares sold during the period and<br />

shares reacquired during the period have been weighted for the<br />

portion of the period that they were outstanding.<br />

In fiscal year 2009/2010 the weighted average number outstanding<br />

shares was increased by the sale of treasury shares in December 2009<br />

and March 2010 in the context of the Group’s Share Purchase Program<br />

as well as by the sale of treasury shares in May 2010 in the context of<br />

the employee share purchase program. In fiscal year 2010/2011 the<br />

weighted average number of outstanding shares was increased by the<br />

sale of treasury shares in February 2011 in the context of the Group’s<br />

share purchase program, by the sale of treasury shares in May 2011 in<br />

the context of the employee share purchase and by the sale of treasury<br />

shares in the accelerated bookbuilding process to mainly institutional<br />

investors in July 2011.<br />

There were no dilutive securities in the periods presented.<br />

33 Additional disclosures on the consolidated statement of<br />

income<br />

Personnel expenses included in the consolidated statement of income<br />

are comprised of:<br />

million €<br />

Year ended<br />

Sept. 30,<br />

2010<br />

Year ended<br />

Sept. 30,<br />

2011<br />

Wages and salaries 6,812 7,045<br />

Social security taxes 1,308 1,352<br />

Net periodic pension costs - defined benefit* 108 171<br />

Net periodic pension costs - defined contribution<br />

Net periodic postretirement benefit cost other than<br />

119 111<br />

pensions* (20) (93)<br />

Other expenses for pensions and retirements 38 (19)<br />

Related fringe benefits 407 447<br />

Total 8,772 9,014<br />

* Excluding expected return on plan assets and interest cost which are<br />

recognzied as part of interest income/expense