Engineering

Engineering

Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3.6 Consolidated financial statements Notes Notes to to the the consolidated financial financial statements<br />

Capital stock<br />

The capital stock of ThyssenKrupp AG consists of 514,489,044 no-par<br />

bearer shares of stock, all of which have been issued and are fully<br />

paid, with 514,489,044 outstanding as of September 30, 2011 and<br />

464,394,337 outstanding as of September 30, 2010, respectively.<br />

Each share of common stock has a stated value of €2.56.<br />

All shares grant the same rights. The stockholders are entitled to<br />

receive dividends as declared and are entitled to one vote per share at<br />

the stockholders’ meetings.<br />

Additional paid in capital<br />

Additional paid in capital include the effects of the business<br />

combination of Thyssen and Krupp as well as premiums resulting from<br />

capital increases at subsidiaries with non-controlling interest.<br />

Retained earnings<br />

Retained earnings include prior years’ undistributed consolidated<br />

income. In addition, actuarial gains and losses are included in this<br />

balance sheet item.<br />

Treasury stock<br />

On the basis of the authorization granted by the Annual General<br />

Meeting on January 18, 2008, the Executive Board of ThyssenKrupp<br />

AG resolved on January 31, 2008, to acquire up to approximately 3%<br />

of the current capital stock issued. In the period from February 01,<br />

2008 to March 07, 2008, ThyssenKrupp AG purchased a total of<br />

14,791,100 treasury shares, representing approximately 2.9% of the<br />

capital stock, at an average price of €35.34. This represents a total<br />

amount of €523 million. In addition, based on the authorization of the<br />

Annual General Meeting, the Executive Board resolved on July 14,<br />

2008, to acquire up to approximately 2.0% of the capital stock issued.<br />

In the period from July 15, 2008 to August 13, 2008, ThyssenKrupp<br />

AG purchased a total of 10,500,000 treasury shares, representing<br />

approximately 2.0% of the capital stock, at an average price of €33.98.<br />

This represents a total amount of €357 million.<br />

In the context of the settlement of the Group’s Share Purchase Program<br />

of fiscal year 2007/2008, as of December 02, 2009, 350,924 treasury<br />

shares were sold to the beneficiaries of the first tranche and as of<br />

March 04, 2010, 40,793 treasury shares were sold to the beneficiaries<br />

of the second tranche at a price of €24.62 per share. Another 529,128<br />

treasury shares were sold at a price of €22.09 per share in the context<br />

of the German employee share purchase program. In addition in the<br />

context of the settlement of the Group’s Share Purchase Program of<br />

fiscal year 2009/2010, as of February 02, 2011, 209,770 treasury<br />

shares were sold to the beneficiaries using a price of €29.59 per share.<br />

Another 400,095 treasury shares were sold at a price of €29.46 per<br />

share in the context of the German employee share purchase program<br />

as of May 06, 2011. All prices stated before represent the basis for the<br />

discounted selling price.<br />

To reduce net financial debt as part of the Group’s strategic<br />

development, on July 06, 2011 the Executive Board of ThyssenKrupp<br />

AG resolved to sell the 49,484,842 treasury shares; this corresponds<br />

to 9.6% of the capital stock. The shares were sold in an accelerated<br />

bookbuilding process at a price of €32.95 per share to mainly German<br />

and international institutional investors on July 07, 2011, leading to a<br />

cash inflow of approximately €1.6 million; the related transaction costs<br />

of €7 million are accounted for as a deduction from equity.<br />

The presented sales of the treasury sales are based on the<br />

authorizations of the Annual General Meeting of January 23, 2009 and<br />

January 21, 2010, respectively, resulting in the fact that ThyssenKrupp<br />

AG does not any longer hold treasury shares as of September 30,<br />

2011.<br />

Management of capital<br />

As of September 30, 2011, the equity ratio reached 23.8% (2010:<br />

23.8%). Among the ThyssenKrupp Group’s most important financial<br />

goals are a sustainable appreciation of entity value and ensuring<br />

solvency at all times. Creating sufficient liquidity reserves is therefore<br />

of great importance. These objectives are achieved by implementing<br />

various capital cost reduction and capital structure optimization<br />

measures as well as effective risk management.<br />

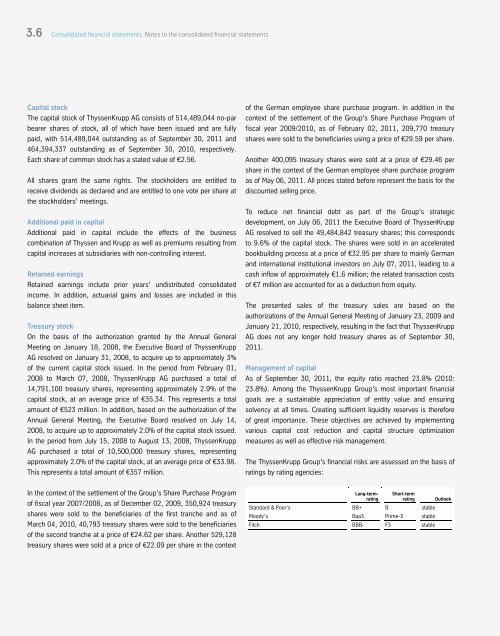

The ThyssenKrupp Group’s financial risks are assessed on the basis of<br />

ratings by rating agencies:<br />

Lang-term-<br />

rating<br />

162<br />

Short-term<br />

rating Outlook<br />

Standard & Poor’s BB+ B stable<br />

Moody’s Baa3 Prime-3 stable<br />

Fitch BBB- F3 stable