Engineering

Engineering

Engineering

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

3.6 Consolidated financial statements Notes to the consolidated financial statements<br />

3.6 Consolidated financial statements Notes to the consolidated financial statements<br />

violations. It is not yet possible at the reporting date to estimate the<br />

amount of any fine. As well as a fine by the Federal Cartel Office, it<br />

must be expected that customers may file claims for damages.<br />

Concrete claims for damages have not yet been filed.<br />

In addition ThyssenKrupp is involved in pending and threatened<br />

litigation in connection with the purchase and sale of certain<br />

companies, which may lead to partial repayment of purchase price or<br />

to the payment of damages. In addition, damage claims may be<br />

payable to contractual partners, customers, consortium partners and<br />

subcontractors under performance contracts. Some of these claims<br />

have proven unfounded, have been ended by settlement or expired<br />

under the statute of limitations. A number of these proceedings are still<br />

pending. However, at present ThyssenKrupp does not expect pending<br />

lawsuits not explained separately in this section to have a major<br />

negative impact on the financial position.<br />

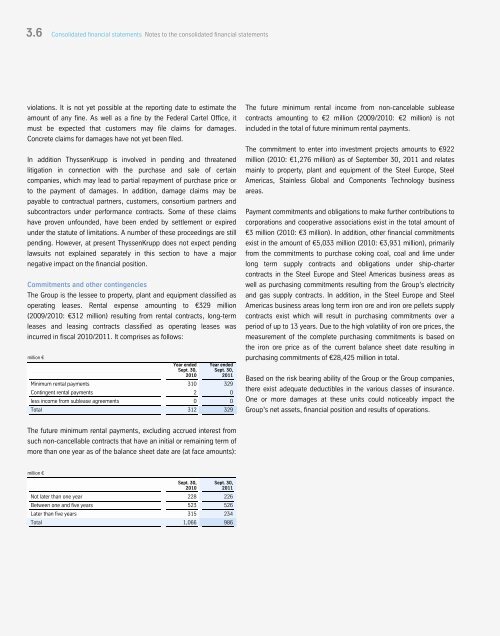

Commitments and other contingencies<br />

The Group is the lessee to property, plant and equipment classified as<br />

operating leases. Rental expense amounting to €329 million<br />

(2009/2010: €312 million) resulting from rental contracts, long-term<br />

leases and leasing contracts classified as operating leases was<br />

incurred in fiscal 2010/2011. It comprises as follows:<br />

million €<br />

Year ended<br />

Sept. 30,<br />

2010<br />

Year ended<br />

Sept. 30,<br />

2011<br />

Minimum rental payments 310 329<br />

Contingent rental payments 2 0<br />

less income from sublease agreements 0 0<br />

Total 312 329<br />

The future minimum rental payments, excluding accrued interest from<br />

such non-cancellable contracts that have an initial or remaining term of<br />

more than one year as of the balance sheet date are (at face amounts):<br />

million €<br />

Sept. 30,<br />

2010<br />

Sept. 30,<br />

2011<br />

Not later than one year 228 226<br />

Between one and five years 523 526<br />

Later than five years 315 234<br />

Total 1,066 986<br />

The future minimum rental income from non-cancelable sublease<br />

contracts amounting to €2 million (2009/2010: €2 million) is not<br />

included in the total of future minimum rental payments.<br />

The commitment to enter into investment projects amounts to €922<br />

million (2010: €1,276 million) as of September 30, 2011 and relates<br />

mainly to property, plant and equipment of the Steel Europe, Steel<br />

Americas, Stainless Global and Components Technology business<br />

areas.<br />

Payment commitments and obligations to make further contributions to<br />

corporations and cooperative associations exist in the total amount of<br />

€3 million (2010: €3 million). In addition, other financial commitments<br />

exist in the amount of €5,033 million (2010: €3,931 million), primarily<br />

from the commitments to purchase coking coal, coal and lime under<br />

long term supply contracts and obligations under ship-charter<br />

contracts in the Steel Europe and Steel Americas business areas as<br />

well as purchasing commitments resulting from the Group’s electricity<br />

and gas supply contracts. In addition, in the Steel Europe and Steel<br />

Americas business areas long term iron ore and iron ore pellets supply<br />

contracts exist which will result in purchasing commitments over a<br />

period of up to 13 years. Due to the high volatility of iron ore prices, the<br />

measurement of the complete purchasing commitments is based on<br />

the iron ore price as of the current balance sheet date resulting in<br />

purchasing commitments of €28,425 million in total.<br />

Based on the risk bearing ability of the Group or the Group companies,<br />

there exist adequate deductibles in the various classes of insurance.<br />

One or more damages at these units could noticeably impact the<br />

Group’s net assets, financial position and results of operations.<br />

176