Student Handbook and Catalog 2021-22 V2

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

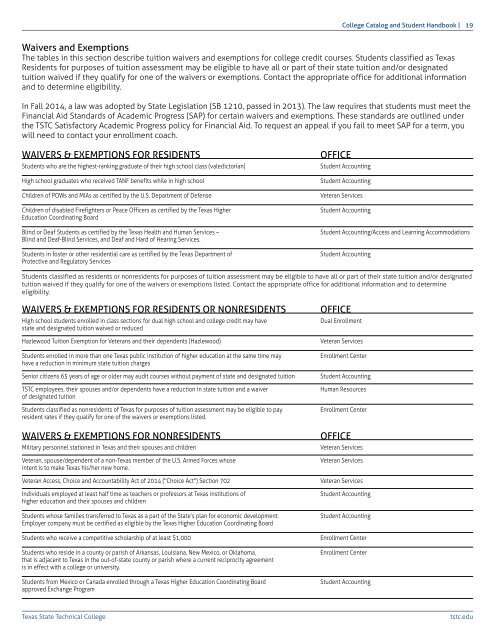

College <strong>Catalog</strong> <strong>and</strong> <strong>Student</strong> <strong>H<strong>and</strong>book</strong> | 19<br />

Waivers <strong>and</strong> Exemptions<br />

The tables in this section describe tuition waivers <strong>and</strong> exemptions for college credit courses. <strong>Student</strong>s classified as Texas<br />

Residents for purposes of tuition assessment may be eligible to have all or part of their state tuition <strong>and</strong>/or designated<br />

tuition waived if they qualify for one of the waivers or exemptions. Contact the appropriate office for additional information<br />

<strong>and</strong> to determine eligibility.<br />

In Fall 2014, a law was adopted by State Legislation (SB 1210, passed in 2013). The law requires that students must meet the<br />

Financial Aid St<strong>and</strong>ards of Academic Progress (SAP) for certain waivers <strong>and</strong> exemptions. These st<strong>and</strong>ards are outlined under<br />

the TSTC Satisfactory Academic Progress policy for Financial Aid. To request an appeal if you fail to meet SAP for a term, you<br />

will need to contact your enrollment coach.<br />

WAIVERS & EXEMPTIONS FOR RESIDENTS<br />

<strong>Student</strong>s who are the highest-ranking graduate of their high school class (valedictorian)<br />

High school graduates who received TANF benefits while in high school<br />

Children of POWs <strong>and</strong> MIAs as certified by the U.S. Department of Defense<br />

Children of disabled Firefighters or Peace Officers as certified by the Texas Higher<br />

Education Coordinating Board<br />

Blind or Deaf <strong>Student</strong>s as certified by the Texas Health <strong>and</strong> Human Services –<br />

Blind <strong>and</strong> Deaf-Blind Services, <strong>and</strong> Deaf <strong>and</strong> Hard of Hearing Services.<br />

<strong>Student</strong>s in foster or other residential care as certified by the Texas Department of<br />

Protective <strong>and</strong> Regulatory Services<br />

OFFICE<br />

<strong>Student</strong> Accounting<br />

<strong>Student</strong> Accounting<br />

Veteran Services<br />

<strong>Student</strong> Accounting<br />

<strong>Student</strong> Accounting/Access <strong>and</strong> Learning Accommodations<br />

<strong>Student</strong> Accounting<br />

<strong>Student</strong>s classified as residents or nonresidents for purposes of tuition assessment may be eligible to have all or part of their state tuition <strong>and</strong>/or designated<br />

tuition waived if they qualify for one of the waivers or exemptions listed. Contact the appropriate office for additional information <strong>and</strong> to determine<br />

eligibility.<br />

WAIVERS & EXEMPTIONS FOR RESIDENTS OR NONRESIDENTS<br />

High school students enrolled in class sections for dual high school <strong>and</strong> college credit may have<br />

state <strong>and</strong> designated tuition waived or reduced<br />

Hazlewood Tuition Exemption for Veterans <strong>and</strong> their dependents (Hazlewood)<br />

<strong>Student</strong>s enrolled in more than one Texas public institution of higher education at the same time may<br />

have a reduction in minimum state tuition charges<br />

Senior citizens 65 years of age or older may audit courses without payment of state <strong>and</strong> designated tuition<br />

TSTC employees, their spouses <strong>and</strong>/or dependents have a reduction in state tuition <strong>and</strong> a waiver<br />

of designated tuition<br />

<strong>Student</strong>s classified as nonresidents of Texas for purposes of tuition assessment may be eligible to pay<br />

resident rates if they qualify for one of the waivers or exemptions listed.<br />

WAIVERS & EXEMPTIONS FOR NONRESIDENTS<br />

Military personnel stationed in Texas <strong>and</strong> their spouses <strong>and</strong> children<br />

Veteran, spouse/dependent of a non-Texas member of the U.S. Armed Forces whose<br />

intent is to make Texas his/her new home.<br />

Veteran Access, Choice <strong>and</strong> Accountability Act of 2014 ("Choice Act") Section 702<br />

Individuals employed at least half time as teachers or professors at Texas institutions of<br />

higher education <strong>and</strong> their spouses <strong>and</strong> children<br />

<strong>Student</strong>s whose families transferred to Texas as a part of the State’s plan for economic development.<br />

Employer company must be certified as eligible by the Texas Higher Education Coordinating Board<br />

<strong>Student</strong>s who receive a competitive scholarship of at least $1,000<br />

<strong>Student</strong>s who reside in a county or parish of Arkansas, Louisiana, New Mexico, or Oklahoma,<br />

that is adjacent to Texas in the out-of-state county or parish where a current reciprocity agreement<br />

is in effect with a college or university.<br />

<strong>Student</strong>s from Mexico or Canada enrolled through a Texas Higher Education Coordinating Board<br />

approved Exchange Program<br />

OFFICE<br />

Dual Enrollment<br />

Veteran Services<br />

Enrollment Center<br />

<strong>Student</strong> Accounting<br />

Human Resources<br />

Enrollment Center<br />

OFFICE<br />

Veteran Services<br />

Veteran Services<br />

Veteran Services<br />

<strong>Student</strong> Accounting<br />

<strong>Student</strong> Accounting<br />

Enrollment Center<br />

Enrollment Center<br />

<strong>Student</strong> Accounting<br />

Texas State Technical College<br />

tstc.edu