Student Handbook and Catalog 2021-22 V2

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

College <strong>Catalog</strong> <strong>and</strong> <strong>Student</strong> <strong>H<strong>and</strong>book</strong> | 21<br />

Refunds for Drops/Reduction in Course Load<br />

<strong>Student</strong>s who drop credit courses <strong>and</strong> reduce their course<br />

loads while remaining enrolled at the College will have<br />

their state <strong>and</strong> designated tuition refunded, based on<br />

the official drop date recorded by the enrollment coach<br />

or program enrollment coach according to the following<br />

schedule. <strong>Student</strong>s who concurrently add <strong>and</strong> drop the<br />

same number of credit hours will not be charged or<br />

refunded for these simultaneous transactions if they occur<br />

by the published deadlines.<br />

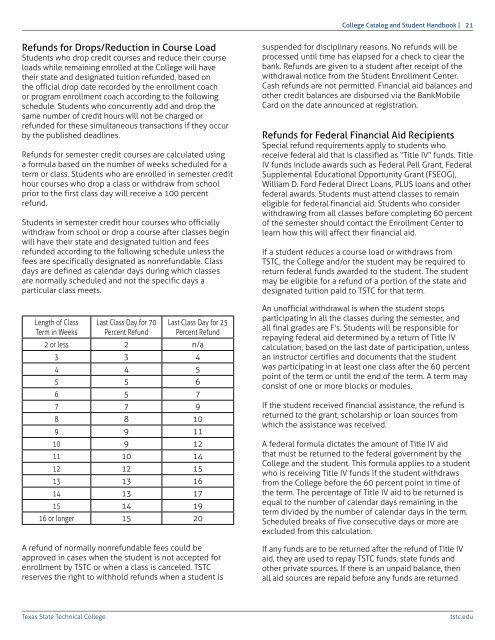

Refunds for semester credit courses are calculated using<br />

a formula based on the number of weeks scheduled for a<br />

term or class. <strong>Student</strong>s who are enrolled in semester credit<br />

hour courses who drop a class or withdraw from school<br />

prior to the first class day will receive a 100 percent<br />

refund.<br />

<strong>Student</strong>s in semester credit hour courses who officially<br />

withdraw from school or drop a course after classes begin<br />

will have their state <strong>and</strong> designated tuition <strong>and</strong> fees<br />

refunded according to the following schedule unless the<br />

fees are specifically designated as nonrefundable. Class<br />

days are defined as calendar days during which classes<br />

are normally scheduled <strong>and</strong> not the specific days a<br />

particular class meets.<br />

Length of Class<br />

Term in Weeks<br />

Last Class Day for 70<br />

Percent Refund<br />

Last Class Day for 25<br />

Percent Refund<br />

2 or less 2 n/a<br />

3 3 4<br />

4 4 5<br />

5 5 6<br />

6 5 7<br />

7 7 9<br />

8 8 10<br />

9 9 11<br />

10 9 12<br />

11 10 14<br />

12 12 15<br />

13 13 16<br />

14 13 17<br />

15 14 19<br />

16 or longer 15 20<br />

A refund of normally nonrefundable fees could be<br />

approved in cases when the student is not accepted for<br />

enrollment by TSTC or when a class is canceled. TSTC<br />

reserves the right to withhold refunds when a student is<br />

suspended for disciplinary reasons. No refunds will be<br />

processed until time has elapsed for a check to clear the<br />

bank. Refunds are given to a student after receipt of the<br />

withdrawal notice from the <strong>Student</strong> Enrollment Center.<br />

Cash refunds are not permitted. Financial aid balances <strong>and</strong><br />

other credit balances are disbursed via the BankMobile<br />

Card on the date announced at registration.<br />

Refunds for Federal Financial Aid Recipients<br />

Special refund requirements apply to students who<br />

receive federal aid that is classified as “Title IV” funds. Title<br />

IV funds include awards such as Federal Pell Grant, Federal<br />

Supplemental Educational Opportunity Grant (FSEOG),<br />

William D. Ford Federal Direct Loans, PLUS loans <strong>and</strong> other<br />

federal awards. <strong>Student</strong>s must attend classes to remain<br />

eligible for federal financial aid. <strong>Student</strong>s who consider<br />

withdrawing from all classes before completing 60 percent<br />

of the semester should contact the Enrollment Center to<br />

learn how this will affect their financial aid.<br />

If a student reduces a course load or withdraws from<br />

TSTC, the College <strong>and</strong>/or the student may be required to<br />

return federal funds awarded to the student. The student<br />

may be eligible for a refund of a portion of the state <strong>and</strong><br />

designated tuition paid to TSTC for that term.<br />

An unofficial withdrawal is when the student stops<br />

participating in all the classes during the semester, <strong>and</strong><br />

all final grades are F's. <strong>Student</strong>s will be responsible for<br />

repaying federal aid determined by a return of Title IV<br />

calculation, based on the last date of participation, unless<br />

an instructor certifies <strong>and</strong> documents that the student<br />

was participating in at least one class after the 60 percent<br />

point of the term or until the end of the term. A term may<br />

consist of one or more blocks or modules.<br />

If the student received financial assistance, the refund is<br />

returned to the grant, scholarship or loan sources from<br />

which the assistance was received.<br />

A federal formula dictates the amount of Title IV aid<br />

that must be returned to the federal government by the<br />

College <strong>and</strong> the student. This formula applies to a student<br />

who is receiving Title IV funds if the student withdraws<br />

from the College before the 60 percent point in time of<br />

the term. The percentage of Title IV aid to be returned is<br />

equal to the number of calendar days remaining in the<br />

term divided by the number of calendar days in the term.<br />

Scheduled breaks of five consecutive days or more are<br />

excluded from this calculation.<br />

If any funds are to be returned after the refund of Title IV<br />

aid, they are used to repay TSTC funds, state funds <strong>and</strong><br />

other private sources. If there is an unpaid balance, then<br />

all aid sources are repaid before any funds are returned<br />

Texas State Technical College<br />

tstc.edu