Maritime Trade and Transport - HWWI

Maritime Trade and Transport - HWWI

Maritime Trade and Transport - HWWI

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Three-quarters of the vessels in the multi-purpose fleet are used for regional or feeder transport,<br />

half of these vessels in Asia, the rest especially on north-south routes <strong>and</strong> in trade with developing<br />

countries. Since only few such ships have been built or ordered <strong>and</strong> the existing fleet<br />

already has an average age of 16 years, the segment offers promising perspectives. 28<br />

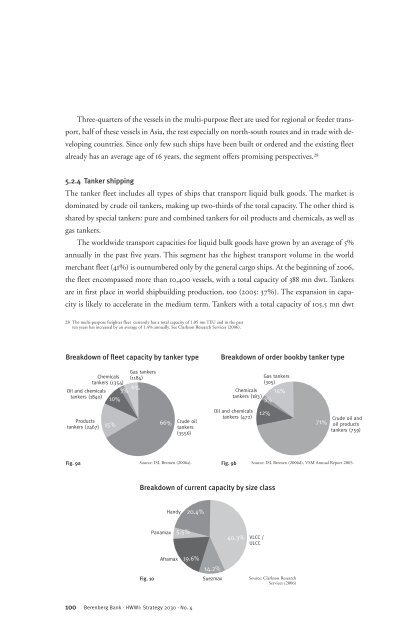

5.2.4 Tanker shipping<br />

The tanker fleet includes all types of ships that transport liquid bulk goods. The market is<br />

dominated by crude oil tankers, making up two-thirds of the total capacity. The other third is<br />

shared by special tankers: pure <strong>and</strong> combined tankers for oil products <strong>and</strong> chemicals, as well as<br />

gas tankers.<br />

The worldwide transport capacities for liquid bulk goods have grown by an average of 5%<br />

annually in the past five years. This segment has the highest transport volume in the world<br />

merchant fleet (41%) is outnumbered only by the general cargo ships. At the beginning of 2006,<br />

the fleet encompassed more than 10,400 vessels, with a total capacity of 388 mn dwt. Tankers<br />

are in first place in world shipbuilding production, too (2005: 37%). The expansion in capacity<br />

is likely to accelerate in the medium term. Tankers with a total capacity of 105.5 mn dwt<br />

28 The multi-purpose freighter fleet currently has a total capacity of 1.05 mn TEU <strong>and</strong> in the past<br />

ten years has increased by an average of 1.4% annually. See Clarkson Research Services (2006).<br />

Breakdown of fleet capacity by tanker type Breakdown of order bookby tanker type<br />

Gas tankers<br />

Chemicals (1184)<br />

tankers (1354)<br />

6%<br />

Oil <strong>and</strong> chemicals 3%<br />

tankers (1840) 10%<br />

Products<br />

tankers (2467)<br />

15%<br />

66%<br />

Crude oil<br />

tankers<br />

(3556)<br />

100 Berenberg Bank · <strong>HWWI</strong>: Strategy 2030 · No. 4<br />

Gas tankers<br />

(305)<br />

Chemicals 14%<br />

tankers (183)<br />

3%<br />

Oil <strong>and</strong> chemicals<br />

tankers (472)<br />

12%<br />

71%<br />

Crude oil <strong>and</strong><br />

oil products<br />

tankers (759)<br />

Fig. 9a Source: ISL Bremen (2006a).<br />

Fig. 9b Source: ISL Bremen (2006d), VSM Annual Report 2005.<br />

Breakdown of current capacity by size class<br />

Fig. 10<br />

Panamax<br />

H<strong>and</strong>y<br />

Aframax<br />

5.5%<br />

20.4%<br />

19.6%<br />

14.2%<br />

Suezmax<br />

40.3%<br />

VLCC /<br />

ULCC<br />

Source: Clarkson Research<br />

Services (2006)