Maritime Trade and Transport - HWWI

Maritime Trade and Transport - HWWI

Maritime Trade and Transport - HWWI

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

250<br />

200<br />

150<br />

100<br />

50<br />

7.3.2 Investment opportunities<br />

Financial <strong>and</strong> wholesale institutional investors deal increasingly with the infrastructure market.<br />

Pension funds, insurance companies, <strong>and</strong> fund managers are looking for new investment opportunities.<br />

With the growing number of private investors worldwide, new products are being<br />

created that are also suitable for small investors. The range of products will be exp<strong>and</strong>ed to include<br />

bonds, certificates, or other derivatives. Infrastructure funds are likely to profit especially<br />

from the increasing market volume.<br />

7.3.2.1 Equities <strong>and</strong> derivatives<br />

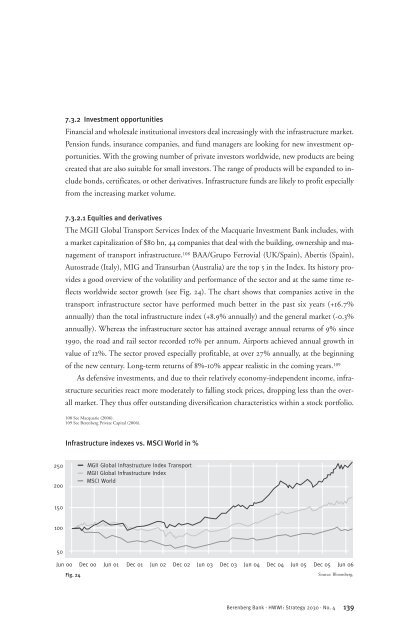

The MGII Global <strong>Transport</strong> Services Index of the Macquarie Investment Bank includes, with<br />

a market capitalization of $80 bn, 44 companies that deal with the building, ownership <strong>and</strong> management<br />

of transport infrastructure. 108 BAA/Grupo Ferrovial (UK/Spain), Abertis (Spain),<br />

Autostrade (Italy), MIG <strong>and</strong> Transurban (Australia) are the top 5 in the Index. Its history provides<br />

a good overview of the volatility <strong>and</strong> performance of the sector <strong>and</strong> at the same time reflects<br />

worldwide sector growth (see Fig. 24). The chart shows that companies active in the<br />

transport infrastructure sector have per formed much better in the past six years (+16.7%<br />

annually) than the total infrastructure index (+8.9% annually) <strong>and</strong> the general market (-0.3%<br />

annually). Whereas the infrastructure sector has attained average annual returns of 9% since<br />

1990, the road <strong>and</strong> rail sector recorded 10% per annum. Airports achieved annual growth in<br />

value of 12%. The sector proved especially profitable, at over 27% annually, at the beginning<br />

of the new century. Long-term returns of 8%-10% appear realistic in the coming years. 109<br />

As defensive investments, <strong>and</strong> due to their relatively economy-independent income, infrastructure<br />

securities react more moderately to falling stock prices, dropping less than the overall<br />

market. They thus offer outst<strong>and</strong>ing diversification characteristics within a stock portfolio.<br />

108 See Macquarie (2006).<br />

109 See Berenberg Private Capital (2006).<br />

Jun 00<br />

Infrastructure indexes vs. MSCI World in %<br />

Fig. 24<br />

MGII Global Infrastructure Index <strong>Transport</strong><br />

MGII Global Infrastructure Index<br />

MSCI World<br />

Dec 00 Jun 01 Dec 01 Jun 02 Dec 02 Jun 03 Dec 03 Jun 04 Dec 04 Jun 05 Dec 05 Jun 06<br />

Berenberg Bank · <strong>HWWI</strong>: Strategy 2030 · No. 4<br />

Source: Bloomberg.<br />

139