Maritime Trade and Transport - HWWI

Maritime Trade and Transport - HWWI

Maritime Trade and Transport - HWWI

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

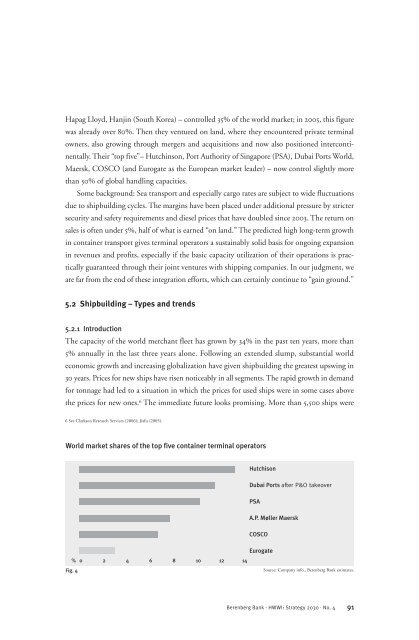

Hapag Lloyd, Hanjin (South Korea) – controlled 35% of the world market; in 2005, this figure<br />

was already over 80%. Then they ventured on l<strong>and</strong>, where they encountered private terminal<br />

owners, also growing through mergers <strong>and</strong> acquisitions <strong>and</strong> now also positioned intercontinentally.<br />

Their “top five”– Hutchinson, Port Authority of Singapore (PSA), Dubai Ports World,<br />

Maersk, COSCO (<strong>and</strong> Eurogate as the European market leader) – now control slightly more<br />

than 50% of global h<strong>and</strong>ling capacities.<br />

Some background: Sea transport <strong>and</strong> especially cargo rates are subject to wide fluctuations<br />

due to shipbuilding cycles. The margins have been placed under additional pressure by stricter<br />

security <strong>and</strong> safety requirements <strong>and</strong> diesel prices that have doubled since 2003. The return on<br />

sales is often under 5%, half of what is earned “on l<strong>and</strong>.” The predicted high long-term growth<br />

in container transport gives terminal operators a sustainably solid basis for ongoing expansion<br />

in revenues <strong>and</strong> profits, especially if the basic capacity utilization of their operations is practically<br />

guaranteed through their joint ventures with shipping companies. In our judgment, we<br />

are far from the end of these integration efforts, which can certainly continue to “gain ground.”<br />

5.2 Shipbuilding – Types <strong>and</strong> trends<br />

5.2.1 Introduction<br />

The capacity of the world merchant fleet has grown by 34% in the past ten years, more than<br />

5% annually in the last three years alone. Following an extended slump, substantial world<br />

economic growth <strong>and</strong> increasing globalization have given shipbuilding the greatest upswing in<br />

30 years. Prices for new ships have risen noticeably in all segments. The rapid growth in dem<strong>and</strong><br />

for tonnage had led to a situation in which the prices for used ships were in some cases above<br />

the prices for new ones. 6 The immediate future looks promising. More than 5,500 ships were<br />

6 See Clarkson Research Services (2006); Jiafu (2005).<br />

World market shares of the top five container terminal operators<br />

Fig. 4<br />

Hutchison<br />

Dubai Ports after P&O takeover<br />

PSA<br />

A.P. Møller Maersk<br />

COSCO<br />

Eurogate<br />

% 0 2 4 6 8 10 12 14<br />

Source: Company info., Berenberg Bank estimates.<br />

Berenberg Bank · <strong>HWWI</strong>: Strategy 2030 · No. 4<br />

91