Maritime Trade and Transport - HWWI

Maritime Trade and Transport - HWWI

Maritime Trade and Transport - HWWI

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

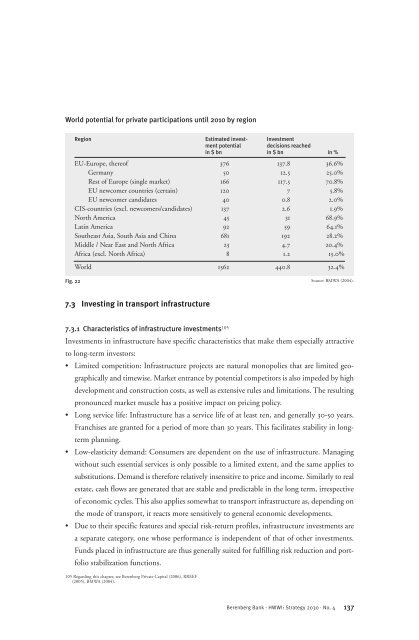

World potential for private participations until 2010 by region<br />

Region Estimated invest- Investment<br />

ment potential decisions reached<br />

in $ bn in $ bn in %<br />

EU-Europe, thereof 376 137.8 36.6%<br />

Germany 50 12.5 25.0%<br />

Rest of Europe (single market) 166 117.5 70.8%<br />

EU newcomer countries (certain) 120 7 5.8%<br />

EU newcomer c<strong>and</strong>idates 40 0.8 2.0%<br />

CIS-countries (excl. newcomers/c<strong>and</strong>idates) 137 2.6 1.9%<br />

North America 45 31 68.9%<br />

Latin America 92 59 64.1%<br />

Southeast Asia, South Asia <strong>and</strong> China 681 192 28.2%<br />

Middle / Near East <strong>and</strong> North Africa 23 4.7 20.4%<br />

Africa (excl. North Africa) 8 1.2 15.0%<br />

World 1362 440.8 32.4%<br />

Fig. 22<br />

7.3 Investing in transport infrastructure<br />

7.3.1 Characteristics of infrastructure investments 105<br />

Investments in infrastructure have specific characteristics that make them especially attractive<br />

to long-term investors:<br />

Limited competition: Infrastructure projects are natural monopolies that are limited geographically<br />

<strong>and</strong> timewise. Market entrance by potential competitors is also impeded by high<br />

development <strong>and</strong> construction costs, as well as extensive rules <strong>and</strong> limitations. The resulting<br />

pronounced market muscle has a positive impact on pricing policy.<br />

Long service life: Infrastructure has a service life of at least ten, <strong>and</strong> generally 30-50 years.<br />

Franchises are granted for a period of more than 30 years. This facilitates stability in longterm<br />

planning.<br />

Low-elasticity dem<strong>and</strong>: Consumers are dependent on the use of infrastructure. Managing<br />

without such essential services is only possible to a limited extent, <strong>and</strong> the same applies to<br />

substitutions. Dem<strong>and</strong> is therefore relatively insensitive to price <strong>and</strong> income. Similarly to real<br />

estate, cash flows are generated that are stable <strong>and</strong> predictable in the long term, irrespective<br />

of economic cycles. This also applies somewhat to transport infrastructure as, depending on<br />

the mode of transport, it reacts more sensitively to general economic developments.<br />

Due to their specific features <strong>and</strong> special risk-return profiles, infrastructure investments are<br />

a separate category, one whose performance is independent of that of other investments.<br />

Funds placed in infrastructure are thus generally suited for fulfilling risk reduction <strong>and</strong> portfolio<br />

stabilization functions.<br />

105 Regarding this chapter, see Berenberg Private Capital (2006), RREEF<br />

(2005), BMWA (2004).<br />

Source: BMWA (2004).<br />

Berenberg Bank · <strong>HWWI</strong>: Strategy 2030 · No. 4<br />

137