Maritime Trade and Transport - HWWI

Maritime Trade and Transport - HWWI

Maritime Trade and Transport - HWWI

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

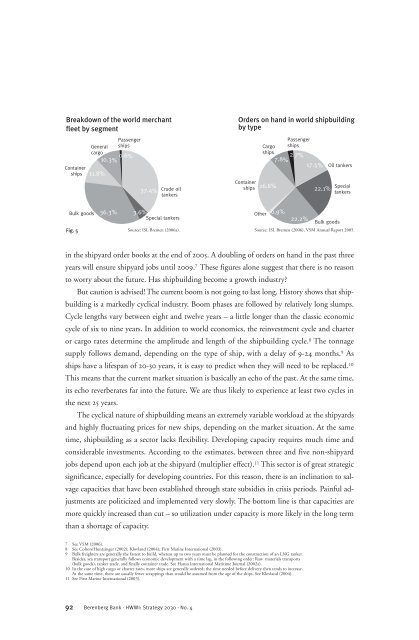

Breakdown of the world merchant<br />

fleet by segment<br />

Container<br />

ships<br />

Bulk goods<br />

Fig. 5<br />

Passenger<br />

General ships<br />

cargo<br />

0.6%<br />

10.3%<br />

11.8%<br />

36.3%<br />

37.4%<br />

Crude oil<br />

tankers<br />

3.6%<br />

Special tankers<br />

Other 0.9%<br />

22.2%<br />

Bulk goods<br />

Source: ISL Bremen (2006a). Source: ISL Bremen (2006), VSM Annual Report 2005.<br />

in the shipyard order books at the end of 2005. A doubling of orders on h<strong>and</strong> in the past three<br />

years will ensure shipyard jobs until 2009. 7 These figures alone suggest that there is no reason<br />

to worry about the future. Has shipbuilding become a growth industry?<br />

But caution is advised! The current boom is not going to last long. History shows that shipbuilding<br />

is a markedly cyclical industry. Boom phases are followed by relatively long slumps.<br />

Cycle lengths vary between eight <strong>and</strong> twelve years – a little longer than the classic economic<br />

cycle of six to nine years. In addition to world economics, the reinvestment cycle <strong>and</strong> charter<br />

or cargo rates determine the amplitude <strong>and</strong> length of the shipbuilding cycle. 8 The tonnage<br />

supply follows dem<strong>and</strong>, depending on the type of ship, with a delay of 9-24 months. 9 As<br />

ships have a lifespan of 20-30 years, it is easy to predict when they will need to be replaced. 10<br />

This means that the current market situation is basically an echo of the past. At the same time,<br />

its echo reverberates far into the future. We are thus likely to experience at least two cycles in<br />

the next 25 years.<br />

The cyclical nature of shipbuilding means an extremely variable workload at the shipyards<br />

<strong>and</strong> highly fluctuating prices for new ships, depending on the market situation. At the same<br />

time, shipbuilding as a sector lacks flexibility. Developing capacity requires much time <strong>and</strong><br />

considerable investments. According to the estimates, between three <strong>and</strong> five non-shipyard<br />

jobs depend upon each job at the shipyard (multiplier effect). 11 This sector is of great strategic<br />

significance, especially for developing countries. For this reason, there is an inclination to salvage<br />

capacities that have been established through state subsidies in crisis periods. Painful adjustments<br />

are politicized <strong>and</strong> implemented very slowly. The bottom line is that capacities are<br />

more quickly increased than cut – so utilization under capacity is more likely in the long term<br />

than a shortage of capacity.<br />

7 See VSM (2006).<br />

8 See Colton/Huntzinger (2002); Klovl<strong>and</strong> (2004); First Marine International (2003).<br />

9 Bulk freighters are generally the fastest to build, whereas up to two years must be planned for the construction of an LNG tanker.<br />

Besides, sea transport generally follows economic development with a time lag, in the following order: Raw materials transports<br />

(bulk goods), tanker trade, <strong>and</strong> finally container trade. See Hansa International <strong>Maritime</strong> Journal (2002a).<br />

10 In the case of high cargo or charter rates, more ships are generally ordered; the time needed before delivery then tends to increase.<br />

At the same time, there are usually fewer scrappings than would be assumed from the age of the ships. See Klovl<strong>and</strong> (2004).<br />

11 See First Marine International (2003).<br />

92 Berenberg Bank · <strong>HWWI</strong>: Strategy 2030 · No. 4<br />

Orders on h<strong>and</strong> in world shipbuilding<br />

by type<br />

Container<br />

ships<br />

Passenger<br />

Cargo ships<br />

ships 2.7%<br />

7.8%<br />

17.5%<br />

26.8%<br />

22.1%<br />

Oil tankers<br />

Special<br />

tankers