- Page 1 and 2:

Blue Cross and Blue Shield of Minne

- Page 3 and 4:

Recent Chapter changes: Chapter 11

- Page 5 and 6:

Chapter 11 - Coding Policies and Gu

- Page 7 and 8:

Durable Medical Equipment Date Topi

- Page 9 and 10:

Medical Emergency Date Topic Change

- Page 11 and 12:

Rehabilitative Services Date Topic

- Page 13 and 14:

Table of Contents Chapter 1 At Your

- Page 15 and 16:

Introduction Provider Policy and Pr

- Page 17 and 18:

How to Contact Us At Your Service P

- Page 19 and 20:

At Your Service Claims Address Subm

- Page 21 and 22:

Care Management Numbers and Address

- Page 23 and 24:

Care Management Numbers and Address

- Page 25 and 26:

Company Phone Number Address Public

- Page 27 and 28:

At Your Service Provider Identifica

- Page 29 and 30:

ID Cards At Your Service Introducti

- Page 31 and 32:

Electronic Commerce Overview An imp

- Page 33 and 34:

Remote Access Services (continued)

- Page 35 and 36:

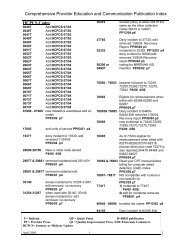

Provider Communications Provider Co

- Page 37 and 38:

Health Plan Members have the Follow

- Page 39 and 40:

Provider Agreements Participation a

- Page 41 and 42:

Provider Agreements Responsibilitie

- Page 43 and 44:

Provider Agreements Provider Number

- Page 45 and 46:

Provider Agreements Accounting for

- Page 47 and 48:

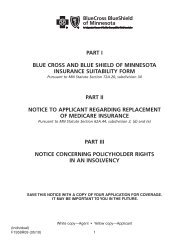

Provider Agreements Carrier Replace

- Page 49 and 50:

Table of Contents Chapter 3 Quality

- Page 51 and 52:

Quality Improvement Leadership Rati

- Page 53 and 54:

Quality Improvement Telephone Care:

- Page 55 and 56:

Quality Improvement Quality of Care

- Page 57 and 58:

Quality Improvement Written Policie

- Page 59 and 60:

Quality Improvement Written Policie

- Page 61 and 62:

Quality Improvement Patient Safety

- Page 63 and 64:

Quality Improvement Medical Record

- Page 65 and 66:

Quality Improvement Institute for C

- Page 67 and 68:

Quality Improvement Quality Improve

- Page 69 and 70:

Quality Improvement Physical Facili

- Page 71 and 72:

Quality Improvement Treatment Recor

- Page 73 and 74:

Quality Improvement Treatment Recor

- Page 75 and 76:

Quality Improvement Treatment Recor

- Page 77 and 78:

Integrated Health Management Progra

- Page 79 and 80:

Integrated Health Management Provid

- Page 81 and 82:

Integrated Health Management Utiliz

- Page 83 and 84:

Integrated Health Management Medica

- Page 85 and 86:

Integrated Health Management Medica

- Page 87 and 88:

Integrated Health Management Overvi

- Page 89 and 90:

Integrated Health Management Pre-Ce

- Page 91 and 92:

Integrated Health Management Decisi

- Page 93 and 94:

Integrated Health Management Defini

- Page 95 and 96:

Integrated Health Management For Lo

- Page 97 and 98:

Integrated Health Management Appeal

- Page 99 and 100:

Integrated Health Management Case &

- Page 101 and 102:

Integrated Health Management Diseas

- Page 103 and 104:

Integrated Health Management Focuse

- Page 105 and 106:

Integrated Health Management Specia

- Page 107 and 108:

Integrated Health Management Overvi

- Page 109 and 110:

Integrated Health Management Medica

- Page 111 and 112:

Integrated Health Management Sample

- Page 113 and 114:

Health Care Options Prepaid Medical

- Page 115 and 116:

Health Care Options Member ID Cards

- Page 117 and 118:

Health Care Options Blue Cross and

- Page 119 and 120:

Health Care Options Double Gold Dou

- Page 121 and 122:

Health Care Options Medicare Basic

- Page 123 and 124:

Health Care Options Platinum Blue S

- Page 125 and 126:

Health Care Options MedicareBlue PP

- Page 127 and 128:

Health Care Options Inquiries and C

- Page 129 and 130:

Health Care Options Additional info

- Page 131 and 132:

Health Care Options Minnesota Senio

- Page 133 and 134:

Health Care Options MinnesotaCare P

- Page 135 and 136:

Health Care Options BlueLinkTPA Blu

- Page 137 and 138:

Health Care Options Delta Dental Hi

- Page 139 and 140:

Health Care Options Prime Therapeut

- Page 141 and 142:

Health Care Options Workers' Compen

- Page 143 and 144:

Health Care Options HICF 1500 Form

- Page 145 and 146:

Health Care Options Networks Blue C

- Page 147 and 148:

Blue Plus Member Information Introd

- Page 149 and 150:

Blue Plus Member Rights and Respons

- Page 151 and 152:

Blue Plus Member Rights and Respons

- Page 153 and 154:

Blue Plus Member Benefits Members

- Page 155 and 156:

Blue Plus Quality of Care Complaint

- Page 157 and 158: Blue Plus Referral Points Remember

- Page 159 and 160: Blue Plus Referral Not Required We

- Page 161 and 162: Blue Plus Standing Referral Minneso

- Page 163 and 164: Blue Plus Clarifications of Terms (

- Page 165 and 166: Blue Plus [Date] [Name of patient]

- Page 167 and 168: Blue Plus Special Member Benefits O

- Page 169 and 170: Blue Plus OB/GYN Open Access Diagno

- Page 171 and 172: Blue Plus OB/GYN Open Access Diagno

- Page 173 and 174: BlueCard® Claim Status Inquiry ...

- Page 175 and 176: BlueCard® Identifying BlueCard ®

- Page 177 and 178: BlueCard® Identifying BlueCard ®

- Page 179 and 180: BlueCard® BlueCard Service Claims

- Page 181 and 182: BlueCard® Prior Authorization and

- Page 183 and 184: BlueCard® Electronic Data Intercha

- Page 185 and 186: BlueCard® Claims Processed by the

- Page 187 and 188: BlueCard® Overview (continued) 3.

- Page 189 and 190: BlueCard® Claim Payment Guidelines

- Page 191 and 192: BlueCard® Calls from Members and O

- Page 193 and 194: BlueCard® Guidelines (continued) W

- Page 195 and 196: BlueCard® Types of Medicare Advant

- Page 197 and 198: BlueCard® Medicare Advantage Claim

- Page 199 and 200: BlueCard® Reimbursement for Medica

- Page 201 and 202: Claims Filing HCPCS/ Accommodation

- Page 203 and 204: Claims Filing Administrative Simpli

- Page 205 and 206: Claims Filing Claims with Attachmen

- Page 207: Claims Filing Claims with Coordinat

- Page 211 and 212: Claims Filing 1500 HICF Form Profes

- Page 213 and 214: Claims Filing Ordering Forms and Ma

- Page 215 and 216: Claims Filing Site of Service (cont

- Page 217 and 218: Claims Filing Institution (837I) /F

- Page 219 and 220: Claims Filing Treatment Room Blue C

- Page 221 and 222: Claims Filing Single facility claim

- Page 223 and 224: Claims Filing Present on Admission

- Page 225 and 226: Claims Filing Medicare Crossover Bl

- Page 227 and 228: Claims Filing Cancel/Void and Repla

- Page 229 and 230: Claims Filing Cancel/Void and Repla

- Page 231 and 232: Claims Filing Cancel/Void and Repla

- Page 233 and 234: Claims Filing Verifying Patient Eli

- Page 235 and 236: Claims Filing Basic Character Set V

- Page 237 and 238: Claims Filing Rural Health Clinics

- Page 239 and 240: Claims Filing Coordination of Benef

- Page 241 and 242: Claims Filing TEFRA The 1982 Tax Eq

- Page 243 and 244: Claims Filing Employment As defined

- Page 245 and 246: Claims Filing Surgical Technicians

- Page 247 and 248: Reimbursement / Reconciliation Reim

- Page 249 and 250: Reimbursement / Reconciliation Comp

- Page 251 and 252: Reimbursement / Reconciliation Remi

- Page 253 and 254: Reimbursement / Reconciliation Ques

- Page 255 and 256: Reimbursement / Reconciliation Ques

- Page 257 and 258: Reimbursement / Reconciliation Acco

- Page 259 and 260:

Reimbursement / Reconciliation Fiel

- Page 261 and 262:

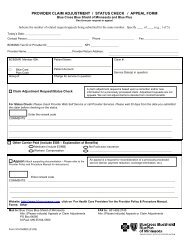

Appeals Provider Appeals Introducti

- Page 263 and 264:

Appeals Submitting Requests for Pos

- Page 265 and 266:

Appeals Coding Appeals (continued)

- Page 267 and 268:

Appeals Supporting Documentation (c

- Page 269 and 270:

Coding Policies and Guidelines (Cod

- Page 271 and 272:

Coding Policies and Guidelines (Cod

- Page 273 and 274:

Coding Policies and Guidelines (Cod

- Page 275 and 276:

Coding Policies and Guidelines (Cod

- Page 277 and 278:

Coding Policies and Guidelines (Cod

- Page 279 and 280:

Coding Policies and Guidelines (Cod

- Page 281 and 282:

Coding Policies and Guidelines (Cod

- Page 283 and 284:

Coding Policies and Guidelines (Cod

- Page 285 and 286:

Coding Policies and Guidelines (Cod

- Page 287 and 288:

Coding Policies and Guidelines (Cod

- Page 289 and 290:

Coding Policies and Guidelines (Cod

- Page 291 and 292:

Coding Policies and Guidelines (Cod

- Page 293 and 294:

Coding Policies and Guidelines (Cod

- Page 295 and 296:

Coding Policies and Guidelines (Cod

- Page 297 and 298:

Coding Policies and Guidelines (Cod

- Page 299 and 300:

Coding Policies and Guidelines (Cod

- Page 301 and 302:

Coding Policies and Guidelines (Cop

- Page 303 and 304:

Coding Policies and Guidelines (Mod

- Page 305 and 306:

Coding Policies and Guidelines (Mod

- Page 307 and 308:

Coding Policies and Guidelines (Mod

- Page 309 and 310:

Coding Policies and Guidelines (Mod

- Page 311 and 312:

Coding Policies and Guidelines (Mod

- Page 313 and 314:

Coding Policies and Guidelines (Mod

- Page 315 and 316:

Coding Policies and Guidelines (Mod

- Page 317 and 318:

Coding Policies and Guidelines (Mod

- Page 319 and 320:

Coding Policies and Guidelines (Mod

- Page 321 and 322:

Coding Policies and Guidelines (Mod

- Page 323 and 324:

Coding Policies and Guidelines (Mod

- Page 325 and 326:

Chapter 11 Coding Policies and Guid

- Page 327 and 328:

Part-time (Medically Directed) Anes

- Page 329 and 330:

Electroconvulsive Treatments Blue C

- Page 331 and 332:

Moderate (Conscious) Sedation Monit

- Page 333 and 334:

Chapter 11 Coding Policies and Guid

- Page 335 and 336:

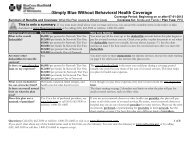

Coding Policies and Guidelines (Beh

- Page 337 and 338:

Coding Restrictions Code Restrictio

- Page 339 and 340:

CTSS Skills Training and Developmen

- Page 341 and 342:

Intensive Residential Treatment Ser

- Page 343 and 344:

IRTS Member Eligibility IRTS Access

- Page 345 and 346:

Adult Non-Residential Crisis Servic

- Page 347 and 348:

MH-TCM Services to Minnesota Health

- Page 349 and 350:

Dialectical Behavioral Therapy/DBT

- Page 351 and 352:

Autism Spectrum Disorder/EIBI (cont

- Page 353 and 354:

Autism Spectrum Disorder/EIBI (cont

- Page 355 and 356:

Psychiatric Consultation to Primary

- Page 357 and 358:

Psychiatry and Chemical Dependency

- Page 359 and 360:

Medication Management M0064 and 908

- Page 361 and 362:

Nutritional Counseling/Medical Nutr

- Page 363 and 364:

Coding Policies and Guidelines (Beh

- Page 365 and 366:

Coding Policies and Guidelines (Beh

- Page 367 and 368:

Coding Policies and Guidelines (Beh

- Page 369 and 370:

Practitioner Key MD = Psychiatrist

- Page 371 and 372:

Clinical Supervision Under Minnesot

- Page 373 and 374:

DIAMOND Initiative (continued) Reim

- Page 375 and 376:

Coding Policies and Guidelines (Beh

- Page 377 and 378:

Missed Appointments (continued) Cou

- Page 379 and 380:

Guidelines for Court Ordered Evalua

- Page 381 and 382:

Guidelines for Court Ordered Evalua

- Page 383 and 384:

Coding Policies and Guidelines (Beh

- Page 385 and 386:

Behavioral Health Quality Improveme

- Page 387 and 388:

Pre-certification and Concurrent Re

- Page 389:

Coding Policies and Guidelines (Beh

- Page 392 and 393:

Coding Policies and Guidelines (Beh

- Page 394 and 395:

Coding Policies and Guidelines (Beh

- Page 396 and 397:

Coding Policies and Guidelines (Beh

- Page 398 and 399:

Coding Policies and Guidelines (Beh

- Page 400 and 401:

Coding Policies and Guidelines (Beh

- Page 402 and 403:

Coding Policies and Guidelines (Beh

- Page 404 and 405:

Coding Policies and Guidelines (Beh

- Page 406 and 407:

Coding Policies and Guidelines (Beh

- Page 408 and 409:

Coding Policies and Guidelines (Beh

- Page 410 and 411:

Coding Policies and Guidelines (Beh

- Page 412 and 413:

Coding Policies and Guidelines (Beh

- Page 414 and 415:

Coding Policies and Guidelines (Beh

- Page 416 and 417:

Coding Policies and Guidelines (Beh

- Page 418 and 419:

Coding Policies and Guidelines (Beh

- Page 420 and 421:

Coding Policies and Guidelines (Beh

- Page 422 and 423:

Coding Policies and Guidelines (Beh

- Page 424 and 425:

Coding Policies and Guidelines (Beh

- Page 426 and 427:

Coding Policies and Guidelines (Beh

- Page 428 and 429:

Coding Policies and Guidelines (Beh

- Page 430 and 431:

Coding Policies and Guidelines (Beh

- Page 432 and 433:

Coding Policies and Guidelines (Beh

- Page 434 and 435:

Coding Policies and Guidelines (Beh

- Page 436 and 437:

Coding Policies and Guidelines (Beh

- Page 438 and 439:

Coding Policies and Guidelines (Beh

- Page 440 and 441:

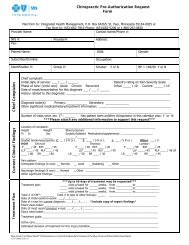

Coding Policies and Guidelines (Chi

- Page 442 and 443:

Coding Policies and Guidelines (Chi

- Page 444 and 445:

Coding Policies and Guidelines (Chi

- Page 446 and 447:

Coding Policies and Guidelines (Chi

- Page 448 and 449:

Coding Policies and Guidelines (Chi

- Page 450 and 451:

Coding Policies and Guidelines (Chi

- Page 452 and 453:

Coding Policies and Guidelines (Den

- Page 454 and 455:

Coding Policies and Guidelines (Den

- Page 456 and 457:

Chapter 11 Coding Policies and Guid

- Page 458 and 459:

Prior Authorization Requirements Co

- Page 460 and 461:

Coding Policies and Guidelines (Dur

- Page 462 and 463:

Waivers and Upgraded/Deluxe DME Wai

- Page 464 and 465:

Coding Policies and Guidelines (Dur

- Page 466 and 467:

Hearing Aids (continued) Website Co

- Page 468 and 469:

Portable Oxygen Billing (continued)

- Page 470 and 471:

Coding Policies and Guidelines (Dur

- Page 472 and 473:

DME/Supply Internet Purchases Codin

- Page 474 and 475:

Chapter 11 Coding Policies and Guid

- Page 476 and 477:

Coding Policies and Guidelines (Hom

- Page 478 and 479:

Elderly Waiver Program (continued)

- Page 480 and 481:

Referrals and Prior Authorization (

- Page 482 and 483:

Referrals and Prior Authorization (

- Page 484 and 485:

Adult Day Care Bath Services Coding

- Page 486 and 487:

Home Infusion (continued) Coding Po

- Page 488 and 489:

Coding Policies and Guidelines (Hom

- Page 490 and 491:

Rules and Regulations (continued) H

- Page 492 and 493:

Hospice Billing for Medicare Produc

- Page 494 and 495:

Coding Policies and Guidelines (Hos

- Page 496 and 497:

Coding Policies and Guidelines (Hos

- Page 498 and 499:

Coding Policies and Guidelines (Hos

- Page 500 and 501:

Coding Policies and Guidelines (Hos

- Page 502 and 503:

Chapter 11 Coding Policies and Guid

- Page 504 and 505:

Coding Policies and Guidelines (Lab

- Page 506 and 507:

Papanicolaou Smears (continued) Dia

- Page 508 and 509:

Blue Cross and Blue Shield of Minne

- Page 510 and 511:

Coding Policies and Guidelines (Mat

- Page 512 and 513:

Coding Policies and Guidelines (Mat

- Page 514 and 515:

Coding Policies and Guidelines (Mat

- Page 516 and 517:

Coding Policies and Guidelines (Mat

- Page 518 and 519:

Coding Policies and Guidelines (Mat

- Page 520 and 521:

Coding Policies and Guidelines (Med

- Page 522 and 523:

Coding Policies and Guidelines (Med

- Page 524 and 525:

Coding Policies and Guidelines (Med

- Page 526 and 527:

Coding Policies and Guidelines (Med

- Page 528 and 529:

Coding Policies and Guidelines (Med

- Page 530 and 531:

Coding Policies and Guidelines (Med

- Page 532 and 533:

Coding Policies and Guidelines (Med

- Page 534 and 535:

Coding Policies and Guidelines (Med

- Page 536 and 537:

Coding Policies and Guidelines (Med

- Page 538 and 539:

Coding Policies and Guidelines (Med

- Page 540 and 541:

Coding Policies and Guidelines (Med

- Page 542 and 543:

Coding Policies and Guidelines (Med

- Page 544 and 545:

Coding Policies and Guidelines (Med

- Page 546 and 547:

Coding Policies and Guidelines (Med

- Page 548 and 549:

Coding Policies and Guidelines (Med

- Page 550 and 551:

Coding Policies and Guidelines (Med

- Page 552 and 553:

Coding Policies and Guidelines (Med

- Page 554 and 555:

Coding Policies and Guidelines (Med

- Page 556 and 557:

Coding Policies and Guidelines (Med

- Page 558 and 559:

Coding Policies and Guidelines (Med

- Page 560 and 561:

Coding Policies and Guidelines (Med

- Page 562 and 563:

Coding Policies and Guidelines (Med

- Page 564 and 565:

Coding Policies and Guidelines (Med

- Page 566 and 567:

Coding Policies and Guidelines (Med

- Page 568 and 569:

Coding Policies and Guidelines (Med

- Page 570 and 571:

Coding Policies and Guidelines (Med

- Page 572 and 573:

Coding Policies and Guidelines (Med

- Page 574 and 575:

Coding Policies and Guidelines (Med

- Page 576 and 577:

Coding Policies and Guidelines (Med

- Page 578 and 579:

Coding Policies and Guidelines (Med

- Page 580 and 581:

Coding Policies and Guidelines (Opt

- Page 582 and 583:

Chapter 11 Coding Policies and Guid

- Page 584 and 585:

Coding Policies and Guidelines (Pha

- Page 586 and 587:

Drugs Coding Policies and Guideline

- Page 588 and 589:

Coding Policies and Guidelines (Pha

- Page 590 and 591:

Drug Programs Coding Policies and G

- Page 592 and 593:

Coding Policies and Guidelines (Pha

- Page 594 and 595:

Coding Policies and Guidelines (Pub

- Page 596 and 597:

Coding Policies and Guidelines (Pub

- Page 598 and 599:

Coding Policies and Guidelines (Pub

- Page 600 and 601:

Coding Policies and Guidelines (Pub

- Page 602 and 603:

Coding Policies and Guidelines (Pub

- Page 604 and 605:

Coding Policies and Guidelines (Pub

- Page 606 and 607:

Coding Policies and Guidelines (Pub

- Page 608 and 609:

Coding Policies and Guidelines (Pub

- Page 610 and 611:

Coding Policies and Guidelines (Pub

- Page 612 and 613:

Coding Policies and Guidelines (Pub

- Page 614 and 615:

Coding Policies and Guidelines (Pub

- Page 616 and 617:

Coding Policies and Guidelines (Pub

- Page 618 and 619:

Coding Policies and Guidelines (Pub

- Page 620 and 621:

Coding Policies and Guidelines (Pub

- Page 622 and 623:

Coding Policies and Guidelines (Pub

- Page 624 and 625:

Coding Policies and Guidelines (Rad

- Page 626 and 627:

Coding Policies and Guidelines (Rad

- Page 628 and 629:

Coding Policies and Guidelines (Rad

- Page 630 and 631:

Chapter 11 Coding Policies and Guid

- Page 632 and 633:

Physical Therapy Evaluation Codes C

- Page 634 and 635:

Hot and Cold Pack Exclusion TMJ Ort

- Page 636 and 637:

Massage and Manual Therapy Exclusio

- Page 638 and 639:

MHCP PT, OT, ST Authorization Proce

- Page 640 and 641:

Chapter 11 Coding Policies and Guid

- Page 642 and 643:

Bilateral Services (continued) Codi

- Page 644 and 645:

Coding Policies and Guidelines (Sur

- Page 646 and 647:

Acne Treatment/ Skin Rejuvenation a

- Page 648 and 649:

Liposuction Edit Change Coding Poli

- Page 650 and 651:

Assistant Surgeons (continued) Assi

- Page 652:

Coding Policies and Guidelines (Sur