Annual Energy Outlook 2006 with Projections to 2030 - Usinfo.org

Annual Energy Outlook 2006 with Projections to 2030 - Usinfo.org

Annual Energy Outlook 2006 with Projections to 2030 - Usinfo.org

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

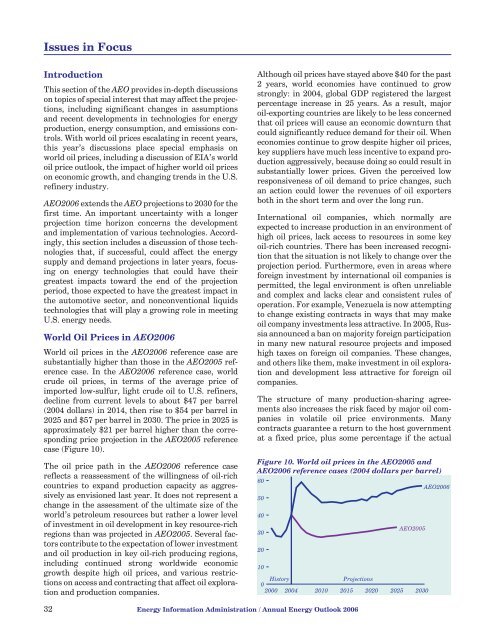

Issues in FocusIntroductionThis section of the AEO provides in-depth discussionson <strong>to</strong>pics of special interest that may affect the projections,including significant changes in assumptionsand recent developments in technologies for energyproduction, energy consumption, and emissions controls.With world oil prices escalating in recent years,this year’s discussions place special emphasis onworld oil prices, including a discussion of EIA’s worldoil price outlook, the impact of higher world oil priceson economic growth, and changing trends in the U.S.refinery industry.AEO<strong>2006</strong> extends the AEO projections <strong>to</strong> <strong>2030</strong> for thefirst time. An important uncertainty <strong>with</strong> a longerprojection time horizon concerns the developmentand implementation of various technologies. Accordingly,this section includes a discussion of those technologiesthat, if successful, could affect the energysupply and demand projections in later years, focusingon energy technologies that could have theirgreatest impacts <strong>to</strong>ward the end of the projectionperiod, those expected <strong>to</strong> have the greatest impact inthe au<strong>to</strong>motive sec<strong>to</strong>r, and nonconventional liquidstechnologies that will play a growing role in meetingU.S. energy needs.World Oil Prices in AEO<strong>2006</strong>World oil prices in the AEO<strong>2006</strong> reference case aresubstantially higher than those in the AEO2005 referencecase. In the AEO<strong>2006</strong> reference case, worldcrude oil prices, in terms of the average price ofimported low-sulfur, light crude oil <strong>to</strong> U.S. refiners,decline from current levels <strong>to</strong> about $47 per barrel(2004 dollars) in 2014, then rise <strong>to</strong> $54 per barrel in2025 and $57 per barrel in <strong>2030</strong>. The price in 2025 isapproximately $21 per barrel higher than the correspondingprice projection in the AEO2005 referencecase (Figure 10).The oil price path in the AEO<strong>2006</strong> reference casereflects a reassessment of the willingness of oil-richcountries <strong>to</strong> expand production capacity as aggressivelyas envisioned last year. It does not represent achange in the assessment of the ultimate size of theworld’s petroleum resources but rather a lower levelof investment in oil development in key resource-richregions than was projected in AEO2005. Several fac<strong>to</strong>rscontribute <strong>to</strong> the expectation of lower investmentand oil production in key oil-rich producing regions,including continued strong worldwide economicgrowth despite high oil prices, and various restrictionson access and contracting that affect oil explorationand production companies.Although oil prices have stayed above $40 for the past2 years, world economies have continued <strong>to</strong> growstrongly: in 2004, global GDP registered the largestpercentage increase in 25 years. As a result, majoroil-exporting countries are likely <strong>to</strong> be less concernedthat oil prices will cause an economic downturn thatcould significantly reduce demand for their oil. Wheneconomies continue <strong>to</strong> grow despite higher oil prices,key suppliers have much less incentive <strong>to</strong> expand productionaggressively, because doing so could result insubstantially lower prices. Given the perceived lowresponsiveness of oil demand <strong>to</strong> price changes, suchan action could lower the revenues of oil exportersboth in the short term and over the long run.International oil companies, which normally areexpected <strong>to</strong> increase production in an environment ofhigh oil prices, lack access <strong>to</strong> resources in some keyoil-rich countries. There has been increased recognitionthat the situation is not likely <strong>to</strong> change over theprojection period. Furthermore, even in areas whereforeign investment by international oil companies ispermitted, the legal environment is often unreliableand complex and lacks clear and consistent rules ofoperation. For example, Venezuela is now attempting<strong>to</strong> change existing contracts in ways that may makeoil company investments less attractive. In 2005, Russiaannounced a ban on majority foreign participationin many new natural resource projects and imposedhigh taxes on foreign oil companies. These changes,and others like them, make investment in oil explorationand development less attractive for foreign oilcompanies.The structure of many production-sharing agreementsalso increases the risk faced by major oil companiesin volatile oil price environments. Manycontracts guarantee a return <strong>to</strong> the host governmentat a fixed price, plus some percentage if the actualFigure 10. World oil prices in the AEO2005 andAEO<strong>2006</strong> reference cases (2004 dollars per barrel)605040302010AEO2005His<strong>to</strong>ry<strong>Projections</strong>02000 2004 2010 2015 2020 2025 <strong>2030</strong>AEO<strong>2006</strong>32 <strong>Energy</strong> Information Administration / <strong>Annual</strong> <strong>Energy</strong> <strong>Outlook</strong> <strong>2006</strong>