Modul de formare-Managementul resurselor financiare - uefiscdi

Modul de formare-Managementul resurselor financiare - uefiscdi

Modul de formare-Managementul resurselor financiare - uefiscdi

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

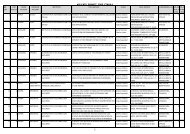

Class 4 - Third party accounts (suppliers and similar accounts; customers and similar<br />

accounts; Payroll and similar accounts; social security and similar accounts; amounts<br />

payable to the state budget, special funds and similar accounts; European Community nonreimbursable<br />

funds settlement account; sundry <strong>de</strong>btors and creditors; budgets’ <strong>de</strong>btors and<br />

creditors; accruals and similar accounts; settlements; Provisions for doubtful <strong>de</strong>bts);<br />

Class 5 - The State Treasury and commercial bank accounts (short-term financial<br />

investments; State Treasury and banks accounts; petty cash and other cash equivalents;<br />

letters of credit; special purpose fund;; available amount from special revenue funds;<br />

internal transfers; write-down of treasury accounts);<br />

Class 6 – Expense accounts ( Expenses related to inventories, Third party services, Other<br />

third party services, Other taxes, duties and similar expenses, Personnel expenses, other<br />

operating expenses, financial expenses; other expenses financed from the state budget,<br />

Depreciation and provisions, extraordinary expenses);<br />

Class 7 - Financing and Revenue accounts (revenues from operating activities, Other<br />

operating revenues, Proceeds from disposal of assets and capital transactions, revenues from<br />

fixed assets production, revenues from taxes, income from security contributions, non-fiscal<br />

revenues, financial revenues, grants, subsidies, transfers, budget allocations with special<br />

purpose, special purpose funds, revenue from reserves and write back of provisions,<br />

extraordinary revenues);<br />

Class 8 - Special accounts (fixed assets and stock of working inventory in use; operational<br />

leased tangible assets, assets held for processing or repair, Assets held in custody,<br />

Receivables written off but still followed up, royalties, rents and similar <strong>de</strong>bts , publications<br />

received free of charge in an international exchange, subscriptions to publications, stamps<br />

with values with later settlement, properties mortgage, assets in execution, bank guarantee<br />

for the submitted offer, bank guarantee of performance, collateral <strong>de</strong>posit, interest payable,<br />

interest receivable, legal guaranties, tax receivables, approved state budget appropriation,<br />

open credit lines to be distributed, funds received from the state budget, funds from the<br />

European Community, budget commitments, legal commitments; payment commitments) -<br />

can <strong>de</strong>velop at the public institutions proposal with the approval of the chief authorizing<br />

officer and the Ministry of Public Finance;<br />

Class 9 - Off balance sheet transactions (use of these accounts is optional).<br />

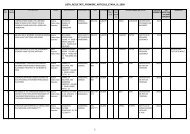

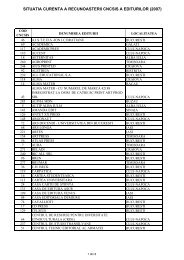

Using accounting data for the management process requires their regular centralization and<br />

summarization. This requirement shall respond to the summary records and/or financial<br />

statements.Through these record or financial statements, the data is recor<strong>de</strong>d by a system of<br />

accounts that are consolidated and presented as a whole, un<strong>de</strong>r the form of economic financial<br />

indicators. At the public institutions level (<strong>de</strong>fault for universities for the activity specific<br />

documents) the summary records inclu<strong>de</strong>: Balance Sheet ; The Patrimonial Result Account,<br />

The Cash Flow Statement, Public institutions’ budget execution account - Expenses; Public<br />

institutions’ budget execution account of own revenues and subsidies - Revenues, Public<br />

institutions’ budget execution account of own revenues (un<strong>de</strong>r local authority) Public<br />

institutions’ budget execution account of own revenues and subsidies (un<strong>de</strong>r local authority) -<br />

Expenses, Local budget execution account - Revenues, the Local budget execution account -<br />

Expenses, Liquidities from special purposes resources, The budget execution account of the<br />

external appropriations, The budget execution account of the internal appropriations, The<br />

budget execution account of the external non-refundable funds - Revenues; The budget<br />

execution account of the external non-refundable funds - Expenses, The budget execution<br />

account of revenue and expenses of local budget extra-budgetary revenues and expenses-<br />

Revenues, The budget execution account of local budget extra-bugetary revenues and expenses<br />

48