7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

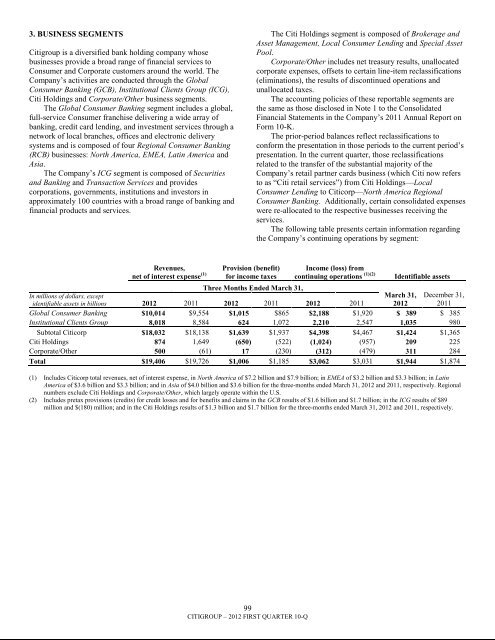

3. BUSINESS SEGMENTS<strong>Citigroup</strong> is a diversified bank holding company whosebusinesses provide a broad range of financial services toConsumer and Corporate customers around the world. TheCompany‘s activities are conducted through the GlobalConsumer Banking (GCB), Institutional Clients Group (ICG),Citi Holdings and Corporate/Other business segments.The Global Consumer Banking segment includes a global,full-service Consumer franchise delivering a wide array ofbanking, credit card lending, and investment services through anetwork of local branches, offices and electronic deliverysystems and is composed of four Regional Consumer Banking(RCB) businesses: North America, EMEA, Latin America andAsia.The Company‘s ICG segment is composed of Securitiesand Banking and Transaction Services and providescorporations, governments, institutions and investors inapproximately 100 countries with a broad range of banking andfinancial products and services.The Citi Holdings segment is composed of Brokerage andAsset Management, Local Consumer Lending and Special AssetPool.Corporate/Other includes net treasury results, unallocatedcorporate expenses, offsets to certain line-item reclassifications(eliminations), the results of discontinued operations andunallocated taxes.The accounting policies of these reportable segments arethe same as those disclosed in Note 1 to the ConsolidatedFinancial Statements in the Company‘s 2011 Annual Report onForm 10-K.The prior-period balances reflect reclassifications toconform the presentation in those periods to the current period‘spresentation. In the current quarter, those reclassificationsrelated to the transfer of the substantial majority of theCompany‘s retail partner cards business (which Citi now refersto as ―Citi retail services‖) from Citi Holdings—LocalConsumer Lending to Citicorp—North America RegionalConsumer Banking. Additionally, certain consolidated expenseswere re-allocated to the respective businesses receiving theservices.The following table presents certain information regardingthe Company‘s continuing operations by segment:Revenues,net of interest expense (1)Provision (benefit)for income taxesIncome (loss) fromcontinuing operations (1)(2)Identifiable assetsThree Months Ended March 31,In millions of dollars, exceptidentifiable assets in <strong>billion</strong>s 2012 2011 2012 2011 2012 2011March 31,2012December 31,2011Global Consumer Banking $10,014 $9,554 $1,015 $865 $2,188 $1,920 $ 389 $ 385Institutional Clients Group 8,018 8,584 624 1,072 2,210 2,547 1,035 980Subtotal Citicorp $18,032 $18,138 $1,639 $1,937 $4,398 $4,467 $1,424 $1,365Citi Holdings 874 1,649 (650) (522) (1,024) (957) 209 225Corporate/Other 500 (61) 17 (230) (312) (479) 311 284Total $19,406 $19,726 $1,006 $1,185 $3,062 $3,031 $1,944 $1,874(1) Includes Citicorp total revenues, net of interest expense, in North America of $7.2 <strong>billion</strong> and $7.9 <strong>billion</strong>; in EMEA of $3.2 <strong>billion</strong> and $3.3 <strong>billion</strong>; in LatinAmerica of $3.6 <strong>billion</strong> and $3.3 <strong>billion</strong>; and in Asia of $4.0 <strong>billion</strong> and $3.6 <strong>billion</strong> for the three-months ended March 31, 2012 and 2011, respectively. Regionalnumbers exclude Citi Holdings and Corporate/Other, which largely operate within the U.S.(2) Includes pretax provisions (credits) for credit losses and for benefits and claims in the GCB results of $1.6 <strong>billion</strong> and $1.7 <strong>billion</strong>; in the ICG results of $89million and $(180) million; and in the Citi Holdings results of $1.3 <strong>billion</strong> and $1.7 <strong>billion</strong> for the three-months ended March 31, 2012 and 2011, respectively.99CITIGROUP – 2012 FIRST QUARTER 10-Q