7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

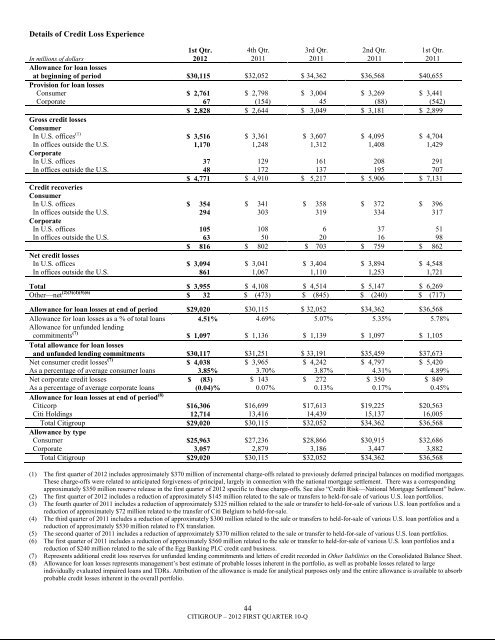

Details of Credit Loss Experience1st Qtr.20124th Qtr.20113rd Qtr.20112nd Qtr.20111st Qtr.2011In millions of dollarsAllowance for loan lossesat beginning of period $30,115 $32,052 $ 34,362 $36,568 $40,655Provision for loan lossesConsumer $ 2,761 $ 2,798 $ 3,004 $ 3,269 $ 3,441Corporate 67 (154) 45 (88) (542)$ 2,828 $ 2,644 $ 3,049 $ 3,181 $ 2,899Gross credit lossesConsumerIn U.S. offices (1) $ 3,516 $ 3,361 $ 3,607 $ 4,095 $ 4,704In offices outside the U.S. 1,170 1,248 1,312 1,408 1,429CorporateIn U.S. offices 37 129 161 208 291In offices outside the U.S. 48 172 137 195 707$ 4,771 $ 4,910 $ 5,217 $ 5,906 $ 7,131Credit recoveriesConsumerIn U.S. offices $ 354 $ 341 $ 358 $ 372 $ 396In offices outside the U.S. 294 303 319 334 317CorporateIn U.S. offices 105 108 6 37 51In offices outside the U.S. 63 50 20 16 98$ 816 $ 802 $ 703 $ 759 $ 862Net credit lossesIn U.S. offices $ 3,094 $ 3,041 $ 3,404 $ 3,894 $ 4,548In offices outside the U.S. 861 1,067 1,110 1,253 1,721Total $ 3,955 $ 4,108 $ 4,514 $ 5,147 $ 6,269Other—net (2)(3)(4)(5)(6) $ 32 $ (473) $ (845) $ (240) $ (717)Allowance for loan losses at end of period $29,020 $30,115 $ 32,052 $34,362 $36,568Allowance for loan losses as a % of total loans 4.51% 4.69% 5.07% 5.35% 5.78%Allowance for unfunded lendingcommitments (7) $ 1,097 $ 1,136 $ 1,139 $ 1,097 $ 1,105Total allowance for loan lossesand unfunded lending commitments $30,117 $31,251 $ 33,191 $35,459 $37,673Net consumer credit losses (7) $ 4,038 $ 3,965 $ 4,242 $ 4,797 $ 5,420As a percentage of average consumer loans 3.85% 3.70% 3.87% 4.31% 4.89%Net corporate credit losses $ (83) $ 143 $ 272 $ 350 $ 849As a percentage of average corporate loans (0.04)% 0.07% 0.13% 0.17% 0.45%Allowance for loan losses at end of period (8)Citicorp $16,306 $16,699 $17,613 $19,225 $20,563Citi Holdings 12,714 13,416 14,439 15,137 16,005Total <strong>Citigroup</strong> $29,020 $30,115 $32,052 $34,362 $36,568Allowance by typeConsumer $25,963 $27,236 $28,866 $30,915 $32,686Corporate 3,057 2,879 3,186 3,447 3,882Total <strong>Citigroup</strong> $29,020 $30,115 $32,052 $34,362 $36,568(1) The first quarter of 2012 includes approximately $370 million of incremental charge-offs related to previously deferred principal balances on modified mortgages.These charge-offs were related to anticipated forgiveness of principal, largely in connection with the national mortgage settlement. There was a correspondingapproximately $350 million reserve release in the first quarter of 2012 specific to these charge-offs. See also ―Credit Risk—National Mortgage Settlement‖ below.(2) The first quarter of 2012 includes a reduction of approximately $145 million related to the sale or transfers to held-for-sale of various U.S. loan portfolios.(3) The fourth quarter of 2011 includes a reduction of approximately $325 million related to the sale or transfer to held-for-sale of various U.S. loan portfolios and areduction of approximately $72 million related to the transfer of Citi Belgium to held-for-sale.(4) The third quarter of 2011 includes a reduction of approximately $300 million related to the sale or transfers to held-for-sale of various U.S. loan portfolios and areduction of approximately $530 million related to FX translation.(5) The second quarter of 2011 includes a reduction of approximately $370 million related to the sale or transfer to held-for-sale of various U.S. loan portfolios.(6) The first quarter of 2011 includes a reduction of approximately $560 million related to the sale or transfer to held-for-sale of various U.S. loan portfolios and areduction of $240 million related to the sale of the Egg Banking PLC credit card business.(7) Represents additional credit loss reserves for unfunded lending commitments and letters of credit recorded in Other liabilities on the Consolidated Balance Sheet.(8) Allowance for loan losses represents management‘s best estimate of probable losses inherent in the portfolio, as well as probable losses related to largeindividually evaluated impaired loans and TDRs. Attribution of the allowance is made for analytical purposes only and the entire allowance is available to absorbprobable credit losses inherent in the overall portfolio.44CITIGROUP – 2012 FIRST QUARTER 10-Q