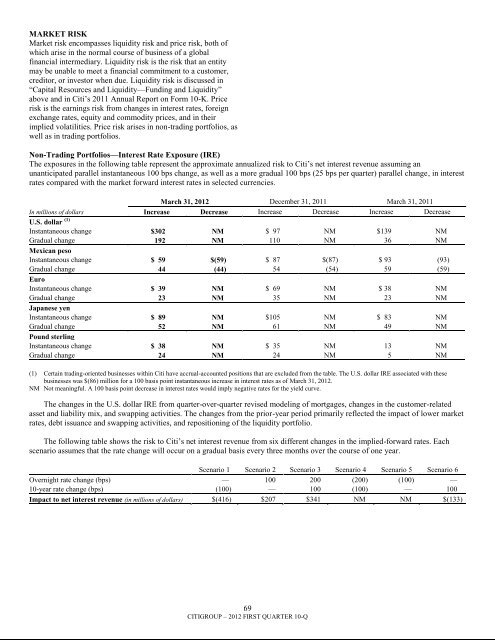

MARKET RISKMarket risk encompasses liquidity risk and price risk, both ofwhich arise in the normal course of business of a globalfinancial intermediary. Liquidity risk is the risk that an entitymay be unable to meet a financial commitment to a customer,creditor, or investor when due. Liquidity risk is discussed in―Capital Resources and Liquidity—Funding and Liquidity‖above and in Citi‘s 2011 Annual Report on Form 10-K. Pricerisk is the earnings risk from changes in interest rates, foreignexchange rates, equity and commodity prices, and in theirimplied volatilities. Price risk arises in non-trading portfolios, aswell as in trading portfolios.Non-Trading Portfolios—Interest Rate Exposure (IRE)The exposures in the following table represent the approximate annualized risk to Citi‘s net interest revenue assuming anunanticipated parallel instantaneous 100 bps change, as well as a more gradual 100 bps (25 bps per quarter) parallel change, in interestrates compared with the market forward interest rates in selected currencies.March 31, 2012 December 31, 2011 March 31, 2011In millions of dollars Increase Decrease Increase Decrease Increase DecreaseU.S. dollar (1)Instantaneous change $302 NM $ 97 NM $139 NMGradual change 192 NM 110 NM 36 NMMexican pesoInstantaneous change $ 59 $(59) $ 87 $(87) $ 93 (93)Gradual change 44 (44) 54 (54) 59 (59)EuroInstantaneous change $ 39 NM $ 69 NM $ 38 NMGradual change 23 NM 35 NM 23 NMJapanese yenInstantaneous change $ 89 NM $105 NM $ 83 NMGradual change 52 NM 61 NM 49 NMPound sterlingInstantaneous change $ 38 NM $ 35 NM 13 NMGradual change 24 NM 24 NM 5 NM(1) Certain trading-oriented businesses within Citi have accrual-accounted positions that are excluded from the table. The U.S. dollar IRE associated with thesebusinesses was $(86) million for a 100 basis point instantaneous increase in interest rates as of March 31, 2012.NM Not meaningful. A 100 basis point decrease in interest rates would imply negative rates for the yield curve.The changes in the U.S. dollar IRE from quarter-over-quarter revised modeling of mortgages, changes in the customer-relatedasset and liability mix, and swapping activities. The changes from the prior-year period primarily reflected the impact of lower marketrates, debt issuance and swapping activities, and repositioning of the liquidity portfolio.The following table shows the risk to Citi‘s net interest revenue from six different changes in the implied-forward rates. Eachscenario assumes that the rate change will occur on a gradual basis every three months over the course of one year.Scenario 1 Scenario 2 Scenario 3 Scenario 4 Scenario 5 Scenario 6Overnight rate change (bps) — 100 200 (200) (100) —10-year rate change (bps) (100) — 100 (100) — 100Impact to net interest revenue (in millions of dollars) $(416) $207 $341 NM NM $(133)69CITIGROUP – 2012 FIRST QUARTER 10-Q

Value at Risk for Trading PortfoliosValue at risk (VAR) estimates, at a 99% confidence level, thepotential decline in the value of a position or a portfolio undernormal market conditions. VAR statistics can be materiallydifferent across firms due to differences in portfoliocomposition, differences in VAR methodologies, anddifferences in model parameters. Due to these inconsistencies,Citi believes VAR statistics can be used more effectively asindicators of trends in risk taking within a firm, rather than asa basis for inferring differences in risk taking across firms.Citi uses Monte Carlo simulation, which it believes isconservatively calibrated to incorporate the greater of shortterm(most recent month) and long-term (three years) marketvolatility. The Monte Carlo simulation involves approximately300,000 market factors, making use of 180,000 time series,with market factors updated daily and model parametersupdated weekly.The conservative features of the VAR calibrationcontribute approximately 20% add-on to what would be aVAR estimated under the assumption of stable and perfectlynormally distributed markets. Under normal and stable marketconditions, Citi would thus expect the number of days wheretrading losses exceed its VAR to be less than two or threeexceptions per year. Periods of unstable market conditionscould increase the number of these exceptions. During the lastfour quarters, there was one back-testing exception wheretrading losses exceeded the VAR estimate at the <strong>Citigroup</strong>level (back-testing is the process in which the daily VAR of aportfolio is compared to the actual daily change in the marketvalue of transactions).As set forth in the table below, Citi's total trading andcredit portfolios VAR was $160 million, $183 million and$171 million at March 31, 2012, December 31, 2011 andMarch 31, 2011, respectively. Daily total trading and creditportfolio VAR averaged $178 million in the first quarter of2012 and ranged between $150 million to $199 million. Thedecrease in Citi‘s average total trading and credit portfolioVAR was primarily driven by a change in VAR modelparameters. Specifically, the relatively higher volatilities fromthe fourth quarter of 2008 are no longer included in the threeyearvolatility time series used in the VAR calculation.In millions of dollarsMarch 31,2012First Quarter2012 AverageDecember 31,2011Fourth Quarter2011 AverageMarch 31,2011First Quarter2011 AverageInterest rate $126 $135 $147 $167 $196 $182Foreign exchange 45 40 37 47 51 47Equity 36 35 36 37 34 48Commodity 18 14 16 18 27 23Diversification benefit (91) (93) (89) (102) (148) (129)Total Trading VAR– all market riskfactors, including general and specificrisk (excluding credit portfolios) (1) $134 $131 $147 $167 $160 $171Specific risk-only component (2) $14 $23 $21 $37 $10 $17Total – general market factors only $120 $108 $126 $130 $150 $154Incremental Impact of Credit Portfolios (3) $26 $47 $36 $31 $11 $8Total Trading and Credit Portfolios $160 $178 $183 $198 $171 $179(1) The total trading VAR includes trading positions from S&B, Citi Holdings and Corporate Treasury.(2) The specific risk-only component represents the level of equity and fixed income issuer-specific risk embedded in VAR.(3) The credit portfolio is composed of the asset side of the CVA derivative exposures and all associated CVA hedges. DVA is not included. It additionally includeshedges to the loan portfolio, fair value option loans, and tail hedges that are not explicitly hedging the trading book.The table below provides the range of market factor VARs, inclusive of specific risk, across the following quarters:First quarter 2012 Fourth quarter 2011 First quarter 2011In millions of dollars Low High Low High Low HighInterest rate $117 $147 $138 $209 $144 $216Foreign exchange 32 53 34 68 28 72Equity 24 59 31 52 28 74Commodity 10 19 14 23 16 36The following table provides the VAR for S&B for the firstquarter of 2012 and fourth quarter of 2011:March 31,2012December 31,2011In millions of dollarsTotal – All market risk factors,including general and specific risk (1) $129 $144Average – during quarter $120 $156High – during quarter 142 187Low – during quarter 108 138(1) S&B VAR excludes all risk associated with CVA (derivative counterpartyCVA and hedges of CVA).70CITIGROUP – 2012 FIRST QUARTER 10-Q