7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

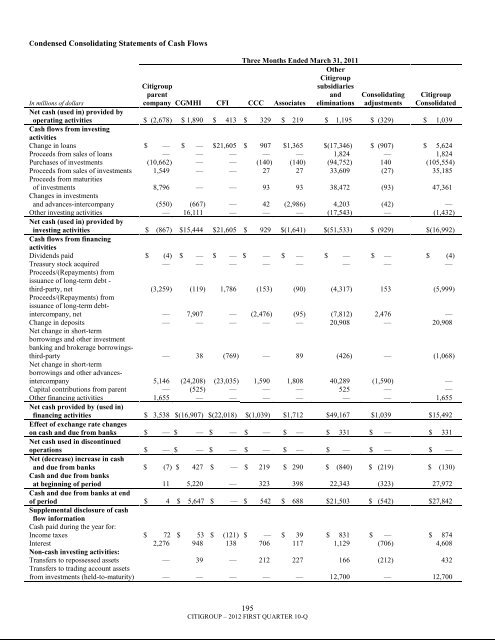

Condensed Consolidating Statements of Cash FlowsThree Months Ended March 31, 2011Other<strong>Citigroup</strong><strong>Citigroup</strong>subsidiariesparentandcompany CGMHI CFI CCC Associates eliminationsConsolidatingadjustments<strong>Citigroup</strong>ConsolidatedIn millions of dollarsNet cash (used in) provided byoperating activities $ (2,678) $ 1,890 $ 413 $ 329 $ 219 $ 1,195 $ (329) $ 1,039Cash flows from investingactivitiesChange in loans $ — $ — $21,605 $ 907 $1,365 $(17,346) $ (907) $ 5,624Proceeds from sales of loans — — — — — 1,824 — 1,824Purchases of investments (10,662) — — (140) (140) (94,752) 140 (105,554)Proceeds from sales of investments 1,549 — — 27 27 33,609 (27) 35,185Proceeds from maturitiesof investments 8,796 — — 93 93 38,472 (93) 47,361Changes in investmentsand advances-intercompany (550) (667) — 42 (2,986) 4,203 (42) —Other investing activities — 16,111 — — — (17,543) — (1,432)Net cash (used in) provided byinvesting activities $ (867) $15,444 $21,605 $ 929 $(1,641) $(51,533) $ (929) $(16,992)Cash flows from financingactivitiesDividends paid $ (4) $ — $ — $ — $ — $ — $ — $ (4)Treasury stock acquired — — — — — — — —Proceeds/(Repayments) fromissuance of long-term debt -third-party, net (3,259) (119) 1,786 (153) (90) (4,317) 153 (5,999)Proceeds/(Repayments) fromissuance of long-term debtintercompany,net — 7,907 — (2,476) (95) (7,812) 2,476 —Change in deposits — — — — — 20,908 — 20,908Net change in short-termborrowings and other investmentbanking and brokerage borrowingsthird-party— 38 (769) — 89 (426) — (1,068)Net change in short-termborrowings and other advancesintercompany5,146 (24,208) (23,035) 1,590 1,808 40,289 (1,590) —Capital contributions from parent — (525) — — — 525 — —Other financing activities 1,655 — — — — — — 1,655Net cash provided by (used in)financing activities $ 3,538 $(16,907) $(22,018) $(1,039) $1,712 $49,167 $1,039 $15,492Effect of exchange rate changeson cash and due from banks $ — $ — $ — $ — $ — $ 331 $ — $ 331Net cash used in discontinuedoperations $ — $ — $ — $ — $ — $ — $ — $ —Net (decrease) increase in cashand due from banks $ (7) $ 427 $ — $ 219 $ 290 $ (840) $ (219) $ (130)Cash and due from banksat beginning of period 11 5,220 — 323 398 22,343 (323) 27,972Cash and due from banks at endof period $ 4 $ 5,647 $ — $ 542 $ 688 $21,503 $ (542) $27,842Supplemental disclosure of cashflow informationCash paid during the year for:Income taxes $ 72 $ 53 $ (121) $ — $ 39 $ 831 $ — $ 874Interest 2,276 948 138 706 117 1,129 (706) 4,608Non-cash investing activities:Transfers to repossessed assets — 39 — 212 227 166 (212) 432Transfers to trading account assetsfrom investments (held-to-maturity) — — — — — 12,700 — 12,700195CITIGROUP – 2012 FIRST QUARTER 10-Q