7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

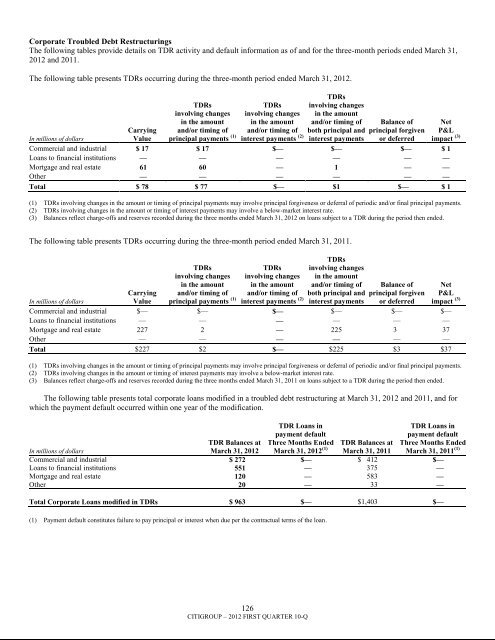

Corporate Troubled Debt RestructuringsThe following tables provide details on TDR activity and default information as of and for the three-month periods ended March 31,2012 and 2011.The following table presents TDRs occurring during the three-month period ended March 31, 2012.TDRsinvolving changesin the amountand/or timing ofprincipal payments (1)TDRsinvolving changesin the amountand/or timing ofinterest payments (2)TDRsinvolving changesin the amountand/or timing ofboth principal andinterest paymentsBalance ofprincipal forgivenor deferredNetP&Limpact (3)CarryingIn millions of dollarsValueCommercial and industrial $ 17 $ 17 $— $— $— $ 1Loans to financial institutions — — — — — —Mortgage and real estate 61 60 — 1 — —Other — — — — — —Total $ 78 $ 77 $— $1 $— $ 1(1) TDRs involving changes in the amount or timing of principal payments may involve principal forgiveness or deferral of periodic and/or final principal payments.(2) TDRs involving changes in the amount or timing of interest payments may involve a below-market interest rate.(3) Balances reflect charge-offs and reserves recorded during the three months ended March 31, 2012 on loans subject to a TDR during the period then ended.The following table presents TDRs occurring during the three-month period ended March 31, 2011.TDRsinvolving changesin the amountand/or timing ofprincipal payments (1)TDRsinvolving changesin the amountand/or timing ofinterest payments (2)TDRsinvolving changesin the amountand/or timing ofboth principal andinterest paymentsBalance ofprincipal forgivenor deferredNetP&Limpact (3)CarryingIn millions of dollarsValueCommercial and industrial $— $— $— $— $— $—Loans to financial institutions — — — — — —Mortgage and real estate 227 2 — 225 3 37Other — — — — — —Total $227 $2 $— $225 $3 $37(1) TDRs involving changes in the amount or timing of principal payments may involve principal forgiveness or deferral of periodic and/or final principal payments.(2) TDRs involving changes in the amount or timing of interest payments may involve a below-market interest rate.(3) Balances reflect charge-offs and reserves recorded during the three months ended March 31, 2011 on loans subject to a TDR during the period then ended.The following table presents total corporate loans modified in a troubled debt restructuring at March 31, 2012 and 2011, and forwhich the payment default occurred within one year of the modification.TDR Loans inpayment defaultThree Months EndedMarch 31, 2012 (1)TDR Loans inpayment defaultThree Months EndedMarch 31, 2011 (1)In millions of dollarsTDR Balances atMarch 31, 2012TDR Balances atMarch 31, 2011Commercial and industrial $ 272 $— $ 412 $—Loans to financial institutions 551 — 375 —Mortgage and real estate 120 — 583 —Other 20 — 33 —Total Corporate Loans modified in TDRs $ 963 $— $1,403 $—(1) Payment default constitutes failure to pay principal or interest when due per the contractual terms of the loan.126CITIGROUP – 2012 FIRST QUARTER 10-Q