7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

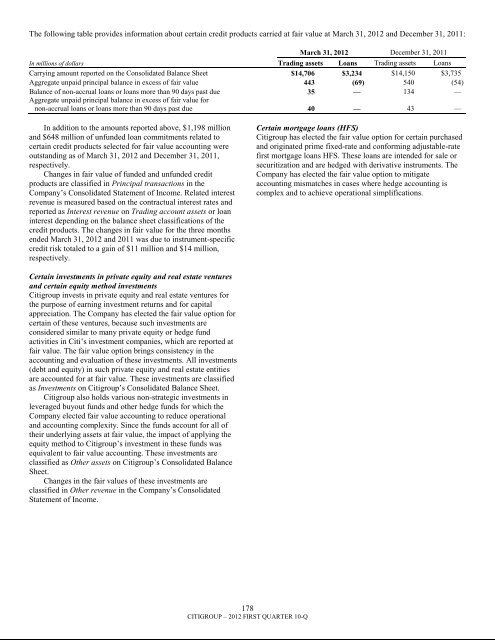

The following table provides information about certain credit products carried at fair value at March 31, 2012 and December 31, 2011:March 31, 2012 December 31, 2011In millions of dollars Trading assets Loans Trading assets LoansCarrying amount reported on the Consolidated Balance Sheet $14,706 $3,234 $14,150 $3,735Aggregate unpaid principal balance in excess of fair value 443 (69) 540 (54)Balance of non-accrual loans or loans more than 90 days past due 35 — 134 —Aggregate unpaid principal balance in excess of fair value fornon-accrual loans or loans more than 90 days past due 40 — 43 —In addition to the amounts reported above, $1,198 millionand $648 million of unfunded loan commitments related tocertain credit products selected for fair value accounting wereoutstanding as of March 31, 2012 and December 31, 2011,respectively.Changes in fair value of funded and unfunded creditproducts are classified in Principal transactions in theCompany‘s Consolidated Statement of Income. Related interestrevenue is measured based on the contractual interest rates andreported as Interest revenue on Trading account assets or loaninterest depending on the balance sheet classifications of thecredit products. The changes in fair value for the three monthsended March 31, 2012 and 2011 was due to instrument-specificcredit risk totaled to a gain of $11 million and $14 million,respectively.Certain mortgage loans (HFS)<strong>Citigroup</strong> has elected the fair value option for certain purchasedand originated prime fixed-rate and conforming adjustable-ratefirst mortgage loans HFS. These loans are intended for sale orsecuritization and are hedged with derivative instruments. TheCompany has elected the fair value option to mitigateaccounting mismatches in cases where hedge accounting iscomplex and to achieve operational simplifications.Certain investments in private equity and real estate venturesand certain equity method investments<strong>Citigroup</strong> invests in private equity and real estate ventures forthe purpose of earning investment returns and for capitalappreciation. The Company has elected the fair value option forcertain of these ventures, because such investments areconsidered similar to many private equity or hedge fundactivities in Citi‘s investment companies, which are reported atfair value. The fair value option brings consistency in theaccounting and evaluation of these investments. All investments(debt and equity) in such private equity and real estate entitiesare accounted for at fair value. These investments are classifiedas Investments on <strong>Citigroup</strong>‘s Consolidated Balance Sheet.<strong>Citigroup</strong> also holds various non-strategic investments inleveraged buyout funds and other hedge funds for which theCompany elected fair value accounting to reduce operationaland accounting complexity. Since the funds account for all oftheir underlying assets at fair value, the impact of applying theequity method to <strong>Citigroup</strong>‘s investment in these funds wasequivalent to fair value accounting. These investments areclassified as Other assets on <strong>Citigroup</strong>‘s Consolidated BalanceSheet.Changes in the fair values of these investments areclassified in Other revenue in the Company‘s ConsolidatedStatement of Income.178CITIGROUP – 2012 FIRST QUARTER 10-Q