7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

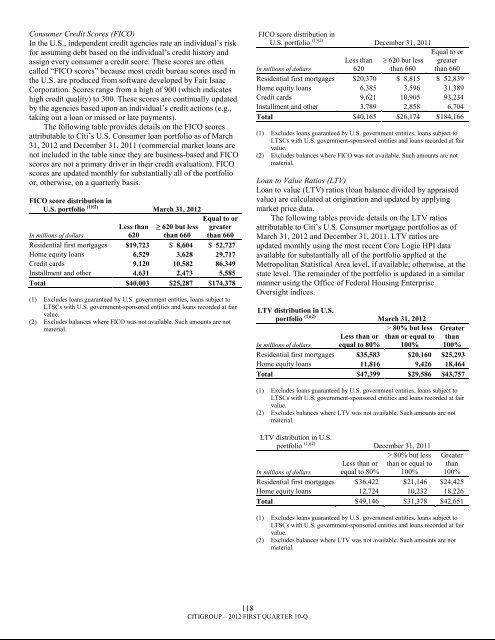

Consumer Credit Scores (FICO)In the U.S., independent credit agencies rate an individual‘s riskfor assuming debt based on the individual‘s credit history andassign every consumer a credit score. These scores are oftencalled ―FICO scores‖ because most credit bureau scores used inthe U.S. are produced from software developed by Fair IsaacCorporation. Scores range from a high of 900 (which indicateshigh credit quality) to 300. These scores are continually updatedby the agencies based upon an individual‘s credit actions (e.g.,taking out a loan or missed or late payments).The following table provides details on the FICO scoresattributable to Citi‘s U.S. Consumer loan portfolio as of March31, 2012 and December 31, 2011 (commercial market loans arenot included in the table since they are business-based and FICOscores are not a primary driver in their credit evaluation). FICOscores are updated monthly for substantially all of the portfolioor, otherwise, on a quarterly basis.FICO score distribution inU.S. portfolio (1)(2) March 31, 2012In millions of dollarsLess than620≥ 620 but lessthan 660Equal to orgreaterthan 660Residential first mortgages $19,723 $ 8,604 $ 52,727Home equity loans 6,529 3,628 29,717Credit cards 9,120 10,582 86,349Installment and other 4,631 2,473 5,585Total $40,003 $25,287 $174,378(1) Excludes loans guaranteed by U.S. government entities, loans subject toLTSCs with U.S. government-sponsored entities and loans recorded at fairvalue.(2) Excludes balances where FICO was not available. Such amounts are notmaterial.FICO score distribution inU.S. portfolio (1)(2) December 31, 2011In millions of dollarsLess than620≥ 620 but lessthan 660Equal to orgreaterthan 660Residential first mortgages $20,370 $ 8,815 $ 52,839Home equity loans 6,385 3,596 31,389Credit cards 9,621 10,905 93,234Installment and other 3,789 2,858 6,704Total $40,165 $26,174 $ 184,166(1) Excludes loans guaranteed by U.S. government entities, loans subject toLTSCs with U.S. government-sponsored entities and loans recorded at fairvalue.(2) Excludes balances where FICO was not available. Such amounts are notmaterial.Loan to Value Ratios (LTV)Loan to value (LTV) ratios (loan balance divided by appraisedvalue) are calculated at origination and updated by applyingmarket price data.The following tables provide details on the LTV ratiosattributable to Citi‘s U.S. Consumer mortgage portfolios as ofMarch 31, 2012 and December 31, 2011. LTV ratios areupdated monthly using the most recent Core Logic HPI dataavailable for substantially all of the portfolio applied at theMetropolitan Statistical Area level, if available; otherwise, at thestate level. The remainder of the portfolio is updated in a similarmanner using the Office of Federal Housing EnterpriseOversight indices.LTV distribution in U.S.portfolio (1)(2) March 31, 2012In millions of dollarsLess than orequal to 80%> 80% but lessthan or equal to100%Greaterthan100%Residential first mortgages $35,583 $20,160 $25,293Home equity loans 11,816 9,426 18,464Total $47,399 $29,586 $43,757(1) Excludes loans guaranteed by U.S. government entities, loans subject toLTSCs with U.S. government-sponsored entities and loans recorded at fairvalue.(2) Excludes balances where LTV was not available. Such amounts are notmaterial.LTV distribution in U.S.portfolio (1)(2) December 31, 2011In millions of dollarsLess than orequal to 80%> 80% but lessthan or equal to100%Greaterthan100%Residential first mortgages $ 36,422 $ 21,146 $24,425Home equity loans 12,724 10,232 18,226Total $ 49,146 $ 31,378 $42,651(1) Excludes loans guaranteed by U.S. government entities, loans subject toLTSCs with U.S. government-sponsored entities and loans recorded at fairvalue.(2) Excludes balances where LTV was not available. Such amounts are notmaterial.118CITIGROUP – 2012 FIRST QUARTER 10-Q