7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

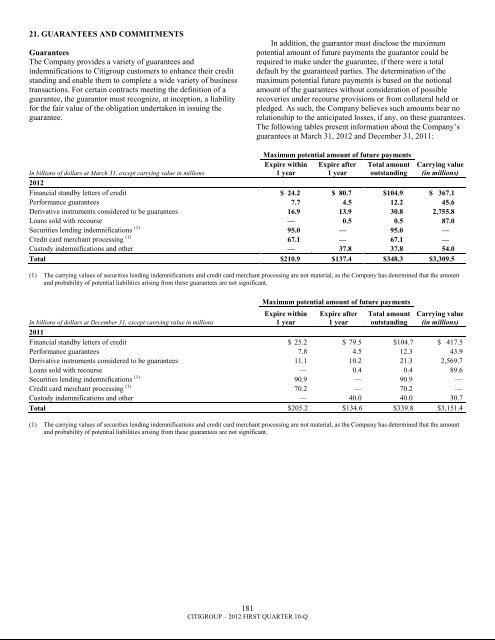

21. GUARANTEES AND COMMITMENTSGuaranteesThe Company provides a variety of guarantees andindemnifications to <strong>Citigroup</strong> customers to enhance their creditstanding and enable them to complete a wide variety of businesstransactions. For certain contracts meeting the definition of aguarantee, the guarantor must recognize, at inception, a liabilityfor the fair value of the obligation undertaken in issuing theguarantee.In addition, the guarantor must disclose the maximumpotential amount of future payments the guarantor could berequired to make under the guarantee, if there were a totaldefault by the guaranteed parties. The determination of themaximum potential future payments is based on the notionalamount of the guarantees without consideration of possiblerecoveries under recourse provisions or from collateral held orpledged. As such, the Company believes such amounts bear norelationship to the anticipated losses, if any, on these guarantees.The following tables present information about the Company‘sguarantees at March 31, 2012 and December 31, 2011:In <strong>billion</strong>s of dollars at March 31, except carrying value in millionsMaximum potential amount of future paymentsExpire within Expire after Total amount1 year 1 year outstandingCarrying value(in millions)2012Financial standby letters of credit $ 24.2 $ 80.7 $104.9 $ 367.1Performance guarantees 7.7 4.5 12.2 45.6Derivative instruments considered to be guarantees 16.9 13.9 30.8 2,755.8Loans sold with recourse — 0.5 0.5 87.0Securities lending indemnifications (1) 95.0 — 95.0 —Credit card merchant processing (1) 67.1 — 67.1 —Custody indemnifications and other — 37.8 37.8 54.0Total $210.9 $137.4 $348.3 $3,309.5(1) The carrying values of securities lending indemnifications and credit card merchant processing are not material, as the Company has determined that the amountand probability of potential liabilities arising from these guarantees are not significant.In <strong>billion</strong>s of dollars at December 31, except carrying value in millionsMaximum potential amount of future paymentsExpire within1 yearExpire after1 yearTotal amountoutstandingCarrying value(in millions)2011Financial standby letters of credit $ 25.2 $ 79.5 $104.7 $ 417.5Performance guarantees 7.8 4.5 12.3 43.9Derivative instruments considered to be guarantees 11.1 10.2 21.3 2,569.7Loans sold with recourse — 0.4 0.4 89.6Securities lending indemnifications (1) 90.9 — 90.9 —Credit card merchant processing (1) 70.2 — 70.2 —Custody indemnifications and other — 40.0 40.0 30.7Total $205.2 $134.6 $339.8 $3,151.4(1) The carrying values of securities lending indemnifications and credit card merchant processing are not material, as the Company has determined that the amountand probability of potential liabilities arising from these guarantees are not significant.181CITIGROUP – 2012 FIRST QUARTER 10-Q