7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

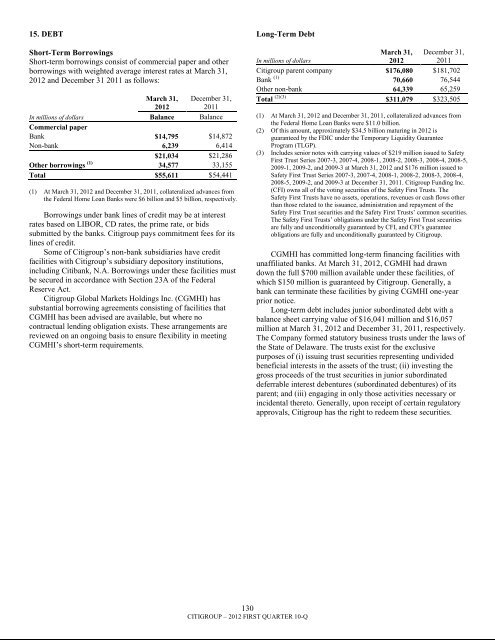

15. DEBTShort-Term BorrowingsShort-term borrowings consist of commercial paper and otherborrowings with weighted average interest rates at March 31,2012 and December 31 2011 as follows:March 31,2012December 31,2011In millions of dollars Balance BalanceCommercial paperBank $14,795 $14,872Non-bank 6,239 6,414$21,034 $21,286Other borrowings (1) 34,577 33,155Total $55,611 $ 54,441(1) At March 31, 2012 and December 31, 2011, collateralized advances fromthe Federal Home Loan Banks were $6 <strong>billion</strong> and $5 <strong>billion</strong>, respectively.Borrowings under bank lines of credit may be at interestrates based on LIBOR, CD rates, the prime rate, or bidssubmitted by the banks. <strong>Citigroup</strong> pays commitment fees for itslines of credit.Some of <strong>Citigroup</strong>‘s non-bank subsidiaries have creditfacilities with <strong>Citigroup</strong>‘s subsidiary depository institutions,including Citibank, N.A. Borrowings under these facilities mustbe secured in accordance with Section 23A of the FederalReserve Act.<strong>Citigroup</strong> Global Markets Holdings Inc. (CGMHI) hassubstantial borrowing agreements consisting of facilities thatCGMHI has been advised are available, but where nocontractual lending obligation exists. These arrangements arereviewed on an ongoing basis to ensure flexibility in meetingCGMHI‘s short-term requirements.Long-Term DebtIn millions of dollarsMarch 31,2012December 31,2011<strong>Citigroup</strong> parent company $176,080 $181,702Bank (1) 70,660 76,544Other non-bank 64,339 65,259Total (2)(3) $311,079 $323,505(1) At March 31, 2012 and December 31, 2011, collateralized advances fromthe Federal Home Loan Banks were $11.0 <strong>billion</strong>.(2) Of this amount, approximately $34.5 <strong>billion</strong> maturing in 2012 isguaranteed by the FDIC under the Temporary Liquidity GuaranteeProgram (TLGP).(3) Includes senior notes with carrying values of $219 million issued to SafetyFirst Trust Series 2007-3, 2007-4, 2008-1, 2008-2, 2008-3, 2008-4, 2008-5,2009-1, 2009-2, and 2009-3 at March 31, 2012 and $176 million issued toSafety First Trust Series 2007-3, 2007-4, 2008-1, 2008-2, 2008-3, 2008-4,2008-5, 2009-2, and 2009-3 at December 31, 2011. <strong>Citigroup</strong> Funding Inc.(CFI) owns all of the voting securities of the Safety First Trusts. TheSafety First Trusts have no assets, operations, revenues or cash flows otherthan those related to the issuance, administration and repayment of theSafety First Trust securities and the Safety First Trusts‘ common securities.The Safety First Trusts‘ obligations under the Safety First Trust securitiesare fully and unconditionally guaranteed by CFI, and CFI‘s guaranteeobligations are fully and unconditionally guaranteed by <strong>Citigroup</strong>.CGMHI has committed long-term financing facilities withunaffiliated banks. At March 31, 2012, CGMHI had drawndown the full $700 million available under these facilities, ofwhich $150 million is guaranteed by <strong>Citigroup</strong>. Generally, abank can terminate these facilities by giving CGMHI one-yearprior notice.Long-term debt includes junior subordinated debt with abalance sheet carrying value of $16,041 million and $16,057million at March 31, 2012 and December 31, 2011, respectively.The Company formed statutory business trusts under the laws ofthe State of Delaware. The trusts exist for the exclusivepurposes of (i) issuing trust securities representing undividedbeneficial interests in the assets of the trust; (ii) investing thegross proceeds of the trust securities in junior subordinateddeferrable interest debentures (subordinated debentures) of itsparent; and (iii) engaging in only those activities necessary orincidental thereto. Generally, upon receipt of certain regulatoryapprovals, <strong>Citigroup</strong> has the right to redeem these securities.130CITIGROUP – 2012 FIRST QUARTER 10-Q