7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

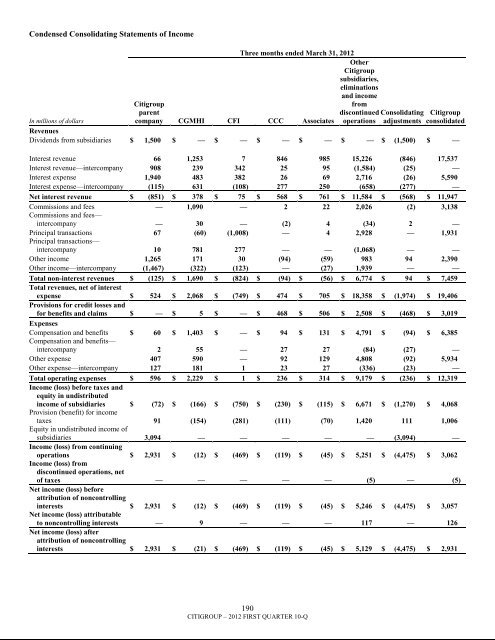

Condensed Consolidating Statements of IncomeIn millions of dollarsThree months ended March 31, 2012<strong>Citigroup</strong>parentcompany CGMHI CFI CCC AssociatesOther<strong>Citigroup</strong>subsidiaries,eliminationsand incomefromdiscontinuedoperationsConsolidatingadjustments<strong>Citigroup</strong>consolidatedRevenuesDividends from subsidiaries $ 1,500 $ — $ — $ — $ — $ — $ (1,500) $ —Interest revenue 66 1,253 7 846 985 15,226 (846) 17,537Interest revenue—intercompany 908 239 342 25 95 (1,584) (25) —Interest expense 1,940 483 382 26 69 2,716 (26) 5,590Interest expense—intercompany (115) 631 (108) 277 250 (658) (277) —Net interest revenue $ (851) $ 378 $ 75 $ 568 $ 761 $ 11,584 $ (568) $ 11,947Commissions and fees — 1,090 — 2 22 2,026 (2) 3,138Commissions and fees—intercompany — 30 — (2) 4 (34) 2 —Principal transactions 67 (60) (1,008) — 4 2,928 — 1,931Principal transactions—intercompany 10 781 277 — — (1,068) — —Other income 1,265 171 30 (94) (59) 983 94 2,390Other income—intercompany (1,467) (322) (123) — (27) 1,939 — —Total non-interest revenues $ (125) $ 1,690 $ (824) $ (94) $ (56) $ 6,774 $ 94 $ 7,459Total revenues, net of interestexpense $ 524 $ 2,068 $ (749) $ 474 $ 705 $ 18,358 $ (1,974) $ 19,406Provisions for credit losses andfor benefits and claims $ — $ 5 $ — $ 468 $ 506 $ 2,508 $ (468) $ 3,019ExpensesCompensation and benefits $ 60 $ 1,403 $ — $ 94 $ 131 $ 4,791 $ (94) $ 6,385Compensation and benefits—intercompany 2 55 — 27 27 (84) (27) —Other expense 407 590 — 92 129 4,808 (92) 5,934Other expense—intercompany 127 181 1 23 27 (336) (23) —Total operating expenses $ 596 $ 2,229 $ 1 $ 236 $ 314 $ 9,179 $ (236) $ 12,319Income (loss) before taxes andequity in undistributedincome of subsidiaries $ (72) $ (166) $ (750) $ (230) $ (115) $ 6,671 $ (1,270) $ 4,068Provision (benefit) for incometaxes 91 (154) (281) (111) (70) 1,420 111 1,006Equity in undistributed income ofsubsidiaries 3,094 — — — — — (3,094) —Income (loss) from continuingoperations $ 2,931 $ (12) $ (469) $ (119) $ (45) $ 5,251 $ (4,475) $ 3,062Income (loss) fromdiscontinued operations, netof taxes — — — — — (5) — (5)Net income (loss) beforeattribution of noncontrollinginterests $ 2,931 $ (12) $ (469) $ (119) $ (45) $ 5,246 $ (4,475) $ 3,057Net income (loss) attributableto noncontrolling interests — 9 — — — 117 — 126Net income (loss) afterattribution of noncontrollinginterests $ 2,931 $ (21) $ (469) $ (119) $ (45) $ 5,129 $ (4,475) $ 2,931190CITIGROUP – 2012 FIRST QUARTER 10-Q