quoted market prices, market borrowing rates of interest areused to discount contractual cash flows.March 31, 2012Estimated fair valueIn <strong>billion</strong>s of dollars Carrying value Estimated fair value Level 1 Level 2 Level 3AssetsInvestments $17.9 $17.4 $ — $ 15.5 $1.9Federal funds sold and securitiesborrowed or purchased underagreements to resell 116.6 116.6 — 109.0 7.6Loans (1)(2) 611.7 599.4 — 4.7 594.7Other financial assets (2)(3) 282.2 282.0 9.9 240.8 31.3LiabilitiesDeposits $904.7 $903.9 $— $837.2 $66.7Federal funds purchased andsecurities loaned or sold underagreements to repurchase 88.4 88.4 — 87.0 1.4Long-term debt 284.4 284.4 — 236.2 48.2Other financial liabilities (4) 143.3 143.3 — 92.1 51.2In <strong>billion</strong>s of dollarsDecember 31, 2011CarryingvalueEstimatedfair valueAssetsInvestments $ 19.4 $ 18.4Federal funds sold and securitiesborrowed or purchased underagreements to resell 133.0 133.0Loans (1)(2) 609.3 598.7Other financial assets (2)(3) 245.7 245.4LiabilitiesDeposits $864.6 $864.5Federal funds purchased and securitiesloaned or sold under agreements torepurchase 85.6 85.6Long-term debt 299.3 289.7Other financial liabilities (4) 141.1 141.1(1) The carrying value of loans is net of the Allowance for loan losses of $29.0 <strong>billion</strong> for March 31, 2012 and $30.1 <strong>billion</strong> for December 31, 2011. Inaddition, the carrying values exclude $2.6 <strong>billion</strong> and $2.5 <strong>billion</strong> of lease finance receivables at March 31, 2012 and December 31, 2011, respectively.(2) Includes items measured at fair value on a nonrecurring basis.(3) Includes cash and due from banks, deposits with banks, brokerage receivables, reinsurance recoverable and other financial instruments included inOther assets on the Consolidated Balance Sheet, for all of which the carrying value is a reasonable estimate of fair value.(4) Includes brokerage payables, separate and variable accounts, short-term borrowings (carried at cost) and other financial instruments included in Otherliabilities on the Consolidated Balance Sheet, for all of which the carrying value is a reasonable estimate of fair value.Fair values vary from period to period based on changes ina wide range of factors, including interest rates, credit quality,and market perceptions of value and as existing assets andliabilities run off and new transactions are entered into.The estimated fair values of loans reflect changes in creditstatus since the loans were made, changes in interest rates in thecase of fixed-rate loans, and premium values at origination ofcertain loans. The carrying values (reduced by the Allowance forloan losses) exceeded the estimated fair values of <strong>Citigroup</strong>‘sloans, in aggregate, by $12.3 <strong>billion</strong> and by $10.6 <strong>billion</strong> atMarch 31, 2012 and December 31, 2011, respectively. At March31, 2012, the carrying values, net of allowances, exceeded theestimated fair values by $8.4 <strong>billion</strong> and $3.9 <strong>billion</strong> forConsumer loans and Corporate loans, respectively.The estimated fair values of the Company‘s corporateunfunded lending commitments at March 31, 2012 andDecember 31, 2011 were liabilities of $7.1 <strong>billion</strong> and $4.7<strong>billion</strong>, respectively, which are substantially fair valued at level3. The Company does not estimate the fair values of consumerunfunded lending commitments, which are generally cancelableby providing notice to the borrower.175CITIGROUP – 2012 FIRST QUARTER 10-Q

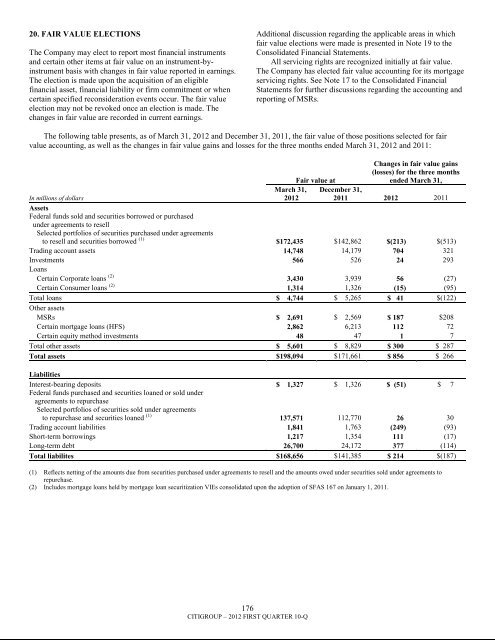

20. FAIR VALUE ELECTIONSThe Company may elect to report most financial instrumentsand certain other items at fair value on an instrument-byinstrumentbasis with changes in fair value reported in earnings.The election is made upon the acquisition of an eligiblefinancial asset, financial liability or firm commitment or whencertain specified reconsideration events occur. The fair valueelection may not be revoked once an election is made. Thechanges in fair value are recorded in current earnings.Additional discussion regarding the applicable areas in whichfair value elections were made is presented in Note 19 to theConsolidated Financial Statements.All servicing rights are recognized initially at fair value.The Company has elected fair value accounting for its mortgageservicing rights. See Note 17 to the Consolidated FinancialStatements for further discussions regarding the accounting andreporting of MSRs.The following table presents, as of March 31, 2012 and December 31, 2011, the fair value of those positions selected for fairvalue accounting, as well as the changes in fair value gains and losses for the three months ended March 31, 2012 and 2011:In millions of dollarsMarch 31,2012Fair value atChanges in fair value gains(losses) for the three monthsended March 31,December 31,2011 2012 2011AssetsFederal funds sold and securities borrowed or purchasedunder agreements to resellSelected portfolios of securities purchased under agreementsto resell and securities borrowed (1) $172,435 $142,862 $(213) $(513)Trading account assets 14,748 14,179 704 321Investments 566 526 24 293LoansCertain Corporate loans (2) 3,430 3,939 56 (27)Certain Consumer loans (2) 1,314 1,326 (15) (95)Total loans $ 4,744 $ 5,265 $ 41 $(122)Other assetsMSRs $ 2,691 $ 2,569 $ 187 $208Certain mortgage loans (HFS) 2,862 6,213 112 72Certain equity method investments 48 47 1 7Total other assets $ 5,601 $ 8,829 $ 300 $ 287Total assets $198,094 $171,661 $ 856 $ 266LiabilitiesInterest-bearing deposits $ 1,327 $ 1,326 $ (51) $ 7Federal funds purchased and securities loaned or sold underagreements to repurchaseSelected portfolios of securities sold under agreementsto repurchase and securities loaned (1) 137,571 112,770 26 30Trading account liabilities 1,841 1,763 (249) (93)Short-term borrowings 1,217 1,354 111 (17)Long-term debt 26,700 24,172 377 (114)Total liabilites $168,656 $141,385 $ 214 $(187)(1) Reflects netting of the amounts due from securities purchased under agreements to resell and the amounts owed under securities sold under agreements torepurchase.(2) Includes mortgage loans held by mortgage loan securitization VIEs consolidated upon the adoption of SFAS 167 on January 1, 2011.176CITIGROUP – 2012 FIRST QUARTER 10-Q