- Page 1 and 2: UNITED STATESSECURITIES AND EXCHANG

- Page 3 and 4: CITIGROUP INCFIRST QUARTER 2012 - F

- Page 5 and 6: As described above, Citigroup is ma

- Page 7 and 8: The Consumer allowance for loan los

- Page 9 and 10: SUMMARY OF SELECTED FINANCIAL DATA

- Page 11 and 12: CITIGROUP REVENUESFirst QuarterIn m

- Page 13 and 14: GLOBAL CONSUMER BANKINGGlobal Consu

- Page 15 and 16: EMEA REGIONAL CONSUMER BANKINGEMEA

- Page 17 and 18: ASIA REGIONAL CONSUMER BANKINGAsia

- Page 19 and 20: [THIS PAGE INTENTIONALLY LEFT BLANK

- Page 21 and 22: 1Q12 vs. 1Q11Net income of $1.2 bil

- Page 23 and 24: CITI HOLDINGSCiti Holdings contains

- Page 25 and 26: LOCAL CONSUMER LENDINGLocal Consume

- Page 27 and 28: SPECIAL ASSET POOLSpecial Asset Poo

- Page 29 and 30: BALANCE SHEET REVIEWThe following s

- Page 31 and 32: transactions, see ―Capital Resour

- Page 33 and 34: CAPITAL RESOURCES AND LIQUIDITYCAPI

- Page 35 and 36: Common Stockholders’ EquityCitigr

- Page 37 and 38: FUNDING AND LIQUIDITYOverviewCiti

- Page 39 and 40: The table below details the long-te

- Page 41 and 42: Credit RatingsCitigroup‘s funding

- Page 43 and 44: OFF-BALANCE-SHEET ARRANGEMENTSCitig

- Page 45 and 46: Details of Credit Loss Experience1s

- Page 47 and 48: Non-Accrual LoansIn millions of dol

- Page 49: Renegotiated LoansThe following tab

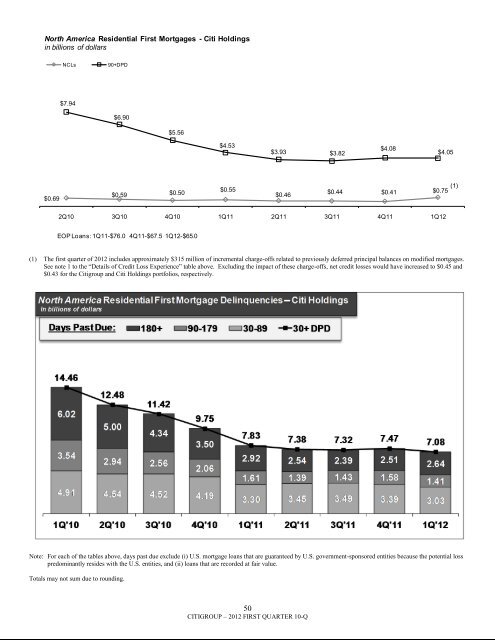

- Page 53 and 54: loans exiting foreclosure inventory

- Page 55 and 56: Note: For each of the tables above,

- Page 57 and 58: Citi will account for the refinanci

- Page 59 and 60: Legacy S&B Securitizations (princip

- Page 61 and 62: In addition to the amounts set fort

- Page 63 and 64: North America Citi Retail Services

- Page 65 and 66: Consumer Loan Net Credit Losses and

- Page 67 and 68: CORPORATE LOAN DETAILSFor corporate

- Page 69 and 70: EXPOSURE TO COMMERCIAL REAL ESTATET

- Page 71 and 72: Value at Risk for Trading Portfolio

- Page 73 and 74: AVERAGE BALANCES AND INTEREST RATES

- Page 75 and 76: (10) Excludes hybrid financial inst

- Page 77 and 78: ANALYSIS OF CHANGES IN INTEREST EXP

- Page 79 and 80: GIIPSGross funded credit exposure t

- Page 81 and 82: Credit Default SwapsCiti buys and s

- Page 84 and 85: CREDIT DERIVATIVESCitigroup makes m

- Page 87 and 88: DISCLOSURE CONTROLS ANDPROCEDURESCi

- Page 89 and 90: FINANCIAL STATEMENTS AND NOTES TABL

- Page 91 and 92: CONSOLIDATED STATEMENT OF COMPREHEN

- Page 93 and 94: CONSOLIDATED BALANCE SHEET(Continue

- Page 95 and 96: CONSOLIDATED STATEMENT OF CASH FLOW

- Page 97 and 98: ACCOUNTING CHANGESPresentation of C

- Page 99 and 100: 2. DISCONTINUED OPERATIONSSale of E

- Page 101 and 102:

4. INTEREST REVENUE AND EXPENSEFor

- Page 103 and 104:

period. The 2012 deferred cash awar

- Page 105 and 106:

9. EARNINGS PER SHAREThe following

- Page 107 and 108:

11. INVESTMENTSOverviewIn millions

- Page 109 and 110:

The following table presents the am

- Page 111 and 112:

During the first quarter of 2011, t

- Page 113 and 114:

Evaluating Investments for Other-Th

- Page 115 and 116:

Recognition and Measurement of OTTI

- Page 117 and 118:

12. LOANSCitigroup loans are report

- Page 119 and 120:

Consumer Credit Scores (FICO)In the

- Page 121 and 122:

In millions of dollarsRecordedinves

- Page 123 and 124:

Corporate LoansCorporate loans repr

- Page 125 and 126:

Corporate Loans Credit Quality Indi

- Page 127 and 128:

Corporate Troubled Debt Restructuri

- Page 129 and 130:

14. GOODWILL AND INTANGIBLE ASSETSG

- Page 131 and 132:

15. DEBTShort-Term BorrowingsShort-

- Page 133 and 134:

16. CHANGES IN ACCUMULATED OTHER CO

- Page 135 and 136:

THIS PAGE INTENTIONALLY LEFT BLANK.

- Page 137 and 138:

In millions of dollars As of Decemb

- Page 139 and 140:

Funding Commitments for Significant

- Page 141 and 142:

Credit Card Securitizations—Citic

- Page 143 and 144:

The range in the key assumptions is

- Page 145 and 146:

The market for MSRs is not sufficie

- Page 147 and 148:

investors in the form of funded not

- Page 149 and 150:

are tendered and the Company (in it

- Page 151 and 152:

18. DERIVATIVES ACTIVITIESIn the or

- Page 153 and 154:

Derivative Mark-to-Market (MTM) Rec

- Page 155 and 156:

Key aspects of achieving ASC 815 he

- Page 157 and 158:

Credit DerivativesA credit derivati

- Page 159 and 160:

19. FAIR VALUE MEASUREMENTASC 820-1

- Page 161 and 162:

The key inputs depend upon the type

- Page 163 and 164:

Items Measured at Fair Value on a R

- Page 165 and 166:

In millions of dollars at December

- Page 167 and 168:

Changes in Level 3 Fair Value Categ

- Page 169 and 170:

Net realized/unrealizedgains (losse

- Page 171 and 172:

— Purchases of Corporate debt tra

- Page 173 and 174:

Fair Value(in millions) Methodology

- Page 175 and 176:

Items Measured at Fair Value on a N

- Page 177 and 178:

20. FAIR VALUE ELECTIONSThe Company

- Page 179 and 180:

The following table provides inform

- Page 181 and 182:

The following table provides inform

- Page 183 and 184:

Financial standby letters of credit

- Page 185 and 186:

Value-Transfer NetworksThe Company

- Page 187 and 188:

Credit Commitments and Lines of Cre

- Page 189 and 190:

Mortgage-Backed Securities and CDO

- Page 191 and 192:

Condensed Consolidating Statements

- Page 193 and 194:

Condensed Consolidating Balance She

- Page 195 and 196:

Condensed Consolidating Statements

- Page 197 and 198:

LEGAL PROCEEDINGSFor a discussion o

- Page 199 and 200:

Item 6. ExhibitsSee Exhibit Index.1

- Page 201:

EXHIBIT INDEX3.01.1 Restated Certif