7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

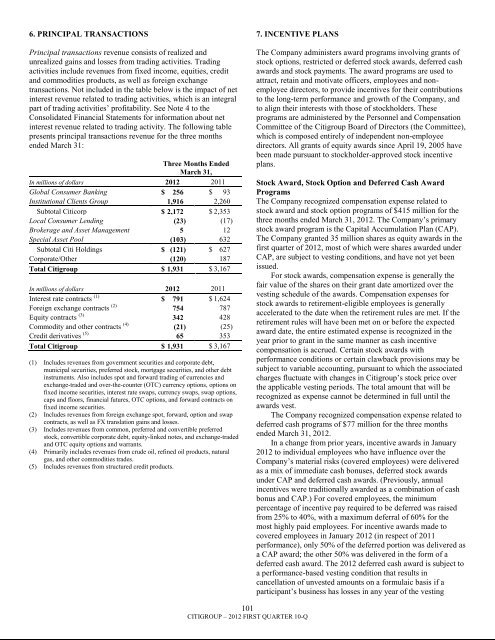

6. PRINCIPAL TRANSACTIONSPrincipal transactions revenue consists of realized andunrealized gains and losses from trading activities. Tradingactivities include revenues from fixed income, equities, creditand commodities products, as well as foreign exchangetransactions. Not included in the table below is the impact of netinterest revenue related to trading activities, which is an integralpart of trading activities‘ profitability. See Note 4 to theConsolidated Financial Statements for information about netinterest revenue related to trading activity. The following tablepresents principal transactions revenue for the three monthsended March 31:Three Months EndedMarch 31,In millions of dollars 2012 2011Global Consumer Banking $ 256 $ 93Institutional Clients Group 1,916 2,260Subtotal Citicorp $ 2,172 $ 2,353Local Consumer Lending (23) (17)Brokerage and Asset Management 5 12Special Asset Pool (103) 632Subtotal Citi Holdings $ (121) $ 627Corporate/Other (120) 187Total <strong>Citigroup</strong> $ 1,931 $ 3,167In millions of dollars 2012 2011Interest rate contracts (1) $ 791 $ 1,624Foreign exchange contracts (2) 754 787Equity contracts (3) 342 428Commodity and other contracts (4) (21) (25)Credit derivatives (5) 65 353Total <strong>Citigroup</strong> $ 1,931 $ 3,167(1) Includes revenues from government securities and corporate debt,municipal securities, preferred stock, mortgage securities, and other debtinstruments. Also includes spot and forward trading of currencies andexchange-traded and over-the-counter (OTC) currency options, options onfixed income securities, interest rate swaps, currency swaps, swap options,caps and floors, financial futures, OTC options, and forward contracts onfixed income securities.(2) Includes revenues from foreign exchange spot, forward, option and swapcontracts, as well as FX translation gains and losses.(3) Includes revenues from common, preferred and convertible preferredstock, convertible corporate debt, equity-linked notes, and exchange-tradedand OTC equity options and warrants.(4) Primarily includes revenues from crude oil, refined oil products, naturalgas, and other commodities trades.(5) Includes revenues from structured credit products.7. INCENTIVE PLANSThe Company administers award programs involving grants ofstock options, restricted or deferred stock awards, deferred cashawards and stock payments. The award programs are used toattract, retain and motivate officers, employees and nonemployeedirectors, to provide incentives for their contributionsto the long-term performance and growth of the Company, andto align their interests with those of stockholders. Theseprograms are administered by the Personnel and CompensationCommittee of the <strong>Citigroup</strong> Board of Directors (the Committee),which is composed entirely of independent non-employeedirectors. All grants of equity awards since April 19, 2005 havebeen made pursuant to stockholder-approved stock incentiveplans.Stock Award, Stock Option and Deferred Cash AwardProgramsThe Company recognized compensation expense related tostock award and stock option programs of $415 million for thethree months ended March 31, 2012. The Company‘s primarystock award program is the Capital Accumulation Plan (CAP).The Company granted 35 million shares as equity awards in thefirst quarter of 2012, most of which were shares awarded underCAP, are subject to vesting conditions, and have not yet beenissued.For stock awards, compensation expense is generally thefair value of the shares on their grant date amortized over thevesting schedule of the awards. Compensation expenses forstock awards to retirement-eligible employees is generallyaccelerated to the date when the retirement rules are met. If theretirement rules will have been met on or before the expectedaward date, the entire estimated expense is recognized in theyear prior to grant in the same manner as cash incentivecompensation is accrued. Certain stock awards withperformance conditions or certain clawback provisions may besubject to variable accounting, pursuant to which the associatedcharges fluctuate with changes in <strong>Citigroup</strong>‘s stock price overthe applicable vesting periods. The total amount that will berecognized as expense cannot be determined in full until theawards vest.The Company recognized compensation expense related todeferred cash programs of $77 million for the three monthsended March 31, 2012.In a change from prior years, incentive awards in January2012 to individual employees who have influence over theCompany‘s material risks (covered employees) were deliveredas a mix of immediate cash bonuses, deferred stock awardsunder CAP and deferred cash awards. (Previously, annualincentives were traditionally awarded as a combination of cashbonus and CAP.) For covered employees, the minimumpercentage of incentive pay required to be deferred was raisedfrom 25% to 40%, with a maximum deferral of 60% for themost highly paid employees. For incentive awards made tocovered employees in January 2012 (in respect of 2011performance), only 50% of the deferred portion was delivered asa CAP award; the other 50% was delivered in the form of adeferred cash award. The 2012 deferred cash award is subject toa performance-based vesting condition that results incancellation of unvested amounts on a formulaic basis if aparticipant‘s business has losses in any year of the vesting101CITIGROUP – 2012 FIRST QUARTER 10-Q