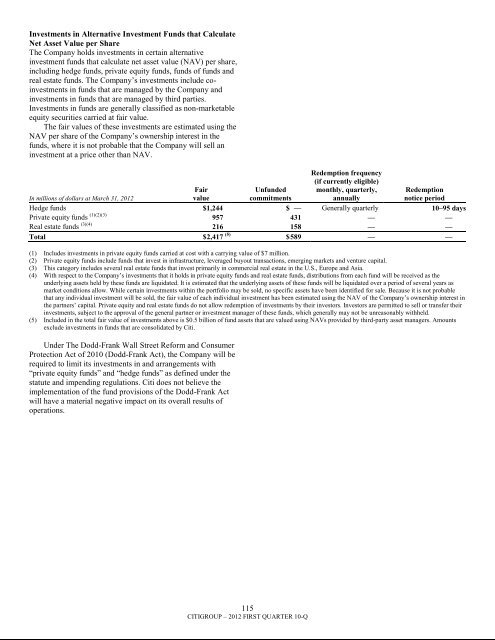

Investments in Alternative Investment Funds that CalculateNet Asset Value per ShareThe Company holds investments in certain alternativeinvestment funds that calculate net asset value (NAV) per share,including hedge funds, private equity funds, funds of funds andreal estate funds. The Company‘s investments include coinvestmentsin funds that are managed by the Company andinvestments in funds that are managed by third parties.Investments in funds are generally classified as non-marketableequity securities carried at fair value.The fair values of these investments are estimated using theNAV per share of the Company‘s ownership interest in thefunds, where it is not probable that the Company will sell aninvestment at a price other than NAV.In millions of dollars at March 31, 2012FairvalueUnfundedcommitmentsRedemption frequency(if currently eligible)monthly, quarterly,annuallyRedemptionnotice periodHedge funds $1,244 $ — Generally quarterly 10–95 daysPrivate equity funds (1)(2)(3) 957 431 — —Real estate funds (3)(4) 216 158 — —Total $ 2,417 (5) $ 589 — —(1) Includes investments in private equity funds carried at cost with a carrying value of $7 million.(2) Private equity funds include funds that invest in infrastructure, leveraged buyout transactions, emerging markets and venture capital.(3) This category includes several real estate funds that invest primarily in commercial real estate in the U.S., Europe and Asia.(4) With respect to the Company‘s investments that it holds in private equity funds and real estate funds, distributions from each fund will be received as theunderlying assets held by these funds are liquidated. It is estimated that the underlying assets of these funds will be liquidated over a period of several years asmarket conditions allow. While certain investments within the portfolio may be sold, no specific assets have been identified for sale. Because it is not probablethat any individual investment will be sold, the fair value of each individual investment has been estimated using the NAV of the Company‘s ownership interest inthe partners‘ capital. Private equity and real estate funds do not allow redemption of investments by their investors. Investors are permitted to sell or transfer theirinvestments, subject to the approval of the general partner or investment manager of these funds, which generally may not be unreasonably withheld.(5) Included in the total fair value of investments above is $0.5 <strong>billion</strong> of fund assets that are valued using NAVs provided by third-party asset managers. Amountsexclude investments in funds that are consolidated by Citi.Under The Dodd-Frank Wall Street Reform and ConsumerProtection Act of 2010 (Dodd-Frank Act), the Company will berequired to limit its investments in and arrangements with―private equity funds‖ and ―hedge funds‖ as defined under thestatute and impending regulations. Citi does not believe theimplementation of the fund provisions of the Dodd-Frank Actwill have a material negative impact on its overall results ofoperations.115CITIGROUP – 2012 FIRST QUARTER 10-Q

12. LOANS<strong>Citigroup</strong> loans are reported in two categories—Consumer andCorporate. These categories are classified primarily according tothe segment and subsegment that manages the loans.Consumer LoansConsumer loans represent loans and leases managed primarilyby the Global Consumer Banking and Local Consumer Lendingbusinesses. The following table provides information by loantype:In millions of dollarsMar. 31,2012Dec. 31,2011Consumer loansIn U.S. officesMortgage and real estate (1) $136,325 $139,177Installment, revolving credit,and other 14,942 15,616Cards 110,049 117,908Commercial and industrial 4,796 4,766Lease financing — 1$266,112 $277,468In offices outside the U.S.Mortgage and real estate (1) $53,652 $ 52,052Installment, revolving credit,and other 35,813 34,613Cards 39,319 38,926Commercial and industrial 20,830 19,975Lease financing 757 711$150,371 $146,277Total Consumer loans $416,483 $423,745Net unearned income (loss) (380) (405)Consumer loans, net ofunearned income $416,103 $423,340(1) Loans secured primarily by real estate.During the three months ended March 31, 2012 and March31, 2011, the Company sold and/or reclassified (to held-forsale)$0.6 <strong>billion</strong> and $6.9 <strong>billion</strong>, respectively, of Consumerloans. The Company did not have significant purchases ofConsumer loans during the three months ended March 31, 2012or March 31, 2011.<strong>Citigroup</strong> has a comprehensive risk management process tomonitor, evaluate and manage the principal risks associated withits Consumer loan portfolio. Included in the loan table above arelending products whose terms may give rise to additional creditissues. Credit cards with below-market introductory interestrates and interest-only loans are examples of such products.However, these products are closely managed using appropriatecredit techniques that mitigate their additional inherent risk.Credit quality indicators that are actively monitored includedelinquency status, consumer credit scores (FICO), and loan tovalue (LTV) ratios, each as discussed in more detail below.Delinquency StatusDelinquency status is carefully monitored and considered a keyindicator of credit quality. Substantially all of the U.S.residential first mortgage loans use the MBA method ofreporting delinquencies, which considers a loan delinquent if amonthly payment has not been received by the end of the dayimmediately preceding the loan‘s next due date. All other loansuse the OTS method of reporting delinquencies, which considersa loan delinquent if a monthly payment has not been received bythe close of business on the loan‘s next due date. As a generalrule, residential first mortgages, home equity loans andinstallment loans are classified as non-accrual when loanpayments are 90 days contractually past due. Credit cards andunsecured revolving loans generally accrue interest untilpayments are 180 days past due. Commercial market loans areplaced on a cash (non-accrual) basis when it is determined,based on actual experience and a forward-looking assessment ofthe collectability of the loan in full, that the payment of interestor principal is doubtful or when interest or principal is 90 dayspast due.The policy for re-aging modified U.S. Consumer loans tocurrent status varies by product. Generally, one of the conditionsto qualify for these modifications is that a minimum number ofpayments (typically ranging from one to three) be made. Uponmodification, the loan is re-aged to current status. However, reagingpractices for certain open-ended Consumer loans, such ascredit cards, are governed by Federal Financial InstitutionsExamination Council (FFIEC) guidelines. For open-endedConsumer loans subject to FFIEC guidelines, one of theconditions for the loan to be re-aged to current status is that atleast three consecutive minimum monthly payments, or theequivalent amount, must be received. In addition, under FFIECguidelines, the number of times that such a loan can be re-agedis subject to limitations (generally once in 12 months and twicein five years). Furthermore, Federal Housing Administration(FHA) and Department of Veterans Affairs (VA) loans aremodified under those respective agencies‘ guidelines, andpayments are not always required in order to re-age a modifiedloan to current.116CITIGROUP – 2012 FIRST QUARTER 10-Q