7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

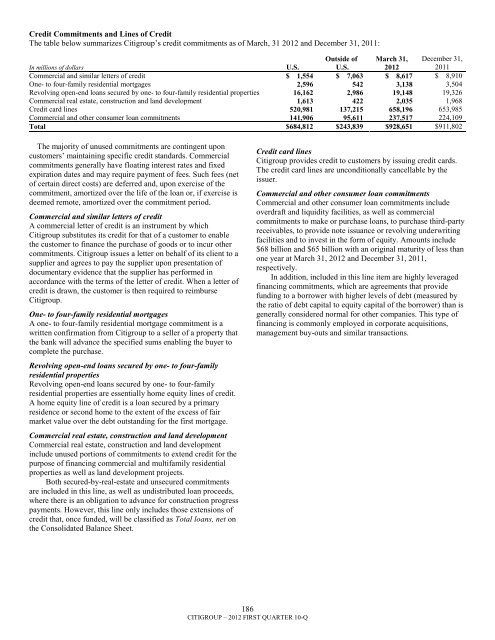

Credit Commitments and Lines of CreditThe table below summarizes <strong>Citigroup</strong>‘s credit commitments as of March, 31 2012 and December 31, 2011:In millions of dollarsU.S.Outside ofU.S.March 31,2012December 31,2011Commercial and similar letters of credit $ 1,554 $ 7,063 $ 8,617 $ 8,910One- to four-family residential mortgages 2,596 542 3,138 3,504Revolving open-end loans secured by one- to four-family residential properties 16,162 2,986 19,148 19,326Commercial real estate, construction and land development 1,613 422 2,035 1,968Credit card lines 520,981 137,215 658,196 653,985Commercial and other consumer loan commitments 141,906 95,611 237,517 224,109Total $684,812 $243,839 $928,651 $911,802The majority of unused commitments are contingent uponcustomers‘ maintaining specific credit standards. Commercialcommitments generally have floating interest rates and fixedexpiration dates and may require payment of fees. Such fees (netof certain direct costs) are deferred and, upon exercise of thecommitment, amortized over the life of the loan or, if exercise isdeemed remote, amortized over the commitment period.Commercial and similar letters of creditA commercial letter of credit is an instrument by which<strong>Citigroup</strong> substitutes its credit for that of a customer to enablethe customer to finance the purchase of goods or to incur othercommitments. <strong>Citigroup</strong> issues a letter on behalf of its client to asupplier and agrees to pay the supplier upon presentation ofdocumentary evidence that the supplier has performed inaccordance with the terms of the letter of credit. When a letter ofcredit is drawn, the customer is then required to reimburse<strong>Citigroup</strong>.One- to four-family residential mortgagesA one- to four-family residential mortgage commitment is awritten confirmation from <strong>Citigroup</strong> to a seller of a property thatthe bank will advance the specified sums enabling the buyer tocomplete the purchase.Revolving open-end loans secured by one- to four-familyresidential propertiesRevolving open-end loans secured by one- to four-familyresidential properties are essentially home equity lines of credit.A home equity line of credit is a loan secured by a primaryresidence or second home to the extent of the excess of fairmarket value over the debt outstanding for the first mortgage.Commercial real estate, construction and land developmentCommercial real estate, construction and land developmentinclude unused portions of commitments to extend credit for thepurpose of financing commercial and multifamily residentialproperties as well as land development projects.Both secured-by-real-estate and unsecured commitmentsare included in this line, as well as undistributed loan proceeds,where there is an obligation to advance for construction progresspayments. However, this line only includes those extensions ofcredit that, once funded, will be classified as Total loans, net onthe Consolidated Balance Sheet.Credit card lines<strong>Citigroup</strong> provides credit to customers by issuing credit cards.The credit card lines are unconditionally cancellable by theissuer.Commercial and other consumer loan commitmentsCommercial and other consumer loan commitments includeoverdraft and liquidity facilities, as well as commercialcommitments to make or purchase loans, to purchase third-partyreceivables, to provide note issuance or revolving underwritingfacilities and to invest in the form of equity. Amounts include$68 <strong>billion</strong> and $65 <strong>billion</strong> with an original maturity of less thanone year at March 31, 2012 and December 31, 2011,respectively.In addition, included in this line item are highly leveragedfinancing commitments, which are agreements that providefunding to a borrower with higher levels of debt (measured bythe ratio of debt capital to equity capital of the borrower) than isgenerally considered normal for other companies. This type offinancing is commonly employed in corporate acquisitions,management buy-outs and similar transactions.186CITIGROUP – 2012 FIRST QUARTER 10-Q