7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

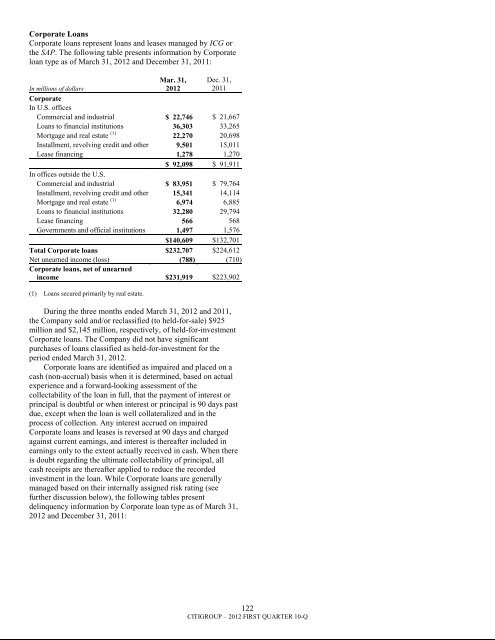

Corporate LoansCorporate loans represent loans and leases managed by ICG orthe SAP. The following table presents information by Corporateloan type as of March 31, 2012 and December 31, 2011:In millions of dollarsMar. 31,2012Dec. 31,2011CorporateIn U.S. officesCommercial and industrial $ 22,746 $ 21,667Loans to financial institutions 36,303 33,265Mortgage and real estate (1) 22,270 20,698Installment, revolving credit and other 9,501 15,011Lease financing 1,278 1,270$ 92,098 $ 91,911In offices outside the U.S.Commercial and industrial $ 83,951 $ 79,764Installment, revolving credit and other 15,341 14,114Mortgage and real estate (1) 6,974 6,885Loans to financial institutions 32,280 29,794Lease financing 566 568Governments and official institutions 1,497 1,576$140,609 $132,701Total Corporate loans $232,707 $224,612Net unearned income (loss) (788) (710)Corporate loans, net of unearnedincome $231,919 $223,902(1) Loans secured primarily by real estate.During the three months ended March 31, 2012 and 2011,the Company sold and/or reclassified (to held-for-sale) $925million and $2,145 million, respectively, of held-for-investmentCorporate loans. The Company did not have significantpurchases of loans classified as held-for-investment for theperiod ended March 31, 2012.Corporate loans are identified as impaired and placed on acash (non-accrual) basis when it is determined, based on actualexperience and a forward-looking assessment of thecollectability of the loan in full, that the payment of interest orprincipal is doubtful or when interest or principal is 90 days pastdue, except when the loan is well collateralized and in theprocess of collection. Any interest accrued on impairedCorporate loans and leases is reversed at 90 days and chargedagainst current earnings, and interest is thereafter included inearnings only to the extent actually received in cash. When thereis doubt regarding the ultimate collectability of principal, allcash receipts are thereafter applied to reduce the recordedinvestment in the loan. While Corporate loans are generallymanaged based on their internally assigned risk rating (seefurther discussion below), the following tables presentdelinquency information by Corporate loan type as of March 31,2012 and December 31, 2011:122CITIGROUP – 2012 FIRST QUARTER 10-Q