7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

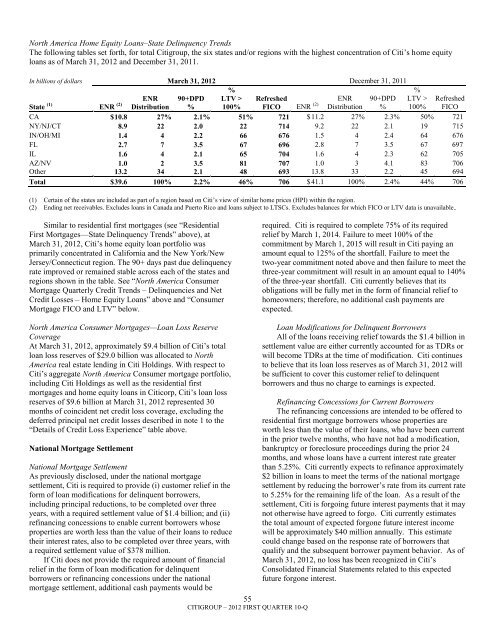

North America Home Equity Loans–State Delinquency TrendsThe following tables set forth, for total <strong>Citigroup</strong>, the six states and/or regions with the highest concentration of Citi‘s home equityloans as of March 31, 2012 and December 31, 2011.In <strong>billion</strong>s of dollars March 31, 2012 December 31, 2011%90+DPD LTV > RefreshedENR 90+DPD% 100% FICO ENR (2) Distribution %%LTV >100%State (1) ENR (2) ENRDistributionRefreshedFICOCA $ 10.8 27% 2.1% 51% 721 $ 11.2 27% 2.3% 50% 721NY/NJ/CT 8.9 22 2.0 22 714 9.2 22 2.1 19 715IN/OH/MI 1.4 4 2.2 66 676 1.5 4 2.4 64 676FL 2.7 7 3.5 67 696 2.8 7 3.5 67 697IL 1.6 4 2.1 65 704 1.6 4 2.3 62 705AZ/NV 1.0 2 3.5 81 707 1.0 3 4.1 83 706Other 13.2 34 2.1 48 693 13.8 33 2.2 45 694Total $ 39.6 100% 2.2% 46% 706 $ 41.1 100% 2.4% 44% 706(1) Certain of the states are included as part of a region based on Citi‘s view of similar home prices (HPI) within the region.(2) Ending net receivables. Excludes loans in Canada and Puerto Rico and loans subject to LTSCs. Excludes balances for which FICO or LTV data is unavailable..Similar to residential first mortgages (see ―ResidentialFirst Mortgages—State Delinquency Trends‖ above), atMarch 31, 2012, Citi‘s home equity loan portfolio wasprimarily concentrated in California and the New York/NewJersey/Connecticut region. The 90+ days past due delinquencyrate improved or remained stable across each of the states andregions shown in the table. See ―North America ConsumerMortgage Quarterly Credit Trends – Delinquencies and NetCredit Losses – Home Equity Loans‖ above and ―ConsumerMortgage FICO and LTV‖ below.required. Citi is required to complete 75% of its requiredrelief by March 1, 2014. Failure to meet 100% of thecommitment by March 1, 2015 will result in Citi paying anamount equal to 125% of the shortfall. Failure to meet thetwo-year commitment noted above and then failure to meet thethree-year commitment will result in an amount equal to 140%of the three-year shortfall. Citi currently believes that itsobligations will be fully met in the form of financial relief tohomeowners; therefore, no additional cash payments areexpected.North America Consumer Mortgages—Loan Loss ReserveCoverageAt March 31, 2012, approximately $9.4 <strong>billion</strong> of Citi‘s totalloan loss reserves of $29.0 <strong>billion</strong> was allocated to NorthAmerica real estate lending in Citi Holdings. With respect toCiti‘s aggregate North America Consumer mortgage portfolio,including Citi Holdings as well as the residential firstmortgages and home equity loans in Citicorp, Citi‘s loan lossreserves of $9.6 <strong>billion</strong> at March 31, 2012 represented 30months of coincident net credit loss coverage, excluding thedeferred principal net credit losses described in note 1 to the―Details of Credit Loss Experience‖ table above.National Mortgage SettlementNational Mortgage SettlementAs previously disclosed, under the national mortgagesettlement, Citi is required to provide (i) customer relief in theform of loan modifications for delinquent borrowers,including principal reductions, to be completed over threeyears, with a required settlement value of $1.4 <strong>billion</strong>; and (ii)refinancing concessions to enable current borrowers whoseproperties are worth less than the value of their loans to reducetheir interest rates, also to be completed over three years, witha required settlement value of $378 million.If Citi does not provide the required amount of financialrelief in the form of loan modification for delinquentborrowers or refinancing concessions under the nationalmortgage settlement, additional cash payments would be55CITIGROUP – 2012 FIRST QUARTER 10-QLoan Modifications for Delinquent BorrowersAll of the loans receiving relief towards the $1.4 <strong>billion</strong> insettlement value are either currently accounted for as TDRs orwill become TDRs at the time of modification. Citi continuesto believe that its loan loss reserves as of March 31, 2012 willbe sufficient to cover this customer relief to delinquentborrowers and thus no charge to earnings is expected.Refinancing Concessions for Current BorrowersThe refinancing concessions are intended to be offered toresidential first mortgage borrowers whose properties areworth less than the value of their loans, who have been currentin the prior twelve months, who have not had a modification,bankruptcy or foreclosure proceedings during the prior 24months, and whose loans have a current interest rate greaterthan 5.25%. Citi currently expects to refinance approximately$2 <strong>billion</strong> in loans to meet the terms of the national mortgagesettlement by reducing the borrower‘s rate from its current rateto 5.25% for the remaining life of the loan. As a result of thesettlement, Citi is forgoing future interest payments that it maynot otherwise have agreed to forgo. Citi currently estimatesthe total amount of expected forgone future interest incomewill be approximately $40 million annually. This estimatecould change based on the response rate of borrowers thatqualify and the subsequent borrower payment behavior. As ofMarch 31, 2012, no loss has been recognized in Citi‘sConsolidated Financial Statements related to this expectedfuture forgone interest.