7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

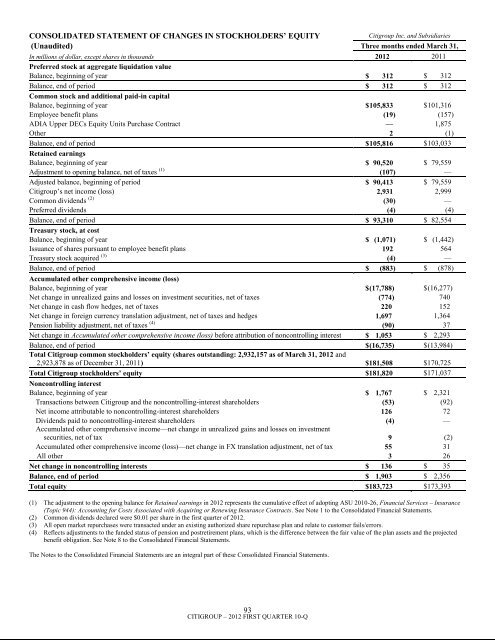

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY<strong>Citigroup</strong> Inc. and Subsidiaries(Unaudited) Three months ended March 31,In millions of dollar, except shares in thousands 2012 2011Preferred stock at aggregate liquidation valueBalance, beginning of year $ 312 $ 312Balance, end of period $ 312 $ 312Common stock and additional paid-in capitalBalance, beginning of year $ 105,833 $ 101,316Employee benefit plans (19) (157)ADIA Upper DECs Equity Units Purchase Contract — 1,875Other 2 (1)Balance, end of period $ 105,816 $ 103,033Retained earningsBalance, beginning of year $ 90,520 $ 79,559Adjustment to opening balance, net of taxes (1) (107) —Adjusted balance, beginning of period $ 90,413 $ 79,559<strong>Citigroup</strong>‘s net income (loss) 2,931 2,999Common dividends (2) (30) —Preferred dividends (4) (4)Balance, end of period $ 93,310 $ 82,554Treasury stock, at costBalance, beginning of year $ (1,071) $ (1,442)Issuance of shares pursuant to employee benefit plans 192 564Treasury stock acquired (3) (4) —Balance, end of period $ (883) $ (878)Accumulated other comprehensive income (loss)Balance, beginning of year $ (17,788) $ (16,277)Net change in unrealized gains and losses on investment securities, net of taxes (774) 740Net change in cash flow hedges, net of taxes 220 152Net change in foreign currency translation adjustment, net of taxes and hedges 1,697 1,364Pension liability adjustment, net of taxes (4) (90) 37Net change in Accumulated other comprehensive income (loss) before attribution of noncontrolling interest $ 1,053 $ 2,293Balance, end of period $ (16,735) $ (13,984)Total <strong>Citigroup</strong> common stockholders’ equity (shares outstanding: 2,932,157 as of March 31, 2012 and2,923,878 as of December 31, 2011) $181,508 $170,725Total <strong>Citigroup</strong> stockholders’ equity $181,820 $171,037Noncontrolling interestBalance, beginning of year $ 1,767 $ 2,321Transactions between <strong>Citigroup</strong> and the noncontrolling-interest shareholders (53) (92)Net income attributable to noncontrolling-interest shareholders 126 72Dividends paid to noncontrolling-interest shareholders (4) —Accumulated other comprehensive income—net change in unrealized gains and losses on investmentsecurities, net of tax 9 (2)Accumulated other comprehensive income (loss)—net change in FX translation adjustment, net of tax 55 31All other 3 26Net change in noncontrolling interests $ 136 $ 35Balance, end of period $ 1,903 $ 2,356Total equity $183,723 $173,393(1) The adjustment to the opening balance for Retained earnings in 2012 represents the cumulative effect of adopting ASU 2010-26, Financial Services – Insurance(Topic 944): Accounting for Costs Associated with Acquiring or Renewing Insurance Contracts. See Note 1 to the Consolidated Financial Statements.(2) Common dividends declared were $0.01 per share in the first quarter of 2012.(3) All open market repurchases were transacted under an existing authorized share repurchase plan and relate to customer fails/errors.(4) Reflects adjustments to the funded status of pension and postretirement plans, which is the difference between the fair value of the plan assets and the projectedbenefit obligation. See Note 8 to the Consolidated Financial Statements.The Notes to the Consolidated Financial Statements are an integral part of these Consolidated Financial Statements.93CITIGROUP – 2012 FIRST QUARTER 10-Q