7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

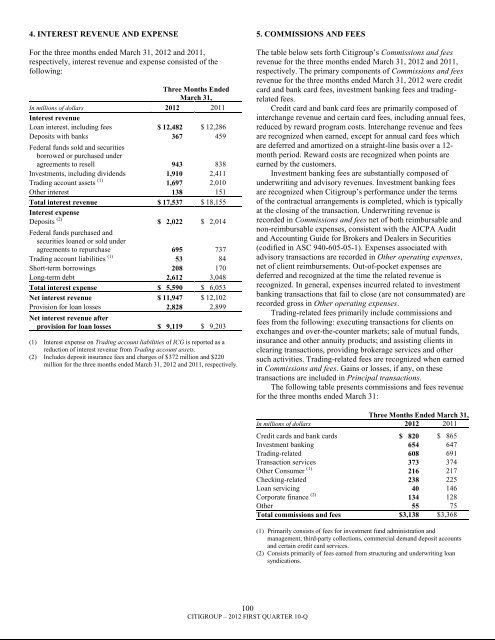

4. INTEREST REVENUE AND EXPENSEFor the three months ended March 31, 2012 and 2011,respectively, interest revenue and expense consisted of thefollowing:Three Months EndedMarch 31,In millions of dollars 2012 2011Interest revenueLoan interest, including fees $ 12,482 $ 12,286Deposits with banks 367 459Federal funds sold and securitiesborrowed or purchased underagreements to resell 943 838Investments, including dividends 1,910 2,411Trading account assets (1) 1,697 2,010Other interest 138 151Total interest revenue $ 17,537 $ 18,155Interest expenseDeposits (2) $ 2,022 $ 2,014Federal funds purchased andsecurities loaned or sold underagreements to repurchase 695 737Trading account liabilities (1) 53 84Short-term borrowings 208 170Long-term debt 2,612 3,048Total interest expense $ 5,590 $ 6,053Net interest revenue $ 11,947 $ 12,102Provision for loan losses 2,828 2,899Net interest revenue afterprovision for loan losses $ 9,119 $ 9,203(1) Interest expense on Trading account liabilities of ICG is reported as areduction of interest revenue from Trading account assets.(2) Includes deposit insurance fees and charges of $372 million and $220million for the three months ended March 31, 2012 and 2011, respectively.5. COMMISSIONS AND FEESThe table below sets forth <strong>Citigroup</strong>‘s Commissions and feesrevenue for the three months ended March 31, 2012 and 2011,respectively. The primary components of Commissions and feesrevenue for the three months ended March 31, 2012 were creditcard and bank card fees, investment banking fees and tradingrelatedfees.Credit card and bank card fees are primarily composed ofinterchange revenue and certain card fees, including annual fees,reduced by reward program costs. Interchange revenue and feesare recognized when earned, except for annual card fees whichare deferred and amortized on a straight-line basis over a 12-month period. Reward costs are recognized when points areearned by the customers.Investment banking fees are substantially composed ofunderwriting and advisory revenues. Investment banking feesare recognized when <strong>Citigroup</strong>‘s performance under the termsof the contractual arrangements is completed, which is typicallyat the closing of the transaction. Underwriting revenue isrecorded in Commissions and fees net of both reimbursable andnon-reimbursable expenses, consistent with the AICPA Auditand Accounting Guide for Brokers and Dealers in Securities(codified in ASC 940-605-05-1). Expenses associated withadvisory transactions are recorded in Other operating expenses,net of client reimbursements. Out-of-pocket expenses aredeferred and recognized at the time the related revenue isrecognized. In general, expenses incurred related to investmentbanking transactions that fail to close (are not consummated) arerecorded gross in Other operating expenses.Trading-related fees primarily include commissions andfees from the following: executing transactions for clients onexchanges and over-the-counter markets; sale of mutual funds,insurance and other annuity products; and assisting clients inclearing transactions, providing brokerage services and othersuch activities. Trading-related fees are recognized when earnedin Commissions and fees. Gains or losses, if any, on thesetransactions are included in Principal transactions.The following table presents commissions and fees revenuefor the three months ended March 31:Three Months Ended March 31,In millions of dollars 2012 2011Credit cards and bank cards $ 820 $ 865Investment banking 654 647Trading-related 608 691Transaction services 373 374Other Consumer (1) 216 217Checking-related 238 225Loan servicing 40 146Corporate finance (2) 134 128Other 55 75Total commissions and fees $3,138 $3,368(1) Primarily consists of fees for investment fund administration andmanagement, third-party collections, commercial demand deposit accountsand certain credit card services.(2) Consists primarily of fees earned from structuring and underwriting loansyndications.100CITIGROUP – 2012 FIRST QUARTER 10-Q