7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

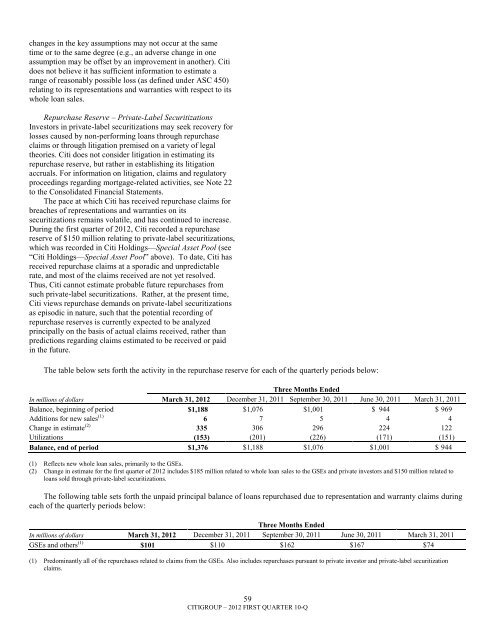

changes in the key assumptions may not occur at the sametime or to the same degree (e.g., an adverse change in oneassumption may be offset by an improvement in another). Citidoes not believe it has sufficient information to estimate arange of reasonably possible loss (as defined under ASC 450)relating to its representations and warranties with respect to itswhole loan sales.Repurchase Reserve – Private-Label SecuritizationsInvestors in private-label securitizations may seek recovery forlosses caused by non-performing loans through repurchaseclaims or through litigation premised on a variety of legaltheories. Citi does not consider litigation in estimating itsrepurchase reserve, but rather in establishing its litigationaccruals. For information on litigation, claims and regulatoryproceedings regarding mortgage-related activities, see Note 22to the Consolidated Financial Statements.The pace at which Citi has received repurchase claims forbreaches of representations and warranties on itssecuritizations remains volatile, and has continued to increase.During the first quarter of 2012, Citi recorded a repurchasereserve of $150 million relating to private-label securitizations,which was recorded in Citi Holdings—Special Asset Pool (see―Citi Holdings—Special Asset Pool‖ above). To date, Citi hasreceived repurchase claims at a sporadic and unpredictablerate, and most of the claims received are not yet resolved.Thus, Citi cannot estimate probable future repurchases fromsuch private-label securitizations. Rather, at the present time,Citi views repurchase demands on private-label securitizationsas episodic in nature, such that the potential recording ofrepurchase reserves is currently expected to be analyzedprincipally on the basis of actual claims received, rather thanpredictions regarding claims estimated to be received or paidin the future.The table below sets forth the activity in the repurchase reserve for each of the quarterly periods below:Three Months EndedIn millions of dollars March 31, 2012 December 31, 2011 September 30, 2011 June 30, 2011 March 31, 2011Balance, beginning of period $1,188 $1,076 $1,001 $ 944 $ 969Additions for new sales (1) 6 7 5 4 4Change in estimate (2) 335 306 296 224 122Utilizations (153) (201) (226) (171) (151)Balance, end of period $1,376 $1,188 $1,076 $1,001 $ 944(1) Reflects new whole loan sales, primarily to the GSEs.(2) Change in estimate for the first quarter of 2012 includes $185 million related to whole loan sales to the GSEs and private investors and $150 million related toloans sold through private-label securitizations.The following table sets forth the unpaid principal balance of loans repurchased due to representation and warranty claims duringeach of the quarterly periods below:Three Months EndedIn millions of dollars March 31, 2012 December 31, 2011 September 30, 2011 June 30, 2011 March 31, 2011GSEs and others (1) $101 $110 $162 $167 $74(1) Predominantly all of the repurchases related to claims from the GSEs. Also includes repurchases pursuant to private investor and private-label securitizationclaims.59CITIGROUP – 2012 FIRST QUARTER 10-Q