7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

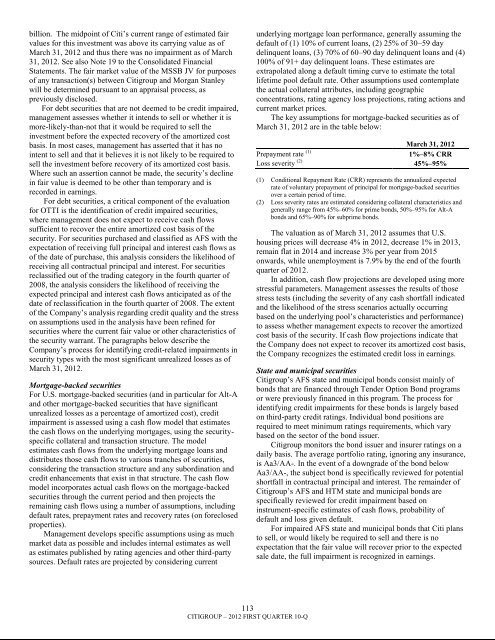

illion. The midpoint of Citi‘s current range of estimated fairvalues for this investment was above its carrying value as ofMarch 31, 2012 and thus there was no impairment as of March31, 2012. See also Note 19 to the Consolidated FinancialStatements. The fair market value of the MSSB JV for purposesof any transaction(s) between <strong>Citigroup</strong> and Morgan Stanleywill be determined pursuant to an appraisal process, aspreviously disclosed.For debt securities that are not deemed to be credit impaired,management assesses whether it intends to sell or whether it ismore-likely-than-not that it would be required to sell theinvestment before the expected recovery of the amortized costbasis. In most cases, management has asserted that it has nointent to sell and that it believes it is not likely to be required tosell the investment before recovery of its amortized cost basis.Where such an assertion cannot be made, the security‘s declinein fair value is deemed to be other than temporary and isrecorded in earnings.For debt securities, a critical component of the evaluationfor OTTI is the identification of credit impaired securities,where management does not expect to receive cash flowssufficient to recover the entire amortized cost basis of thesecurity. For securities purchased and classified as AFS with theexpectation of receiving full principal and interest cash flows asof the date of purchase, this analysis considers the likelihood ofreceiving all contractual principal and interest. For securitiesreclassified out of the trading category in the fourth quarter of2008, the analysis considers the likelihood of receiving theexpected principal and interest cash flows anticipated as of thedate of reclassification in the fourth quarter of 2008. The extentof the Company‘s analysis regarding credit quality and the stresson assumptions used in the analysis have been refined forsecurities where the current fair value or other characteristics ofthe security warrant. The paragraphs below describe theCompany‘s process for identifying credit-related impairments insecurity types with the most significant unrealized losses as ofMarch 31, 2012.Mortgage-backed securitiesFor U.S. mortgage-backed securities (and in particular for Alt-Aand other mortgage-backed securities that have significantunrealized losses as a percentage of amortized cost), creditimpairment is assessed using a cash flow model that estimatesthe cash flows on the underlying mortgages, using the securityspecificcollateral and transaction structure. The modelestimates cash flows from the underlying mortgage loans anddistributes those cash flows to various tranches of securities,considering the transaction structure and any subordination andcredit enhancements that exist in that structure. The cash flowmodel incorporates actual cash flows on the mortgage-backedsecurities through the current period and then projects theremaining cash flows using a number of assumptions, includingdefault rates, prepayment rates and recovery rates (on foreclosedproperties).Management develops specific assumptions using as muchmarket data as possible and includes internal estimates as wellas estimates published by rating agencies and other third-partysources. Default rates are projected by considering currentunderlying mortgage loan performance, generally assuming thedefault of (1) 10% of current loans, (2) 25% of 30–59 daydelinquent loans, (3) 70% of 60–90 day delinquent loans and (4)100% of 91+ day delinquent loans. These estimates areextrapolated along a default timing curve to estimate the totallifetime pool default rate. Other assumptions used contemplatethe actual collateral attributes, including geographicconcentrations, rating agency loss projections, rating actions andcurrent market prices.The key assumptions for mortgage-backed securities as ofMarch 31, 2012 are in the table below:March 31, 2012Prepayment rate (1)1%–8% CRRLoss severity (2) 45%–95%(1) Conditional Repayment Rate (CRR) represents the annualized expectedrate of voluntary prepayment of principal for mortgage-backed securitiesover a certain period of time.(2) Loss severity rates are estimated considering collateral characteristics andgenerally range from 45%–60% for prime bonds, 50%–95% for Alt-Abonds and 65%–90% for subprime bonds.The valuation as of March 31, 2012 assumes that U.S.housing prices will decrease 4% in 2012, decrease 1% in 2013,remain flat in 2014 and increase 3% per year from 2015onwards, while unemployment is 7.9% by the end of the fourthquarter of 2012.In addition, cash flow projections are developed using morestressful parameters. Management assesses the results of thosestress tests (including the severity of any cash shortfall indicatedand the likelihood of the stress scenarios actually occurringbased on the underlying pool‘s characteristics and performance)to assess whether management expects to recover the amortizedcost basis of the security. If cash flow projections indicate thatthe Company does not expect to recover its amortized cost basis,the Company recognizes the estimated credit loss in earnings.State and municipal securities<strong>Citigroup</strong>‘s AFS state and municipal bonds consist mainly ofbonds that are financed through Tender Option Bond programsor were previously financed in this program. The process foridentifying credit impairments for these bonds is largely basedon third-party credit ratings. Individual bond positions arerequired to meet minimum ratings requirements, which varybased on the sector of the bond issuer.<strong>Citigroup</strong> monitors the bond issuer and insurer ratings on adaily basis. The average portfolio rating, ignoring any insurance,is Aa3/AA-. In the event of a downgrade of the bond belowAa3/AA-, the subject bond is specifically reviewed for potentialshortfall in contractual principal and interest. The remainder of<strong>Citigroup</strong>‘s AFS and HTM state and municipal bonds arespecifically reviewed for credit impairment based oninstrument-specific estimates of cash flows, probability ofdefault and loss given default.For impaired AFS state and municipal bonds that Citi plansto sell, or would likely be required to sell and there is noexpectation that the fair value will recover prior to the expectedsale date, the full impairment is recognized in earnings.113CITIGROUP – 2012 FIRST QUARTER 10-Q