7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

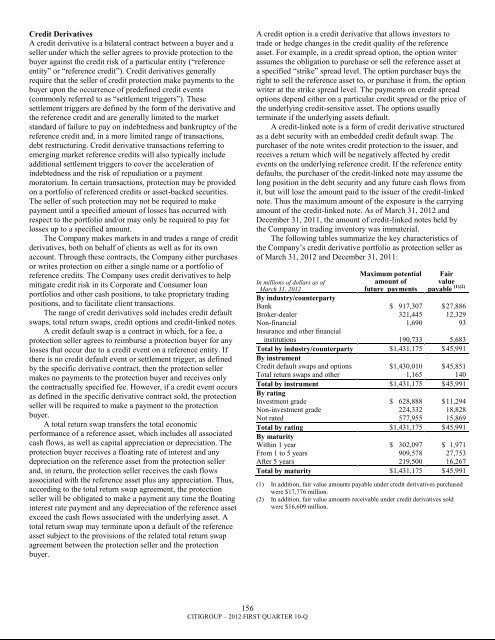

Credit DerivativesA credit derivative is a bilateral contract between a buyer and aseller under which the seller agrees to provide protection to thebuyer against the credit risk of a particular entity (―referenceentity‖ or ―reference credit‖). Credit derivatives generallyrequire that the seller of credit protection make payments to thebuyer upon the occurrence of predefined credit events(commonly referred to as ―settlement triggers‖). Thesesettlement triggers are defined by the form of the derivative andthe reference credit and are generally limited to the marketstandard of failure to pay on indebtedness and bankruptcy of thereference credit and, in a more limited range of transactions,debt restructuring. Credit derivative transactions referring toemerging market reference credits will also typically includeadditional settlement triggers to cover the acceleration ofindebtedness and the risk of repudiation or a paymentmoratorium. In certain transactions, protection may be providedon a portfolio of referenced credits or asset-backed securities.The seller of such protection may not be required to makepayment until a specified amount of losses has occurred withrespect to the portfolio and/or may only be required to pay forlosses up to a specified amount.The Company makes markets in and trades a range of creditderivatives, both on behalf of clients as well as for its ownaccount. Through these contracts, the Company either purchasesor writes protection on either a single name or a portfolio ofreference credits. The Company uses credit derivatives to helpmitigate credit risk in its Corporate and Consumer loanportfolios and other cash positions, to take proprietary tradingpositions, and to facilitate client transactions.The range of credit derivatives sold includes credit defaultswaps, total return swaps, credit options and credit-linked notes.A credit default swap is a contract in which, for a fee, aprotection seller agrees to reimburse a protection buyer for anylosses that occur due to a credit event on a reference entity. Ifthere is no credit default event or settlement trigger, as definedby the specific derivative contract, then the protection sellermakes no payments to the protection buyer and receives onlythe contractually specified fee. However, if a credit event occursas defined in the specific derivative contract sold, the protectionseller will be required to make a payment to the protectionbuyer.A total return swap transfers the total economicperformance of a reference asset, which includes all associatedcash flows, as well as capital appreciation or depreciation. Theprotection buyer receives a floating rate of interest and anydepreciation on the reference asset from the protection sellerand, in return, the protection seller receives the cash flowsassociated with the reference asset plus any appreciation. Thus,according to the total return swap agreement, the protectionseller will be obligated to make a payment any time the floatinginterest rate payment and any depreciation of the reference assetexceed the cash flows associated with the underlying asset. Atotal return swap may terminate upon a default of the referenceasset subject to the provisions of the related total return swapagreement between the protection seller and the protectionbuyer.A credit option is a credit derivative that allows investors totrade or hedge changes in the credit quality of the referenceasset. For example, in a credit spread option, the option writerassumes the obligation to purchase or sell the reference asset ata specified ―strike‖ spread level. The option purchaser buys theright to sell the reference asset to, or purchase it from, the optionwriter at the strike spread level. The payments on credit spreadoptions depend either on a particular credit spread or the price ofthe underlying credit-sensitive asset. The options usuallyterminate if the underlying assets default.A credit-linked note is a form of credit derivative structuredas a debt security with an embedded credit default swap. Thepurchaser of the note writes credit protection to the issuer, andreceives a return which will be negatively affected by creditevents on the underlying reference credit. If the reference entitydefaults, the purchaser of the credit-linked note may assume thelong position in the debt security and any future cash flows fromit, but will lose the amount paid to the issuer of the credit-linkednote. Thus the maximum amount of the exposure is the carryingamount of the credit-linked note. As of March 31, 2012 andDecember 31, 2011, the amount of credit-linked notes held bythe Company in trading inventory was immaterial.The following tables summarize the key characteristics ofthe Company‘s credit derivative portfolio as protection seller asof March 31, 2012 and December 31, 2011:In millions of dollars as ofMarch 31, 2012Maximum potentialamount offuture paymentsFairvaluepayable (1)(2)By industry/counterpartyBank $ 917,307 $ 27,886Broker-dealer 321,445 12,329Non-financial 1,690 93Insurance and other financialinstitutions 190,733 5,683Total by industry/counterparty $ 1,431,175 $ 45,991By instrumentCredit default swaps and options $ 1,430,010 $ 45,851Total return swaps and other 1,165 140Total by instrument $ 1,431,175 $ 45,991By ratingInvestment grade $ 628,888 $ 11,294Non-investment grade 224,332 18,828Not rated 577,955 15,869Total by rating $ 1,431,175 $ 45,991By maturityWithin 1 year $ 302,097 $ 1,971From 1 to 5 years 909,578 27,753After 5 years 219,500 16,267Total by maturity $ 1,431,175 $ 45,991(1) In addition, fair value amounts payable under credit derivatives purchasedwere $17,776 million.(2) In addition, fair value amounts receivable under credit derivatives soldwere $16,609 million.156CITIGROUP – 2012 FIRST QUARTER 10-Q