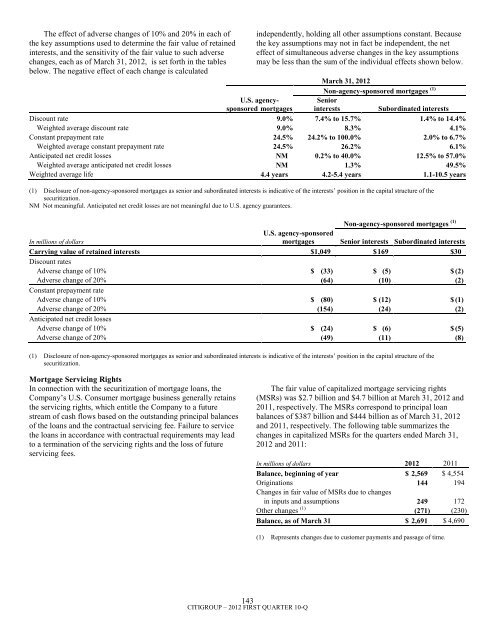

The effect of adverse changes of 10% and 20% in each ofthe key assumptions used to determine the fair value of retainedinterests, and the sensitivity of the fair value to such adversechanges, each as of March 31, 2012, is set forth in the tablesbelow. The negative effect of each change is calculatedindependently, holding all other assumptions constant. Becausethe key assumptions may not in fact be independent, the neteffect of simultaneous adverse changes in the key assumptionsmay be less than the sum of the individual effects shown below.March 31, 2012Non-agency-sponsored mortgages (1)U.S. agencysponsoredmortgagesSeniorinterestsSubordinated interestsDiscount rate 9.0% 7.4% to 15.7% 1.4% to 14.4%Weighted average discount rate 9.0% 8.3% 4.1%Constant prepayment rate 24.5% 24.2% to 100.0% 2.0% to 6.7%Weighted average constant prepayment rate 24.5% 26.2% 6.1%Anticipated net credit losses NM 0.2% to 40.0% 12.5% to 57.0%Weighted average anticipated net credit losses NM 1.3% 49.5%Weighted average life 4.4 years 4.2-5.4 years 1.1-10.5 years(1) Disclosure of non-agency-sponsored mortgages as senior and subordinated interests is indicative of the interests‘ position in the capital structure of thesecuritization.NM Not meaningful. Anticipated net credit losses are not meaningful due to U.S. agency guarantees.Non-agency-sponsored mortgages (1)In millions of dollarsU.S. agency-sponsoredmortgages Senior interests Subordinated interestsCarrying value of retained interests $1,049 $ 169 $30Discount ratesAdverse change of 10% $ (33) $ (5) $ (2)Adverse change of 20% (64) (10) (2)Constant prepayment rateAdverse change of 10% $ (80) $ (12) $ (1)Adverse change of 20% (154) (24) (2)Anticipated net credit lossesAdverse change of 10% $ (24) $ (6) $ (5)Adverse change of 20% (49) (11) (8)(1) Disclosure of non-agency-sponsored mortgages as senior and subordinated interests is indicative of the interests‘ position in the capital structure of thesecuritization.Mortgage Servicing RightsIn connection with the securitization of mortgage loans, theCompany‘s U.S. Consumer mortgage business generally retainsthe servicing rights, which entitle the Company to a futurestream of cash flows based on the outstanding principal balancesof the loans and the contractual servicing fee. Failure to servicethe loans in accordance with contractual requirements may leadto a termination of the servicing rights and the loss of futureservicing fees.The fair value of capitalized mortgage servicing rights(MSRs) was $2.7 <strong>billion</strong> and $4.7 <strong>billion</strong> at March 31, 2012 and2011, respectively. The MSRs correspond to principal loanbalances of $387 <strong>billion</strong> and $444 <strong>billion</strong> as of March 31, 2012and 2011, respectively. The following table summarizes thechanges in capitalized MSRs for the quarters ended March 31,2012 and 2011:In millions of dollars 2012 2011Balance, beginning of year $ 2,569 $ 4,554Originations 144 194Changes in fair value of MSRs due to changesin inputs and assumptions 249 172Other changes (1) (271) (230)Balance, as of March 31 $ 2,691 $ 4,690(1) Represents changes due to customer payments and passage of time.143CITIGROUP – 2012 FIRST QUARTER 10-Q

The market for MSRs is not sufficiently liquid to provideparticipants with quoted market prices. Therefore, the Companyuses an option-adjusted spread valuation approach to determinethe fair value of MSRs. This approach consists of projectingservicing cash flows under multiple interest rate scenarios anddiscounting these cash flows using risk-adjusted discount rates.The key assumptions used in the valuation of MSRs includemortgage prepayment speeds and discount rates. The modelassumptions and the MSRs‘ fair value estimates are compared toobservable trades of similar MSR portfolios and interest-onlysecurity portfolios, as available, as well as to MSR brokervaluations and industry surveys. The cash flow model andunderlying prepayment and interest rate models used to valuethese MSRs are subject to validation in accordance with theCompany‘s model validation policies.The fair value of the MSRs is primarily affected by changesin prepayments that result from shifts in mortgage interest rates.In managing this risk, the Company economically hedges asignificant portion of the value of its MSRs through the use ofinterest rate derivative contracts, forward purchasecommitments of mortgage-backed securities and purchasedsecurities classified as trading.The Company receives fees during the course of servicingpreviously securitized mortgages. The amounts of these fees forthe quarters ended March 31, 2012 and 2011 were as follows:In millions of dollars 2012 2011Servicing fees $268 $304Late fees 17 21Ancillary fees 28 28Total MSR fees $ 313 $ 353These fees are classified in the Consolidated Statement ofIncome as Other revenue.Re-securitizationsThe Company engages in re-securitization transactions in whichdebt securities are transferred to a VIE in exchange for newbeneficial interests. During the quarter ended March 31, 2012,Citi transferred non-agency (private-label) securities with anoriginal par value of approximately $509 million to resecuritizationentities. These securities are backed by eitherresidential or commercial mortgages and are often structured onbehalf of clients. As of March 31, 2012, the fair value of Citiretainedinterests in private-label re-securitization transactionsstructured by Citi totaled approximately $393 million ($74million of which relates to re-securitization transactionsexecuted in 2012) and are recorded in Trading account assets.Of this amount, approximately $32 million and $361 millionrelated to senior and subordinated beneficial interests,respectively. The original par value of private-label resecuritizationtransactions in which Citi holds a retained interestas of March 31, 2012 was approximately $<strong>7.3</strong> <strong>billion</strong>.The Company also re-securitizes U.S. government-agencyguaranteed mortgage-backed (agency) securities. During thequarter ended March 31, 2012, Citi transferred agency securitieswith a fair value of approximately $7.4 <strong>billion</strong> to resecuritizationentities. As of March 31, 2012, the fair value ofCiti-retained interests in agency re-securitization transactionsstructured by Citi totaled approximately $2.1 <strong>billion</strong> ($754million of which related to re-securitization transactions144CITIGROUP – 2012 FIRST QUARTER 10-Qexecuted in 2012) and are recorded in Trading account assets.The original fair value of agency re-securitization transactionsin which Citi holds a retained interest as of March 31, 2012 wasapproximately $59.0 <strong>billion</strong>.As of March 31, 2012, the Company did not consolidateany private-label or agency re-securitization entities.Citi-Administered Asset-Backed Commercial Paper ConduitsThe Company is active in the asset-backed commercial paperconduit business as administrator of several multi-sellercommercial paper conduits and also as a service provider tosingle-seller and other commercial paper conduits sponsored bythird parties.Citi‘s multi-seller commercial paper conduits are designedto provide the Company‘s clients access to low-cost funding inthe commercial paper markets. The conduits purchase assetsfrom or provide financing facilities to clients and are funded byissuing commercial paper to third-party investors. The conduitsgenerally do not purchase assets originated by the Company.The funding of the conduits is facilitated by the liquidity supportand credit enhancements provided by the Company.As administrator to Citi‘s conduits, the Company isgenerally responsible for selecting and structuring assetspurchased or financed by the conduits, making decisionsregarding the funding of the conduits, including determining thetenor and other features of the commercial paper issued,monitoring the quality and performance of the conduits‘ assets,and facilitating the operations and cash flows of the conduits. Inreturn, the Company earns structuring fees from customers forindividual transactions and earns an administration fee from theconduit, which is equal to the income from the client programand liquidity fees of the conduit after payment of conduitexpenses. This administration fee is fairly stable, since mostrisks and rewards of the underlying assets are passed back to theclients and, once the asset pricing is negotiated, most ongoingincome, costs and fees are relatively stable as a percentage ofthe conduit‘s size.The conduits administered by the Company do notgenerally invest in liquid securities that are formally rated bythird parties. The assets are privately negotiated and structuredtransactions that are designed to be held by the conduit, ratherthan actively traded and sold. The yield earned by the conduiton each asset is generally tied to the rate on the commercialpaper issued by the conduit, thus passing interest rate risk to theclient. Each asset purchased by the conduit is structured withtransaction-specific credit enhancement features provided by thethird-party client seller, including over collateralization, cashand excess spread collateral accounts, direct recourse or thirdpartyguarantees. These credit enhancements are sized with theobjective of approximating a credit rating of A or above, basedon the Company‘s internal risk ratings.Substantially all of the funding of the conduits is in theform of short-term commercial paper, with a weighted averagelife generally ranging from 25 to 45 days. As of March 31, 2012and December 31, 2011, the weighted average lives of thecommercial paper issued by consolidated and unconsolidatedconduits were approximately 35 and 37 days, respectively, ateach period end.The primary credit enhancement provided to the conduitinvestors is in the form of transaction-specific creditenhancement described above. In addition, each consolidated