7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

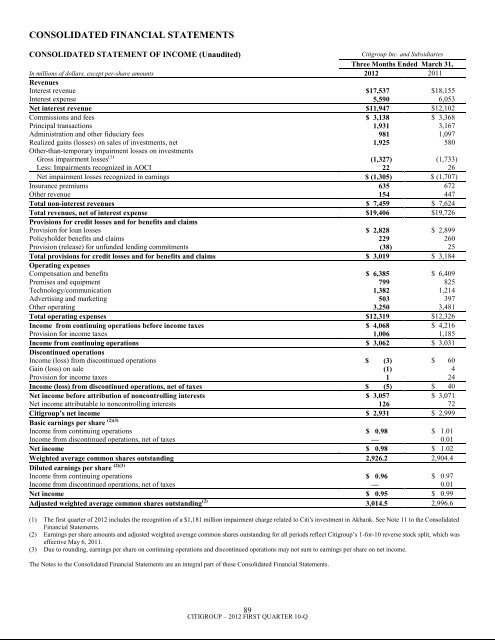

CONSOLIDATED FINANCIAL STATEMENTSCONSOLIDATED STATEMENT OF INCOME (Unaudited)<strong>Citigroup</strong> Inc. and SubsidiariesThree Months Ended March 31,In millions of dollars, except per-share amounts 2012 2011RevenuesInterest revenue $17,537 $18,155Interest expense 5,590 6,053Net interest revenue $11,947 $12,102Commissions and fees $ 3,138 $ 3,368Principal transactions 1,931 3,167Administration and other fiduciary fees 981 1,097Realized gains (losses) on sales of investments, net 1,925 580Other-than-temporary impairment losses on investmentsGross impairment losses (1) (1,327) (1,733)Less: Impairments recognized in AOCI 22 26Net impairment losses recognized in earnings $ (1,305) $ (1,707)Insurance premiums 635 672Other revenue 154 447Total non-interest revenues $ 7,459 $ 7,624Total revenues, net of interest expense $19,406 $19,726Provisions for credit losses and for benefits and claimsProvision for loan losses $ 2,828 $ 2,899Policyholder benefits and claims 229 260Provision (release) for unfunded lending commitments (38) 25Total provisions for credit losses and for benefits and claims $ 3,019 $ 3,184Operating expensesCompensation and benefits $ 6,385 $ 6,409Premises and equipment 799 825Technology/communication 1,382 1,214Advertising and marketing 503 397Other operating 3,250 3,481Total operating expenses $12,319 $12,326Income from continuing operations before income taxes $ 4,068 $ 4,216Provision for income taxes 1,006 1,185Income from continuing operations $ 3,062 $ 3,031Discontinued operationsIncome (loss) from discontinued operations $ (3) $ 60Gain (loss) on sale (1) 4Provision for income taxes 1 24Income (loss) from discontinued operations, net of taxes $ (5) $ 40Net income before attribution of noncontrolling interests $ 3,057 $ 3,071Net income attributable to noncontrolling interests 126 72<strong>Citigroup</strong>’s net income $ 2,931 $ 2,999Basic earnings per share (2)(3)Income from continuing operations $ 0.98 $ 1.01Income from discontinued operations, net of taxes — 0.01Net income $ 0.98 $ 1.02Weighted average common shares outstanding 2,926.2 2,904.4Diluted earnings per share (2)(3)Income from continuing operations $ 0.96 $ 0.97Income from discontinued operations, net of taxes — 0.01Net income $ 0.95 $ 0.99Adjusted weighted average common shares outstanding (2) 3,014.5 2,996.6(1) The first quarter of 2012 includes the recognition of a $1,181 million impairment charge related to Citi's investment in Akbank. See Note 11 to the ConsolidatedFinancial Statements.(2) Earnings per share amounts and adjusted weighted average common shares outstanding for all periods reflect <strong>Citigroup</strong>‘s 1-for-10 reverse stock split, which waseffective May 6, 2011.(3) Due to rounding, earnings per share on continuing operations and discontinued operations may not sum to earnings per share on net income.The Notes to the Consolidated Financial Statements are an integral part of these Consolidated Financial Statements.89CITIGROUP – 2012 FIRST QUARTER 10-Q