7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

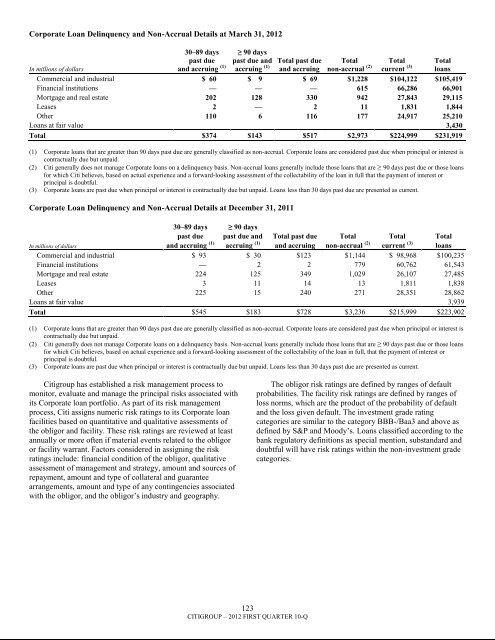

Corporate Loan Delinquency and Non-Accrual Details at March 31, 201230–89 dayspast dueand accruing (1)≥ 90 dayspast due andaccruing (1)Total past due Total Total TotalIn millions of dollarsand accruing non-accrual (2) current (3) loansCommercial and industrial $ 60 $ 9 $ 69 $ 1,228 $104,122 $105,419Financial institutions — — — 615 66,286 66,901Mortgage and real estate 202 128 330 942 27,843 29,115Leases 2 — 2 11 1,831 1,844Other 110 6 116 177 24,917 25,210Loans at fair value 3,430Total $374 $143 $517 $ 2,973 $224,999 $231,919(1) Corporate loans that are greater than 90 days past due are generally classified as non-accrual. Corporate loans are considered past due when principal or interest iscontractually due but unpaid.(2) Citi generally does not manage Corporate loans on a delinquency basis. Non-accrual loans generally include those loans that are ≥ 90 days past due or those loansfor which Citi believes, based on actual experience and a forward-looking assessment of the collectability of the loan in full that the payment of interest orprincipal is doubtful.(3) Corporate loans are past due when principal or interest is contractually due but unpaid. Loans less than 30 days past due are presented as current.Corporate Loan Delinquency and Non-Accrual Details at December 31, 201130–89 days ≥ 90 dayspast due past due and Total past due Total Total TotalIn millions of dollars and accruing (1) accruing (1) and accruing non-accrual (2) current (3) loansCommercial and industrial $ 93 $ 30 $123 $ 1,144 $ 98,968 $100,235Financial institutions — 2 2 779 60,762 61,543Mortgage and real estate 224 125 349 1,029 26,107 27,485Leases 3 11 14 13 1,811 1,838Other 225 15 240 271 28,351 28,862Loans at fair value 3,939Total $545 $183 $728 $ 3,236 $215,999 $223,902(1) Corporate loans that are greater than 90 days past due are generally classified as non-accrual. Corporate loans are considered past due when principal or interest iscontractually due but unpaid.(2) Citi generally does not manage Corporate loans on a delinquency basis. Non-accrual loans generally include those loans that are ≥ 90 days past due or those loansfor which Citi believes, based on actual experience and a forward-looking assessment of the collectability of the loan in full, that the payment of interest orprincipal is doubtful.(3) Corporate loans are past due when principal or interest is contractually due but unpaid. Loans less than 30 days past due are presented as current.<strong>Citigroup</strong> has established a risk management process tomonitor, evaluate and manage the principal risks associated withits Corporate loan portfolio. As part of its risk managementprocess, Citi assigns numeric risk ratings to its Corporate loanfacilities based on quantitative and qualitative assessments ofthe obligor and facility. These risk ratings are reviewed at leastannually or more often if material events related to the obligoror facility warrant. Factors considered in assigning the riskratings include: financial condition of the obligor, qualitativeassessment of management and strategy, amount and sources ofrepayment, amount and type of collateral and guaranteearrangements, amount and type of any contingencies associatedwith the obligor, and the obligor‘s industry and geography.The obligor risk ratings are defined by ranges of defaultprobabilities. The facility risk ratings are defined by ranges ofloss norms, which are the product of the probability of defaultand the loss given default. The investment grade ratingcategories are similar to the category BBB-/Baa3 and above asdefined by S&P and Moody‘s. Loans classified according to thebank regulatory definitions as special mention, substandard anddoubtful will have risk ratings within the non-investment gradecategories.123CITIGROUP – 2012 FIRST QUARTER 10-Q