7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

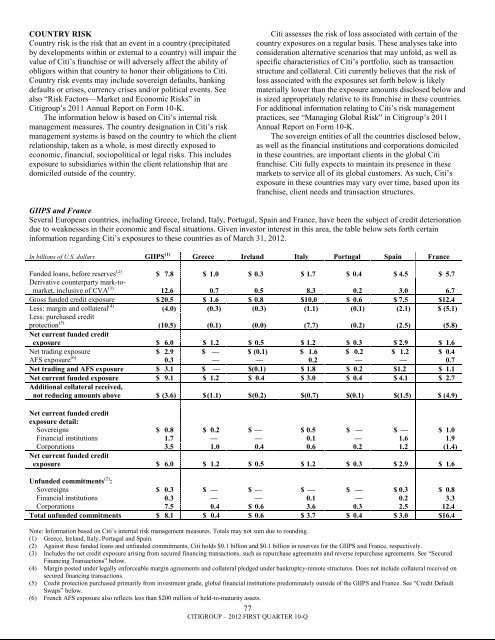

COUNTRY RISKCountry risk is the risk that an event in a country (precipitatedby developments within or external to a country) will impair thevalue of Citi‘s franchise or will adversely affect the ability ofobligors within that country to honor their obligations to Citi.Country risk events may include sovereign defaults, bankingdefaults or crises, currency crises and/or political events. Seealso ―Risk Factors—Market and Economic Risks‖ in<strong>Citigroup</strong>‘s 2011 Annual Report on Form 10-K.The information below is based on Citi‘s internal riskmanagement measures. The country designation in Citi‘s riskmanagement systems is based on the country to which the clientrelationship, taken as a whole, is most directly exposed toeconomic, financial, sociopolitical or legal risks. This includesexposure to subsidiaries within the client relationship that aredomiciled outside of the country.Citi assesses the risk of loss associated with certain of thecountry exposures on a regular basis. These analyses take intoconsideration alternative scenarios that may unfold, as well asspecific characteristics of Citi‘s portfolio, such as transactionstructure and collateral. Citi currently believes that the risk ofloss associated with the exposures set forth below is likelymaterially lower than the exposure amounts disclosed below andis sized appropriately relative to its franchise in these countries.For additional information relating to Citi‘s risk managementpractices, see ―Managing Global Risk‖ in <strong>Citigroup</strong>‘s 2011Annual Report on Form 10-K.The sovereign entities of all the countries disclosed below,as well as the financial institutions and corporations domiciledin these countries, are important clients in the global Citifranchise. Citi fully expects to maintain its presence in thesemarkets to service all of its global customers. As such, Citi‘sexposure in these countries may vary over time, based upon itsfranchise, client needs and transaction structures.GIIPS and FranceSeveral European countries, including Greece, Ireland, Italy, Portugal, Spain and France, have been the subject of credit deteriorationdue to weaknesses in their economic and fiscal situations. Given investor interest in this area, the table below sets forth certaininformation regarding Citi‘s exposures to these countries as of March 31, 2012.In <strong>billion</strong>s of U.S. dollars GIIPS (1) Greece Ireland Italy Portugal Spain FranceFunded loans, before reserves (2) $ 7.8 $ 1.0 $ 0.3 $ 1.7 $ 0.4 $ 4.5 $ 5.7Derivative counterparty mark-tomarket,inclusive of CVA (3) 12.6 0.7 0.5 8.3 0.2 3.0 6.7Gross funded credit exposure $ 20.5 $ 1.6 $ 0.8 $10.0 $ 0.6 $ 7.5 $12.4Less: margin and collateral (4) (4.0) (0.3) (0.3) (1.1) (0.1) (2.1) $ (5.1)Less: purchased creditprotection (5) (10.5) (0.1) (0.0) (7.7) (0.2) (2.5) (5.8)Net current funded creditexposure $ 6.0 $ 1.2 $ 0.5 $ 1.2 $ 0.3 $ 2.9 $ 1.6Net trading exposure $ 2.9 $ — $ (0.1) $ 1.6 $ 0.2 $ 1.2 $ 0.4AFS exposure (6) 0.3 — — 0.2 — — 0.7Net trading and AFS exposure $ 3.1 $ — $(0.1) $ 1.8 $ 0.2 $1.2 $ 1.1Net current funded exposure $ 9.1 $ 1.2 $ 0.4 $ 3.0 $ 0.4 $ 4.1 $ 2.7Additional collateral received,not reducing amounts above $ (3.6) $ (1.1) $ (0.2) $(0.7) $(0.1) $(1.5) $ (4.9)Net current funded creditexposure detail:Sovereigns $ 0.8 $ 0.2 $ — $ 0.5 $ — $ — $ 1.0Financial institutions 1.7 — — 0.1 — 1.6 1.9Corporations 3.5 1.0 0.4 0.6 0.2 1.2 (1.4)Net current funded creditexposure $ 6.0 $ 1.2 $ 0.5 $ 1.2 $ 0.3 $ 2.9 $ 1.6Unfunded commitments (2) :Sovereigns $ 0.3 $ — $ — $ — $ — $ 0.3 $ 0.8Financial institutions 0.3 — — 0.1 — 0.2 3.3Corporations 7.5 0.4 $ 0.6 3.6 0.3 2.5 12.4Total unfunded commitments $ 8.1 $ 0.4 $ 0.6 $ 3.7 $ 0.4 $ 3.0 $16.4Note: Information based on Citi‘s internal risk management measures. Totals may not sum due to rounding.(1) Greece, Ireland, Italy, Portugal and Spain.(2) Against these funded loans and unfunded commitments, Citi holds $0.1 <strong>billion</strong> and $0.1 <strong>billion</strong> in reserves for the GIIPS and France, respectively.(3) Includes the net credit exposure arising from secured financing transactions, such as repurchase agreements and reverse repurchase agreements. See ―SecuredFinancing Transactions‖ below.(4) Margin posted under legally enforceable margin agreements and collateral pledged under bankruptcy-remote structures. Does not include collateral received onsecured financing transactions.(5) Credit protection purchased primarily from investment grade, global financial institutions predominately outside of the GIIPS and France. See ―Credit DefaultSwaps‖ below.(6) French AFS exposure also reflects less than $200 million of held-to-maturity assets.77CITIGROUP – 2012 FIRST QUARTER 10-Q