7.3 billion - Citigroup

7.3 billion - Citigroup

7.3 billion - Citigroup

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

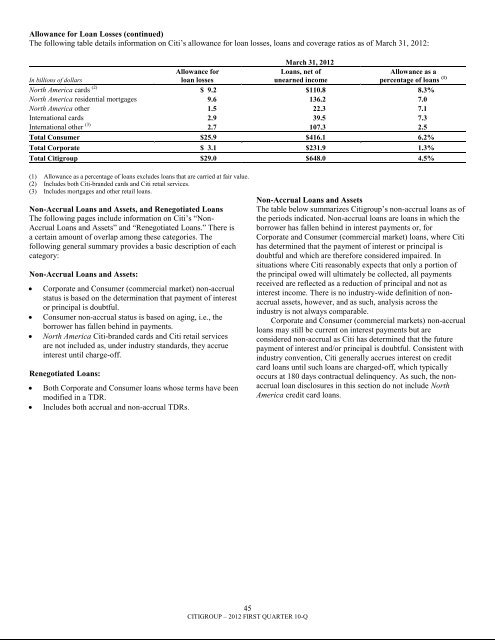

Allowance for Loan Losses (continued)The following table details information on Citi‘s allowance for loan losses, loans and coverage ratios as of March 31, 2012:March 31, 2012In <strong>billion</strong>s of dollarsAllowance forloan lossesLoans, net ofunearned incomeAllowance as apercentage of loans (1)North America cards (2) $ 9.2 $110.8 8.3%North America residential mortgages 9.6 136.2 7.0North America other 1.5 22.3 7.1International cards 2.9 39.5 <strong>7.3</strong>International other (3) 2.7 10<strong>7.3</strong> 2.5Total Consumer $25.9 $416.1 6.2%Total Corporate $ 3.1 $231.9 1.3%Total <strong>Citigroup</strong> $29.0 $648.0 4.5%(1) Allowance as a percentage of loans excludes loans that are carried at fair value.(2) Includes both Citi-branded cards and Citi retail services.(3) Includes mortgages and other retail loans.Non-Accrual Loans and Assets, and Renegotiated LoansThe following pages include information on Citi‘s ―Non-Accrual Loans and Assets‖ and ―Renegotiated Loans.‖ There isa certain amount of overlap among these categories. Thefollowing general summary provides a basic description of eachcategory:Non-Accrual Loans and Assets:Corporate and Consumer (commercial market) non-accrualstatus is based on the determination that payment of interestor principal is doubtful.Consumer non-accrual status is based on aging, i.e., theborrower has fallen behind in payments.North America Citi-branded cards and Citi retail servicesare not included as, under industry standards, they accrueinterest until charge-off.Renegotiated Loans:Both Corporate and Consumer loans whose terms have beenmodified in a TDR.Includes both accrual and non-accrual TDRs.Non-Accrual Loans and AssetsThe table below summarizes <strong>Citigroup</strong>‘s non-accrual loans as ofthe periods indicated. Non-accrual loans are loans in which theborrower has fallen behind in interest payments or, forCorporate and Consumer (commercial market) loans, where Citihas determined that the payment of interest or principal isdoubtful and which are therefore considered impaired. Insituations where Citi reasonably expects that only a portion ofthe principal owed will ultimately be collected, all paymentsreceived are reflected as a reduction of principal and not asinterest income. There is no industry-wide definition of nonaccrualassets, however, and as such, analysis across theindustry is not always comparable.Corporate and Consumer (commercial markets) non-accrualloans may still be current on interest payments but areconsidered non-accrual as Citi has determined that the futurepayment of interest and/or principal is doubtful. Consistent withindustry convention, Citi generally accrues interest on creditcard loans until such loans are charged-off, which typicallyoccurs at 180 days contractual delinquency. As such, the nonaccrualloan disclosures in this section do not include NorthAmerica credit card loans.45CITIGROUP – 2012 FIRST QUARTER 10-Q